Enterprise Quantum Computing Market Opportunities, Sales Revenue, Leading Players and Forecast 2029

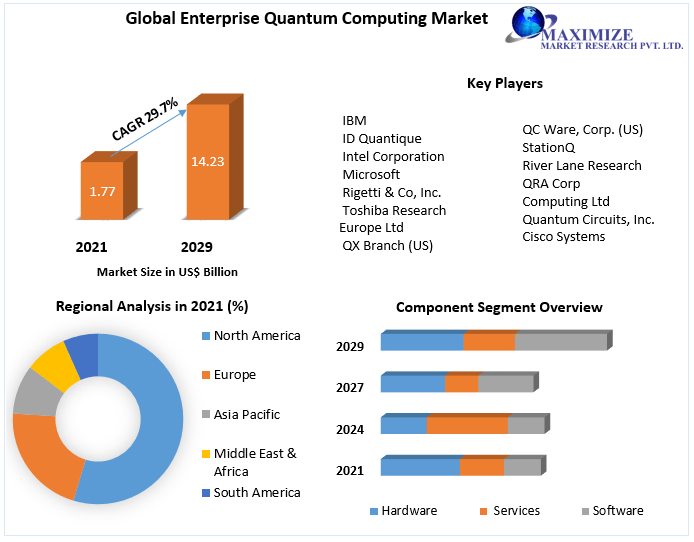

Enterprise Quantum Computing Market size is expected to grow at 29.7% throughout the forecast period, reaching nearly US$ 14.23 Bn. by 2029.

Market Size

The enterprise quantum computing market was estimated at USD 5.2 billion in 2023 and is forecasted to reach USD 70 billion by 2032, with a projected CAGR of 18‑29%, depending on methodologies applied.

Overview

The term "enterprise quantum computing" describes the application of quantum hardware, software, and services by companies to address challenging issues like machine learning, financial modeling, drug development, optimization, and cryptography. About 50–60% of the current market value is made up of hardware, particularly systems and processors, although software and services are rapidly catching up, holding 25–30% and 20% of the market, respectively. As businesses investigate quantum benefits in operations, simulation, and data analytics, demand is growing.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/63462/

Market Scope

- Base Year: 2023

- Forecast Period: 2024–2032

- 2023 Market Value: USD 5.2 billion

- 2032 Outlook: USD 70 billion (upper estimate)

- CAGR Range: 18–29%

Segmentation

By Component:

- Hardware (~50–60%)

- Software (~25–30%)

- Services (~20%)

By Deployment Model:

- On-Premises (dominant in enterprise settings)

- Cloud / Quantum‑as‑a‑Service (QCaaS) (fastest growth)

- Hybrid

By Application:

- Data Analytics (~40%)

- Automation / Optimization (~35%)

- Cryptography & Security, Machine Learning, Simulation

By Technology:

- Superconducting Qubits (market leader)

- Trapped-Ion, Quantum Annealing, Quantum-Dot, etc.

By Region:

- North America (~40% share, largest)

- Europe (~25%)

- Asia‑Pacific (~20%, fastest‑growing ~20% YoY)

- Latin America (~8%)

- Middle East & Africa (~7%)

Major Manufacturers

- IBM

- Microsoft / Azure Quantum

- Amazon Braket

- D-Wave Systems

- Rigetti Computing

- IonQ

- Quantinuum (Honeywell spin-off)

- Intel

- Oracle / Alibaba Cloud

- Cambridge Quantum

- QxBranch

- QC Ware

- Fujitsu

Regional Analysis

United States (North America):

Home to the largest market share, driven by leading research institutions, cloud-based quantum offerings, and enterprise and governmental demand.

Germany & Europe:

Europe holds ~25% with strong R&D initiatives, regulatory backing, and emphasis on sovereign tech capabilities.

Asia-Pacific:

Fastest-growing region at ~20% yearly, fueled by major investments in China, Japan, South Korea, India, and Australia, as well as public–private collaborations.

COVID‑19 Impact Analysis

The pandemic highlighted vulnerabilities in global supply chains and accelerated industries’ interest in computing resilience. While hardware deployment slowed temporarily, quantum cloud services surged in remote-access adoption. Long-term interest intensified, leading to expansion in pilot deployments and collaboration projects post‑2021.

Commutator Analysis

Enterprise quantum systems don’t rely on mechanical commutators but on complex quantum states and control systems. Key technical factors include:

- Qubit Coherence and Error Rates: Critical for operational reliability.

- Hybrid Integration: Combining quantum and classical systems is essential for practical use cases.

- Control Electronics & Cryogenics: Serve as the backbone for maintaining quantum states.

- Cloud Orchestration: Quantum‑as‑a‑Service platforms optimize usability without local hardware.

- Lifecycle Management: Involves calibration, firmware updates, and robust security management.

Key Questions Answered

- What is the market size today and by 2032?

USD 5.2 billion → USD 70 billion, 18–29% CAGR. - Which components dominate?

Hardware leads, but software and services are rapidly gaining share. - Which deployment model is growing fastest?

Cloud/QCaaS adoption is accelerating compared to on-premises. - What are top use cases?

Data analytics, optimization, cryptography, and simulations. - Which technologies lead?

Superconducting qubits dominate but are joined by ion traps and annealing systems. - Which regions lead adoption?

North America leads; Asia‑Pacific sees the fastest growth. - How did COVID‑19 shape the market?

Slowed hardware rollouts, but boosted early adoption of cloud-based quantum services. - What technical challenges must be overcome?

Qubit reliability, hardware scaling, error correction, and integration with existing IT infrastructure.

About Maximize Market Research

Maximize Market Research Pvt. Ltd., based in Pune, India, provides market intelligence across technology, life sciences, industrials, and more. With global insights and custom research, MMR delivers strategic intelligence that helps businesses navigate emerging trends including quantum computing, cybersecurity, biotech, and automation.

Conclusion

Enterprise quantum computing is in a high-growth phase—spanning hardware, software, and services—and driven by demand in analytics, optimization, and secure computing. By 2032, projections range from USD 45 to USD 90 billion, depending on technological milestones and enterprise adoption. With North America and Europe leading, and Asia‑Pacific as a high-growth frontier, stakeholders must invest in hybrid deployment, developer tooling, error-correction solutions, and industry-specific software. Collaboration between public and private entities will be essential to transform quantum promise into business impact.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness