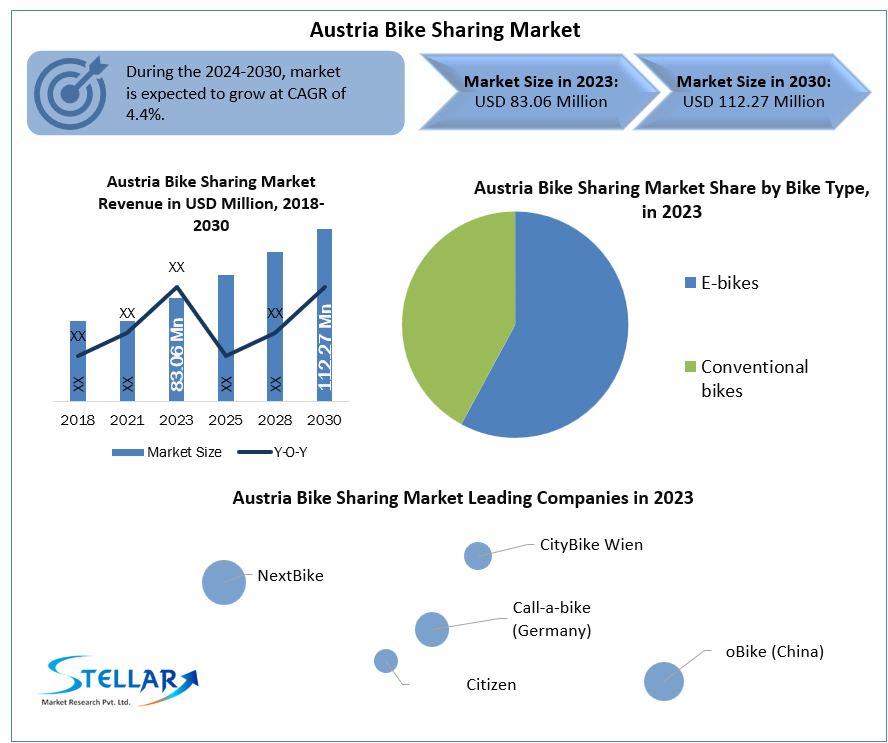

Austria Bike Sharing Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2024-2030

Austria Bike Sharing Market, valued at USD 23.26 million in 2023, is projected to grow at a CAGR of 13.1%, reaching USD 59.21 million by 2030. Increasing urban mobility needs, sustainable transportation goals, and rising tourism activities are propelling Austria’s transition toward shared and eco-friendly commuting solutions. Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Austria-Bike-Sharing-Market/212 Market Estimation, Growth Drivers & Opportunities Austria’s bike sharing market is witnessing consistent growth due to its eco-conscious population, expanding smart city initiatives, and an increasing number of tourists seeking sustainable travel alternatives. From Vienna’s historic lanes to Salzburg’s scenic routes, shared bikes are becoming an integral part of Austria’s urban transport infrastructure. Key Growth Drivers: Sustainable Urban Mobility Push: Austria’s national climate and energy strategies aim to reduce CO₂ emissions from the transport sector, supporting alternatives like bike sharing. Growing Tourism: Tourists prefer shared bikes for short-term, flexible, and scenic travel, particularly in cities like Vienna, Innsbruck, and Salzburg. Smart City Programs: Government-funded projects in cities such as Graz and Linz are incorporating shared mobility solutions into urban planning. Health & Environmental Awareness: Rising awareness of fitness and environmental issues has encouraged residents to adopt bikes for daily commutes and leisure. Opportunities Ahead: E-Bike Expansion: The demand for pedal-assist electric bicycles is increasing in hilly regions and among elderly users. Public-Private Partnerships (PPPs): Strong collaboration between municipalities and private operators can accelerate infrastructure development and service coverage. Digital Innovation: Mobile apps, smart locks, and GPS-enabled fleet management offer enhanced user experiences and data-driven operations. 2024 Market Trends and Investment Landscape In 2024, Austria experienced notable developments in bike sharing infrastructure and policy support. The city of Vienna expanded its public bike sharing network “WienMobil Rad,” which replaced the older “Citybike Wien” program with a more modern, digital platform offering e-bikes and dockless systems. Meanwhile, Graz introduced a pilot program offering integrated ticketing for public transit and bike sharing via a unified smartphone app. Private companies received municipal support to expand fleets, invest in maintenance hubs, and deploy solar-powered docking stations. Austria’s Ministry for Climate Action also introduced subsidies for cities implementing zero-emission shared mobility solutions, further boosting market confidence and investor interest. Market Segmentation – Leading Segments by Market Share By Bike Type: Electric Bicycles (E-Bikes) are rapidly gaining market share due to their ease of use across varied terrain and suitability for longer commutes. E-bikes are particularly favored in cities with hills or where physical exertion is a barrier. Conventional Pedal Bicycles still maintain a significant presence in flat urban areas and tourist zones where simplicity and affordability are valued. By Sharing Model: Docked Bike Sharing Systems are widely used in Vienna and Salzburg, supported by established infrastructure and city transport integration. Dockless Bike Sharing Models are expanding in smaller cities and suburbs, offering flexibility and lower upfront infrastructure costs. By End-User: Tourists and Casual Users represent the largest user base, especially in historic and scenic cities where bike tours and short rentals are common. Daily Commuters form a growing segment, encouraged by employer incentives, integrated mobility passes, and rising fuel costs. Competitive Landscape – Top 5 Players and Key Strategies 1. nextbike GmbH (a Tier Mobility company): Operating under various city brands, nextbike is Austria’s leading bike sharing provider. In 2024, the company expanded e-bike fleets in Vienna and Salzburg and upgraded its mobile app for real-time tracking and dynamic pricing. 2. Donkey Republic: Donkey Republic offers dockless bike sharing in Austrian cities like Innsbruck and Linz. Their focus on simplicity, scalability, and low-overhead operations has made them a preferred partner for small municipalities. In 2024, they introduced IoT-connected smart bikes for better fleet management. 3. WienMobil Rad (Wiener Linien): This city-backed platform replaced Citybike Wien and represents Vienna’s official bike sharing system. It now includes a mix of pedal and electric bikes, app-based bookings, and integrated public transport billing. 4. Sycube: A domestic innovator, Sycube provides high-end bike sharing software and hardware infrastructure. In 2024, the company deployed solar-powered docking stations and expanded partnerships with universities and corporate campuses. 5. BikeCitizens: Primarily a mobility app developer, BikeCitizens supports city cycling through route optimization, rewards programs, and integration with shared bike fleets. Their data analytics services help municipalities optimize cycling infrastructure and user behavior tracking. These players are actively investing in battery-swapping technology, predictive maintenance, and enhanced user analytics to maintain a competitive edge and meet rising user expectations. Regional Insights – Growth Hubs and Government Support Vienna: As the largest and most advanced bike sharing market in Austria, Vienna leads in fleet size, infrastructure, and user base. The launch of WienMobil Rad has modernized the system with e-bikes, flexible pricing, and real-time app control. Strong municipal support and integration with metro and tram networks have made Vienna a European model for multimodal mobility. Graz: Graz has emerged as a smart mobility pioneer, with public-private partnerships enabling wide deployment of shared bikes. The city has focused on reducing car dependency in the historic core by encouraging bikes as a primary short-trip mode. Salzburg: Tourism is a major driver in Salzburg’s bike sharing scene. The city has invested in scenic cycle routes and developed a visitor-friendly mobile app with GPS-guided tours and bike rental stations. Linz and Innsbruck: These cities are growing secondary hubs where dockless systems and campus-based bike sharing are being deployed to cater to students, workers, and tourists. Support from local councils and universities has helped adoption rates rise steadily. Conclusion & Market Outlook Austria’s bike sharing market is evolving into a cornerstone of its sustainable mobility ecosystem. With growing urbanization, increasing tourist influx, and a strong environmental consciousness among its population, the market is well-positioned for long-term expansion. About us Phase 3,Navale IT Zone, S.No. 51/2A/2, Office No. 202, 2nd floor, Near, Navale Brg,Narhe, Pune, Maharashtra 411041 +91 9607365656 sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness