Asia Pacific Ethanolamine Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

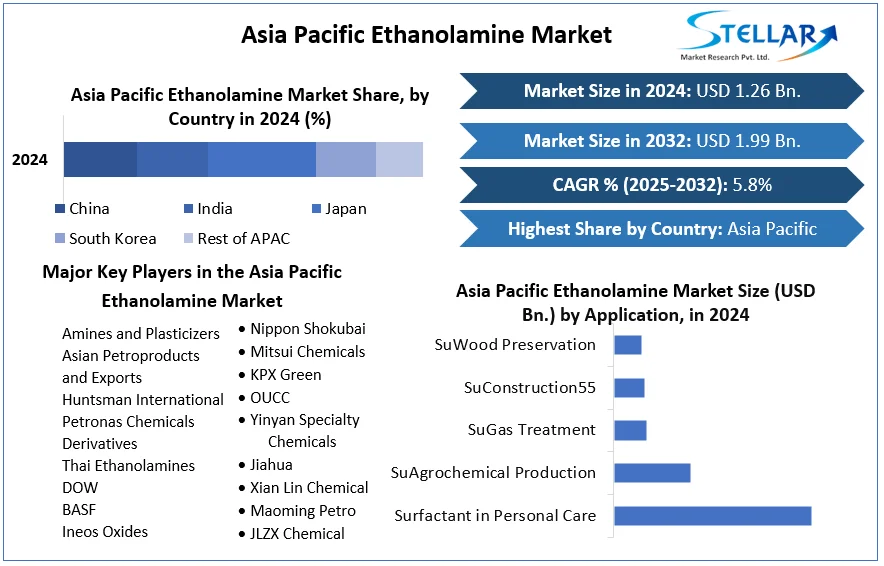

Asia Pacific Ethanolamine Market is projected to grow significantly from USD 2.4 billion in 2023 to approximately USD 5.8 billion by 2032, registering a compound annual growth rate (CAGR) of 5.7%. The rise is primarily attributed to the increasing consumption of ethanolamines in agrochemicals, detergents, construction, and cosmetic formulations, as well as growing environmental awareness and industrial expansion across the region.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Asia-Pacific-Ethanolamine-Market/1712

Market Estimation, Growth Drivers & Opportunities

Ethanolamines—including monoethanolamine (MEA), diethanolamine (DEA), and triethanolamine (TEA)—serve as essential raw materials in a variety of products. Their multifunctional properties such as acting as surfactants, corrosion inhibitors, emulsifiers, and chemical intermediates position them as critical compounds in diverse sectors.

Key Growth Drivers:

-

Agrochemical Demand: The booming agricultural sectors of India, China, and Southeast Asia are using ethanolamines in herbicide formulations to enhance yield and crop protection.

-

Surfactant Applications: Detergents and household cleaners across urban Asia rely on MEA and TEA for effective formulation, especially as hygiene awareness continues to rise post-pandemic.

-

Personal Care Expansion: Urbanization and increasing disposable incomes are driving demand for personal care products, where ethanolamines are used as pH stabilizers and emulsifiers.

-

Construction & Infrastructure: MEA is increasingly used as an additive in cement and concrete formulations across developing countries in the region.

-

Gas Treatment: MEA is critical in treating natural gas and removing carbon dioxide and hydrogen sulfide, particularly as Asia Pacific energy companies focus on clean energy transitions.

Opportunities abound in developing bio-based ethanolamines, expanding carbon capture applications, and customizing formulations to meet both regulatory compliance and consumer preferences.

Regional Trends and 2024 Investment Highlights

The Asia Pacific region remains the global epicenter for ethanolamine production and consumption due to its vast industrial base and fast-paced urban development.

-

China and India are leading the market with continued investments in agrochemicals, textile treatment, and personal care manufacturing. Both countries are developing new manufacturing facilities and integrating ethanolamines in green energy initiatives.

-

BASF’s joint venture with Sinopec in China has significantly expanded ethanolamine production capacity, focusing on improved process efficiency and emission control.

-

Japan and South Korea are focusing on the high-purity applications of ethanolamines in cosmetics and electronics, backed by rigorous quality standards and eco-labeling trends.

-

ASEAN countries, particularly Vietnam and Thailand, are experiencing increased ethanolamine imports to support growing local industries in food processing and construction.

The regional market is also seeing growing interest in sustainable chemical processing, including bio-derived feedstocks and catalytic process optimization.

Market Segmentation – Leading Segments

By Product Type:

-

Monoethanolamine (MEA): Holds the largest share due to its widespread use in detergents, gas treatment, and cement. MEA is also crucial in carbon capture systems, especially as decarbonization goals intensify.

-

Triethanolamine (TEA): Rapidly growing in the personal care segment. TEA is widely used in formulations of lotions, shampoos, and shaving creams.

-

Diethanolamine (DEA): Mostly used in herbicides and corrosion inhibitors, maintaining moderate demand despite regulatory scrutiny in some applications.

By Application:

-

Surfactants & Cleaners: The largest application segment across households and industries.

-

Agrochemicals: Significant growth in herbicide and fertilizer production is driving ethanolamine use in countries like India, China, and Indonesia.

-

Gas Treatment: Especially relevant in industrial gas purification and CCS projects.

-

Personal Care: Rising consumer demand for grooming and skincare products continues to create opportunities.

-

Construction: Cement additives containing ethanolamines enhance workability and curing time, especially in urban megaprojects.

Competitive Analysis – Leading Companies

1. BASF SE (via BASF-YPC JV in China)

With one of the largest production sites for ethanolamines in Asia, BASF focuses on capacity expansion, process innovation, and low-emission production.

2. Huntsman Corporation

Huntsman offers a range of ethanolamines and continues to invest in technological enhancements to meet the demand from the agriculture and energy sectors.

3. SABIC

SABIC maintains a strong regional presence with competitive pricing and integration with other chemical products. It is also investing in greener process technologies.

4. INEOS Oxide

With diversified production across Europe and Asia, INEOS supplies ethanolamines through a strong logistics network, ensuring supply reliability.

5. Nouryon (formerly Akzo Nobel Specialty Chemicals)

Focused on specialty chemicals, Nouryon provides ethanolamines tailored for niche applications including metalworking fluids and high-performance detergents.

Other notable players include Dow Chemicals, Indorama Ventures, Nippon Shokubai, and Air Products, who continue to adapt to evolving regulatory frameworks and invest in sustainability.

Country-Specific Highlights

-

China: Holds the largest share in the Asia Pacific ethanolamine market. Government initiatives in agriculture, clean energy, and industrial upgrading are supporting strong demand growth.

-

India: Emerging as a high-growth market due to expansion in agrochemicals, personal care, and construction. Supportive government policies and FDI inflows are further accelerating ethanolamine applications.

-

Japan: Demand is driven by high-value personal care and specialty chemical industries. Japan is also investing in carbon capture and storage (CCS) applications using MEA.

-

South Korea: The country is seeing rising ethanolamine use in electronic cleaning and fine chemical production.

-

Southeast Asia: Markets like Indonesia, Vietnam, and Thailand are expanding ethanolamine consumption in agriculture, textiles, and food processing industries, supported by trade liberalization and industrial policies.

Conclusion and Strategic Outlook

The Asia Pacific Ethanolamine Market is on a strong growth trajectory, set to exceed USD 5.8 billion by 2032. With consistent demand from sectors like agriculture, personal care, construction, and energy, the market presents robust growth prospects for both established players and new entrants.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness