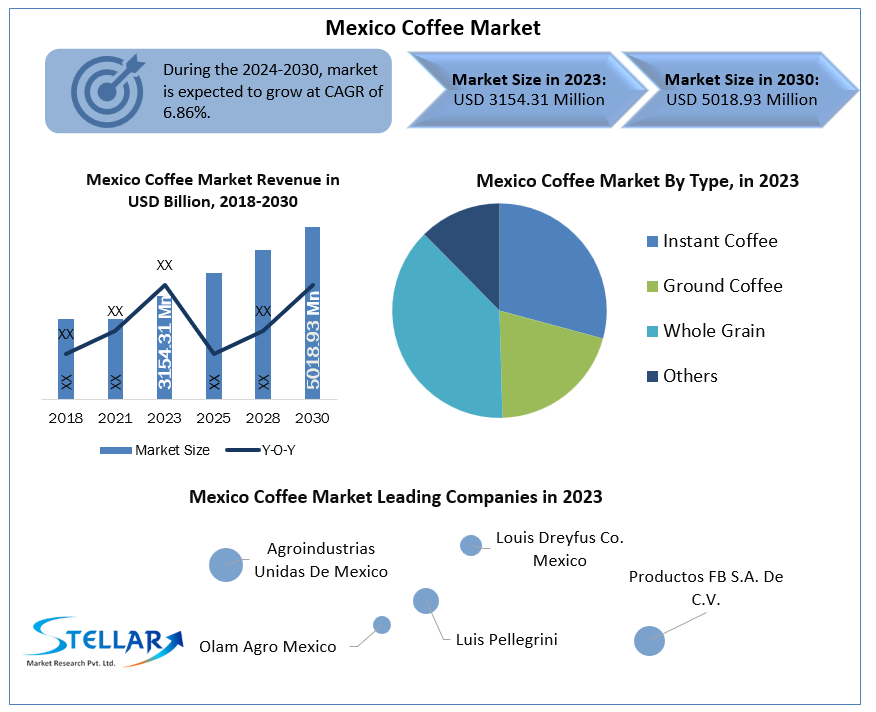

Mexico Coffee Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2024-2030

Mexico Coffee Market is set to grow from USD 3.15 billion in 2023 to USD 5.02 billion by 2030, marking a significant CAGR of 6.9% during 2024–2030. This surge is driven by evolving consumer preferences toward premium, specialty coffee and the rapidly expanding ready-to-drink (RTD) and instant segments .

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Mexico-Coffee-Market/74

Market Estimation, Growth Drivers & Opportunities

The Mexican coffee landscape is being reshaped by several key catalysts:

-

Premium & Specialty Upgrade: Younger consumers—especially millennials—are increasingly opting for premium and artisanal coffee products. This shift is pushing industry players to offer higher-quality beans and distinctive coffee varieties

-

At‑Home Consumption & Convenience: Pandemic-induced changes in lifestyle have sustained strong demand for retail coffee. RTD and instant formats continue to grow, driven by lifestyle convenience and busy routines

-

Domestic Production Resilience: Mexico produces approximately 2.7 million 60 kg bag-equivalents annually, with about 73% of locally grown coffee consumed domestically, reflecting a robust internal supply chain

Export & Specialty Initiatives: Emerging cooperatives in regions like Chiapas are focusing on specialty Arabica beans (e.g., Caturra, Bourbon, Gesha) with high cupping scores for the export market -

Increasing Instant Coffee Preference: In 2024, the instant segment reached USD 247 million and is projected to grow at ~6.6% CAGR toward USD 368 million by 20RTD Product Growth: RTD coffee revenue reached USD 534 million in 2024 and is expected to hit USD 803 million by 2030—a 6.9% CAGR

Opportunities abound in value-added products like flavored instant coffee, artisan single-origin blends, premium RTDs, and e-commerce-driven D2C models.

Mexico Market Trends & Investment Highlights (2024–25)

-

Millennials Leading Growth: Urban young consumers are willing to pay for premium sensory experiences, driving whole bean and specialty offerings across modern retail platforms

-

Government & Private Sector Support: Investment in disease-resistant seed varieties and technical assistance is helping recover from coffee leaf rust and improving yield and bean quality

-

New Processing Facility: Nestlé opened a $340 million instant coffee plant in Veracruz in 2022, solidifying its role in both the domestic and international instant coffee market

-

Cooperative-Led Specialty Growth: Micro-farms in Chiapas are organizing to produce high-scoring beans (83+) and reach new export markets like the US, Middle East, and Asia

Market Segmentation – Leading Segments

-

By Source: Arabica beans dominate premium markets, while Robusta underpins instant coffee products. Arabica accounts for around 80% of Mexican output

-

By Type: Instant coffee remains volume-led due to affordability, while whole bean and ground coffee are leading in premium retail.

-

By Format: RTD coffee is the fastest-growing, while ground/whole bean continues to hold enduring appeal among artisanal and specialty consumers.

-

By Channel: Supermarkets and convenience stores dominate distribution, with digital platforms and specialty roasters gaining significant traction.

Competitive Landscape – Major Players

-

Agroindustrias Unidas de México – Leading local processor with both Arabica and Robusta coffee sourcing.

-

Louis Dreyfus Mexico & Olam Agro Mexico – Prominent in commodity exports and supply chain integration.

-

Nestlé (Nescafé) – Instant coffee market leader, reinforced by large-scale local production.

-

Nescafé Veracruz Plant – Addition of a $340 million manufacturing facility enhances capacity and presence.

-

Cafe Oro, Sabormex & Caffénio – Prominent local brands with robust domestic networks. Caffénio, in particular, operates over 200 drive-through outlets and is entering the U.S. market

Regional Analysis – Mexico’s Coffee Landscape

-

Chiapas, Veracruz & Oaxaca: These southern states produce the majority of Arabica beans, with Chiapas contributing nearly 39% of production. Smallholder cooperatives are promoting shade-grown, organic, and specialty beans

-

Domestic Consumption Trends: In 2023, per-capita consumption remained at ~1.2 kg, lower than global peers but steady, driven mainly by at-home use (85%) .

-

Urban Market Penetration: Expansion of coffee chains—including Starbucks and Caffénio—along with local artisanal roasters, is boosting premium adoption in cities.

-

Climate Risk & Sustainability: Climate change remains a threat to crop viability; shade-grown practices and agroecology are increasingly crucial .

About us

Phase 3,Navale IT Zone,

S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness