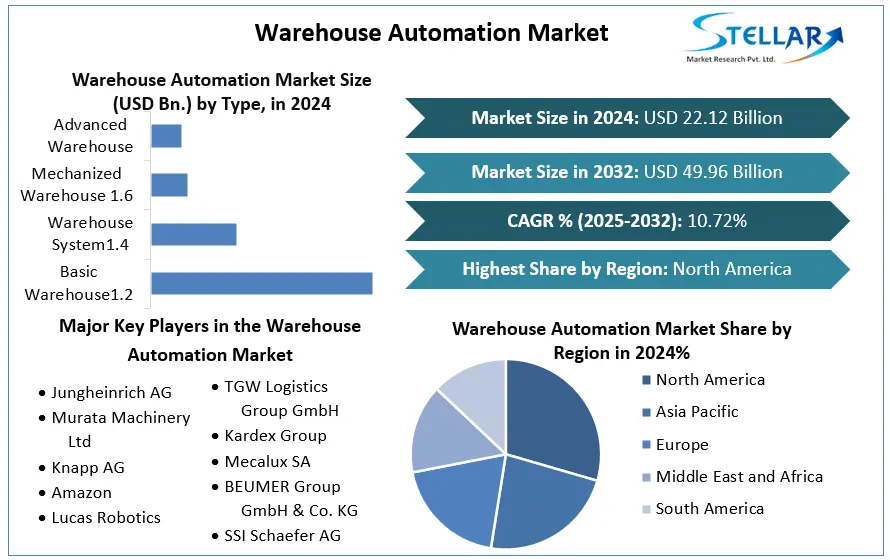

Warehouse Automation Market is projected to grow from USD 23.2 billion in 2023 to USD 65.3 billion by 2030, registering a robust CAGR of 16.2%. The rapid adoption of robotics, AI, IoT, and data analytics in warehouse operations is driving a logistics revolution, as companies prioritize speed, accuracy, and scalability in supply chains.

Request free sample report:https://www.stellarmr.com/report/req_sample/Warehouse-Automation-Market/157

Market Estimation, Growth Drivers & Opportunities

Warehouse automation involves the use of control systems, robotics, and software to streamline warehouse processes—from receiving and storage to picking, packing, and shipping. With growing consumer expectations for fast and error-free delivery, automation has become a strategic imperative.

Key Growth Drivers:

-

E-commerce & Omnichannel Retail Growth: The explosion of online shopping, particularly in developing countries, has created an urgent need for automated fulfillment centers.

-

Labor Shortages & Cost Optimization: A shrinking warehouse workforce and rising labor costs are accelerating automation investments.

-

Rising Demand for Real-Time Inventory Tracking: IoT-enabled sensors, AI, and WMS software help businesses maintain visibility, reduce shrinkage, and improve inventory accuracy.

-

COVID-19 Impact & Contactless Operations: The pandemic highlighted the need for resilient, automated logistics that reduce human contact while enhancing throughput.

Emerging Opportunities:

-

Autonomous Mobile Robots (AMRs): These systems are gaining popularity due to their flexibility and scalability compared to fixed conveyor systems.

-

Artificial Intelligence & Predictive Analytics: AI-based solutions are optimizing resource allocation, forecasting, and operational efficiency.

-

Cloud-Based Warehouse Management Systems (WMS): Small and mid-sized enterprises are adopting cloud WMS platforms to gain real-time insights and scalability.

U.S. Market Trends and 2024 Investment Insights

In 2024, the U.S. maintained its leadership in warehouse automation adoption. Major retailers and logistics providers such as Amazon, Walmart, and UPS expanded their investment in AMRs, AI-powered sorting systems, and cloud-based inventory platforms. The federal government also backed supply chain resilience initiatives, offering grants and tax incentives for automation technology. Moreover, startups across Silicon Valley and the Midwest introduced breakthrough innovations in collaborative robotics and AI vision systems, intensifying competition and reducing the cost of adoption.

Market Segmentation – Leading Segments by Market Share

By Component:

-

Hardware dominates the market, led by automated storage and retrieval systems (AS/RS), conveyors, sortation systems, and robotics. These systems form the physical backbone of automated warehouses.

-

Software, particularly Warehouse Management Systems (WMS) and AI-based analytics tools, is the fastest-growing segment, enabling data-driven decisions and process optimization.

-

Services including installation, integration, and maintenance also show steady growth as complex automation setups require expert support.

By End-Use Industry:

-

E-commerce & Retail holds the largest market share, driven by the need for fast, accurate order fulfillment and returns handling.

-

Food & Beverage is rapidly automating cold storage and inventory management to ensure quality, reduce waste, and comply with safety regulations.

-

Pharmaceuticals and Healthcare are investing in warehouse automation to enhance traceability, maintain storage conditions, and streamline regulatory compliance.

-

Automotive and Manufacturing use automation to manage high-volume, high-precision components and support just-in-time production models.Competitive Landscape – Top 5 Market Players and Innovations

1. Daifuku Co., Ltd.

A global leader in AS/RS and material handling systems, Daifuku continues to innovate in high-density storage solutions. In 2024, it unveiled an AI-integrated shuttle system optimized for rapid order picking in e-commerce facilities.

2. Honeywell International Inc.

Honeywell's Intelligrated division expanded its portfolio in 2024 with next-generation voice picking and robotic palletizing systems. The company also launched cloud-based predictive maintenance services.

3. Dematic (KION Group AG)

Dematic strengthened its market position through strategic partnerships with robotics startups. In 2024, it introduced an integrated goods-to-person (GTP) system combining AI, robotics, and IoT for higher efficiency and safety.

4. Swisslog (KUKA AG)

Swisslog focuses on healthcare, e-commerce, and retail automation. In 2024, it rolled out an updated version of AutoStore-based systems with enhanced AI pathfinding and energy efficiency capabilities.

5. Amazon Robotics

Amazon continues to set benchmarks in warehouse automation. The deployment of Proteus, its first fully autonomous mobile robot that works alongside humans without dedicated infrastructure, exemplifies innovation in collaborative automation.

These industry leaders are shaping a hyper-efficient, intelligent warehouse environment through a combination of software, robotics, AI, and connectivity.

Regional Analysis – Strategic Insights by Country

United States:

As the largest market, the U.S. is driven by massive e-commerce operations, a tech-savvy workforce, and strong investment in AI and robotics. Government support for automation in logistics and supply chain resilience further boosts growth.

Germany:

Germany’s automation market benefits from Industry 4.0 adoption, with a strong presence of advanced manufacturing and automotive logistics. Companies are integrating robotics, ERP, and warehouse systems to ensure precision and traceability.

France:

The French government supports automation adoption through incentives for SMEs. Retail and FMCG companies are increasingly investing in compact, modular systems suited for urban warehousing.

United Kingdom:

Driven by e-grocery, pharmaceuticals, and post-Brexit supply chain restructuring, the UK is investing in robotics and cloud-based inventory platforms. Warehousing strategies are shifting toward regional hubs with high automation density.

Japan:

Known for its robotics leadership, Japan is investing in high-tech warehousing for electronics and healthcare. Aging workforce dynamics and space constraints are accelerating adoption of AMRs and compact AS/RS systems.

China:

China's large manufacturing base and e-commerce boom, led by players like Alibaba and JD.com, have fueled massive investment in warehouse automation. Government policy supports digital logistics hubs, 5G connectivity, and AI-powered warehouses.

Conclusion & Strategic Outlook

The Warehouse Automation Market is undergoing rapid evolution, reshaping the way goods are stored, managed, and delivered. As businesses navigate increasing complexity in global supply chains, automation is emerging as a strategic necessity rather than a luxury.