Out of Band Authentication Market Share, Industry Growth, Business Strategy, Trends and Regional Outlook 2029

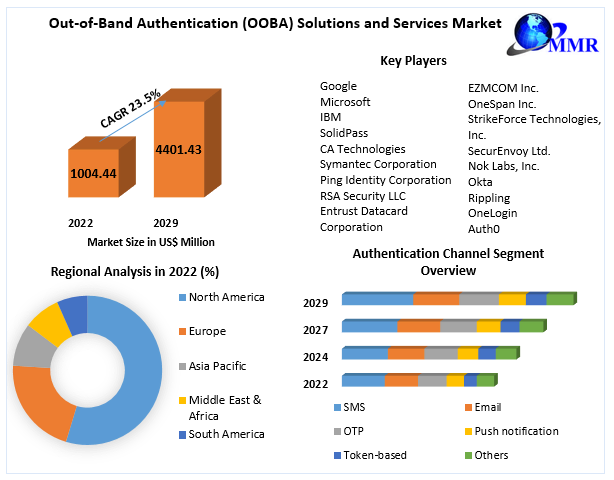

Out‑of‑Band Authentication Market expected to reach US $ 4401.43 Mn by 2029, at a CAGR of 23.5% during the forecast period.

Market Size

- 2024 Market Value: USD 1.5 Billion

- Forecast (2030–2033): USD 4.2–7.5 Billion

- Compound Annual Growth Rate: 11% to 23%

Overview

Two distinct communication channels are needed for the security procedure known as Out-of-Band Authentication (OOBA), which confirms the identity of the user. Hardware tokens, push alerts, email, and SMS are examples of common channels. Because it guards against malware, phishing, and account hijacking, this technique is essential for sectors like banking, government, healthcare, and telecommunications.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/97280/

Market Scope

- Base Year: 2024

- Forecast Period: 2025 to 2033

- Components Covered: Software, hardware, and services

- Industries Covered: BFSI, IT & Telecom, Healthcare, Government, Retail, and Others

Segmentation

By Component:

- Solutions (Software & Hardware)

- Services (Managed & Professional)

By Authentication Channel:

- SMS

- Push Notification

- Voice

- Token-Based

- Others

By Deployment Mode:

- Cloud-Based

- On-Premises

By Enterprise Size:

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-Use Industry:

- Banking, Financial Services & Insurance (BFSI)

- IT & Telecom

- Healthcare

- Government & Defense

- Retail

- Others

Major Manufacturers

- Microsoft

- IBM

- Cisco

- RSA

- Ping Identity

- Duo Security

- Okta

- OneSpan

- Thales

- Entrust

- Auth0

- NortonLifeLock

- Gemalto

- SAASPASS

- SolidPass

- Nok Nok Labs

- CA Technologies

- Early Warning Services

Regional Analysis

North America

The largest regional market, supported by advanced cybersecurity infrastructure, strong enterprise adoption, and stringent compliance regulations in financial services and government sectors.

Asia-Pacific

Fastest-growing region, driven by digital banking adoption, mobile phone penetration, and rising cyber threats. Key countries fueling growth include China, India, and Japan.

Europe

Strong demand due to GDPR compliance and a rise in online financial activities. Countries like Germany, France, and the UK are major contributors.

Latin America & Middle East & Africa

Emerging regions with growing e-commerce, mobile banking, and government digitization programs. Growth is being spurred by increasing awareness of digital threats.

COVID‑19 Impact Analysis

The pandemic accelerated the digital shift, triggering a surge in remote work, online banking, and digital services. As phishing and cyberattacks increased, organizations swiftly adopted OOBA solutions to secure access and maintain business continuity. Post-COVID, cloud-based and mobile-first OOBA solutions remain in high demand.

Market Growth Drivers & Opportunities

Key Drivers:

- Surge in cyberattacks and identity fraud

- Regulatory compliance mandates (e.g., GDPR, HIPAA, PSD2)

- Rise in digital banking, e-commerce, and remote work

- Need for low-friction, high-assurance authentication

- Cloud-first enterprise strategies and zero-trust architecture

Opportunities:

- Adoption of biometric and push-based OOBA

- Integration with IAM and cybersecurity platforms

- Increasing demand from SMEs

- Expansion in emerging markets

- Advancements in tokenless and AI-powered verification

Commutator Analysis

Tech Giants (Google, Microsoft, Cisco, IBM):

Provide full-suite, enterprise-grade authentication systems integrated into cloud ecosystems.

Security-Specific Vendors (RSA, Thales, OneSpan, Entrust):

Offer token-based, hardware-enhanced OOBA solutions with a focus on regulatory compliance.

Cloud-Native Innovators (Okta, Ping Identity, Auth0):

Specialize in seamless, cloud-first user authentication with support for mobile push, biometrics, and contextual risk assessment.

Emerging/Niche Players (SAASPASS, Nok Nok, SolidPass):

Target specific industries and geographies with cost-effective, customizable platforms.

Key Competitive Differentiators:

User experience, integration capability, compliance support, cost, and global reach.

Key Questions Answered

- What is the current size of the OOBA market?

Approximately USD 1.5 Billion in 2024. - What is the forecasted size by 2033?

Between USD 4.2 to 7.5 Billion. - What is the expected CAGR?

11% to 23%, depending on market dynamics. - Which authentication method is most used?

SMS remains dominant, while push notifications and biometric-based methods are gaining traction. - Which industries drive demand?

BFSI leads, followed by IT & Telecom, Government, Healthcare, and Retail. - Which regions are growing fastest?

Asia-Pacific is the fastest-growing; North America is currently the largest. - What are the growth opportunities?

Demand from SMEs, smart authentication, and biometric OOBA represent significant opportunities.

About Maximize Market Research

Maximize Market Research is a global market intelligence and advisory firm serving industrial, technology, healthcare, and security sectors. Their insights combine primary interviews, robust forecasting models, and competitive analysis to guide strategic decisions across business ecosystems.

Conclusion

As digital interactions become central to modern life, securing those interactions becomes critical. The Out-of-Band Authentication market is evolving quickly, driven by increased cyber threats and regulatory pressures. Enterprises adopting adaptive, multi-channel authentication will remain ahead in the race for data security and trust. With growth projected through 2033, OOBA solutions are no longer optional—they're essential.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness