Autonomous Ships Market Share, Industry Growth, Business Strategy, Trends and Regional Outlook 2029

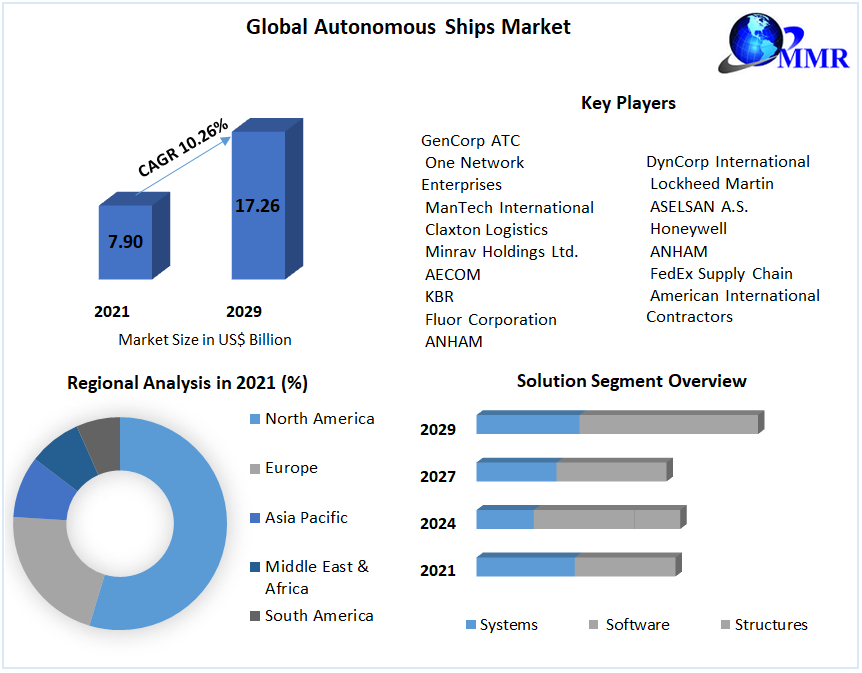

Autonomous Ships Market was valued at US$ 7.90 Bn in 2021 and is expected to reach US$ 17.26 Bn by 2029, at a CAGR of 10.26% during a forecast period.

Market Size

- 2022 Estimate: USD 4.2 billion

- 2023 Update: USD 5.2–5.6 billion

- CAGR (2023–2030): ~8–13%

- 2030 Projection: USD 12–13.4 billion

Overview

Autonomous ships, sometimes referred to as uncrewed or self-navigating vessels, use cutting-edge technologies such as GPS, IoT, radar/LiDAR sensors, and AI-driven navigation to function with little to no crew on board. Significant fuel savings, reduced operating expenses, more cargo capacity, and increased safety are all promised by these ships. Adoption represents a paradigm shift in maritime operations and ranges from tankers and commercial cargo to defense ships and research platforms.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/23715/

Market Scope

The report covers:

- Historical performance (2019–2023) with forecasts through 2030

- Segmentation by autonomy level (semi/autonomous), component (hardware/software), ship type (commercial, defense, passenger), installation mode (line-fit, retrofit), and region

- Regional and country-level assessments

- Competitive landscape profiling OEMs and tech providers

- COVID‑19 impact and post-pandemic recovery

- Key dynamics: drivers, restraints, regulatory trends, and strategic opportunities

Segmentation

By Autonomy Level

- Semi-Autonomous – most prevalent in 2023

- Fully Autonomous – fastest-growing segment

By Component

- Hardware (navigation, sensors, propulsion): dominant segment

- Software & Control Solutions – rapidly ascending share

By Ship Type

- Commercial Vessels (cargo, tankers, containers) – largest segment

- Defense Vessels (USVs, surveillance)

- Passenger Ships – emerging applications

By Propulsion

- Hybrid systems – leading use

- Electric and conventional fuel variants

By Installation

- Line-fit – for newbuild build-outs

- Retrofit – upgrading existing vessels

Major Players

Leading companies shaping the market include:

- ABB

- Siemens

- Kongsberg Maritime

- L3Harris Technologies

- Honeywell

- BAE Systems

- Rolls‑Royce

- Wärtsilä

- Hyundai Heavy Industries

- Northrop Grumman

- DNV

- Buffalo Automation

- Sea Machines Robotics

- Saildrone

These players are innovating in advanced navigation suites, AI orchestration, sensor integration, cybersecurity, and regulatory certification pathways.

Regional Analysis

- Asia-Pacific (≈34%–43% share): Growth powered by China, Japan, South Korea, and India with strong shipbuilding and pilot programs.

- Europe: High regional CAGR supported by maritime autonomy consortiums, cargo ship trials, and regulatory support.

- North America: Steady momentum driven by defense initiatives, commercial pilot projects, Silicon Valley tech firms, and retrofit investments.

- Latin America & MEA: Gradual adoption in offshore logistics and research vessels — early-stage deployment.

Country-Level Insights

- United States & Canada: Early adopters with strong investment in defense USVs and commercial barge retrofit projects.

- China, Japan, South Korea: Major shipbuilders integrating autonomy into new fleets.

- Norway & Europe: Establishment of autonomous cargo routes and cluster partnerships.

- Australia: National trials in defense and maritime domain awareness systems.

- India & Middle East: Defense autonomy strategies and offshore monitoring initiatives.

COVID‑19 Impact Analysis

Pandemic disruptions temporarily slowed newbuild construction. However, shipping demand rebounded, prompting increased investment in retrofit programs and remote-capable systems. Autonomous vessel trials gained traction as operators sought resilient, crew-reduced solutions amid travel restrictions and health concerns.

Market Growth Drivers & Opportunities

- Crew Cost Reduction & Efficiency

Eliminating onboard crew saves ~20%–30% of voyage expenses. - Enhanced Fuel & Space Optimization

Improved hull forms and no crew accommodations increase cargo capacity and reduce fuel use. - Human Error Reduction & Navigation Safety

AI controls and sensor redundancies minimize collision risk and navigational mistakes. - Defense & Security Use Cases

Adoption for maritime surveillance, mine clearance, and strategic patrols continues to rise. - Regulatory Approvals Advancing

IMO MASS guidelines expected by 2028 will facilitate mainstream deployment. - Retrofit Market Expansion

Converting large fleets is becoming a key growth area. - Environmental Incentives

Greenhouse gas regulations support automation tied to hybrid or electric propulsion. - Commercial Development & Collaboration

Partnerships between OEMs and maritime tech firms fuel innovation and route piloting.

Commutator Analysis

Autonomous vessels function as digital commutators—routing multi-source inputs (sensor data, navigation commands, communication signals) in real time across software, hardware, and cloud modules. This ensures seamless coordination of control systems, energy flows, and mission logic, mirroring the role of a commutator in directing electrical current in rotating machinery.

Key Questions Answered

|

Question |

Insight |

|

2023 worldwide market size? |

USD 5.2–5.6 billion |

|

Estimated size by 2030? |

USD 12–13.4 billion |

|

CAGR forecast (2023–2030)? |

~8–13% |

|

Leading autonomy level? |

Semi-Autonomous |

|

Most valuable component? |

Hardware (sensors, propulsion, radar) |

|

Largest market segment? |

Commercial vessels |

|

Top region in share? |

Asia-Pacific (≈40%) |

|

Fastest-growing region? |

Europe and North America |

|

Key adopters? |

Defense, cargo shipping, retrofit players |

About Maximize Market Research

Maximize Market Research is a global intelligence and advisory firm specializing in maritime technologies, defense systems, industrial innovation, and sustainability. Their reports combine in-depth market analysis, regulatory trend tracking, competitor profiling, and scenario planning to guide strategic investment and policy decisions.

Conclusion

The autonomous ships market is on the brink of major transformation. Forecast to reach USD 13 billion by 2030, these vessels promise lower costs, safer operations, and sustainable transport solutions. As governments set regulatory frameworks and shipbuilders integrate intelligence systems, providers offering turnkey autonomy platforms and retrofit kits are well poised to lead a maritime revolution.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness