Quantum Computing Market Global Competitive Landscape and Major Player Strategies Explained

The Quantum Computing Market is becoming increasingly competitive as global tech giants, research institutions, and startups race to build quantum systems and dominate key application areas.

Understanding the Competitive Landscape

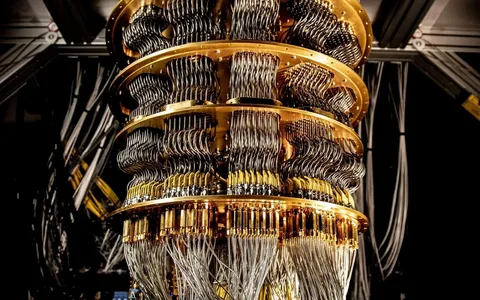

The global quantum computing market is currently led by a mix of established technology corporations and agile startups. While no single company has yet achieved full-scale quantum dominance, several major players have taken clear strategic positions based on their technological preferences — superconducting qubits, trapped ions, photonics, and more.

The competition is not limited to hardware; it extends across software development, algorithm design, cloud platforms, and industry-specific solutions. The coming years will likely determine who leads in scaling these technologies and bringing them to commercial markets.

Key Players and Their Strategic Focus

IBM

IBM is one of the earliest pioneers in quantum computing and remains a dominant force. Its roadmap includes scaling up to a 100,000-qubit machine by 2033. IBM provides cloud access to its quantum systems through IBM Quantum Experience, and its Qiskit software development kit has become a popular platform for quantum programming. IBM's strategy revolves around open access, partnerships with universities, and long-term development of error-corrected systems.

Google gained global attention when it claimed quantum supremacy in 2019 by performing a computation faster than the most powerful classical supercomputer. Google's quantum efforts are part of its Quantum AI division. The company is heavily invested in superconducting qubit research and aims to build a large-scale fault-tolerant system. Google also prioritizes algorithm development for AI and chemistry applications, positioning itself as both a research and infrastructure leader.

Microsoft

Microsoft takes a different approach through its Azure Quantum platform, offering cloud access to a range of quantum systems developed by hardware partners. The company is investing heavily in topological qubits, a theoretically more stable form of qubit. While its own hardware is not yet available, Microsoft focuses on unifying tools and services across hardware platforms, aiming to be the go-to ecosystem for developers.

Amazon Web Services (AWS)

AWS entered the quantum space through Amazon Braket, a cloud service that lets users access various quantum systems from third-party providers. Rather than building its own hardware initially, AWS is investing in the development of neutral atom-based systems and supporting quantum algorithm research. Its goal is to provide flexible access to evolving quantum technologies while building tools for enterprise users.

D-Wave Systems

D-Wave is a Canadian company that has commercialized quantum annealing technology — a different approach from gate-based quantum computers. While not universal quantum systems, D-Wave’s machines are already used in optimization problems by enterprises. Their focus is on delivering practical business value today while working toward hybrid solutions combining classical and quantum capabilities.

Honeywell and Quantinuum

Honeywell spun off its quantum division into Quantinuum, which has emerged as a major competitor. Quantinuum uses trapped-ion technology and offers quantum solutions for encryption, simulation, and enterprise software. The company emphasizes full-stack development — from hardware to applications — and maintains a strong presence in both the U.S. and European markets.

Startup Disruption and Niche Innovation

In addition to tech giants, startups like Rigetti Computing, Xanadu, PsiQuantum, and Alpine Quantum Technologies are making waves. These companies often pursue alternate hardware technologies or software platforms and are critical in driving agility and experimentation in the industry.

Startups can focus on niche applications, from logistics optimization to molecular simulation. This allows them to compete not directly on scale, but on specificity and speed of innovation. As many of these companies partner with larger firms or governments, their role in shaping the competitive landscape continues to grow.

Regional Powerhouses

United States

The U.S. leads in quantum funding, number of startups, and research institutions. The combination of government funding and Silicon Valley innovation gives it a strong competitive edge.

China

China is rapidly catching up with massive government-led investments. It focuses on both quantum communication and computing, aiming for sovereign technological leadership in the field.

Europe

European nations like Germany, France, and the Netherlands are home to several quantum startups and research consortia. The EU’s Quantum Flagship program is a major driver of innovation and collaboration.

Canada

Canada punches above its weight with leading quantum hardware firms like D-Wave and Xanadu, supported by academic excellence and government support.

Strategic Trends Driving Competition

Cloud-Based Access

Many companies are opting for cloud-first strategies to enable broader access and accelerate user adoption. Cloud platforms reduce the cost barrier for experimentation and enterprise trials.

Ecosystem Building

Rather than working in isolation, firms are building ecosystems involving academia, software developers, enterprises, and government labs. These collaborative models improve knowledge transfer and speed up development.

Industry-Specific Targeting

Key players are focusing on specific verticals — such as pharmaceuticals, finance, and materials science — to tailor quantum solutions for measurable business outcomes.

Intellectual Property and Patent Race

The competitive race is also reflected in patent filings. Companies are securing intellectual property around hardware design, quantum algorithms, and software interfaces to protect their market positions and attract investment.

The Road Ahead

The next five years will be critical in determining the true leaders in quantum computing. Companies that demonstrate progress in hardware stability, error correction, and enterprise use cases will gain the most traction.

It is likely that no single company will dominate the entire value chain. Instead, we may see an ecosystem of specialized players — some focused on hardware, others on software or services — collaborating and competing in a dynamic, fast-moving global market.

For investors, enterprises, and policymakers, understanding the strategies and technologies driving this competition is essential for making informed decisions in the rapidly evolving quantum computing market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness