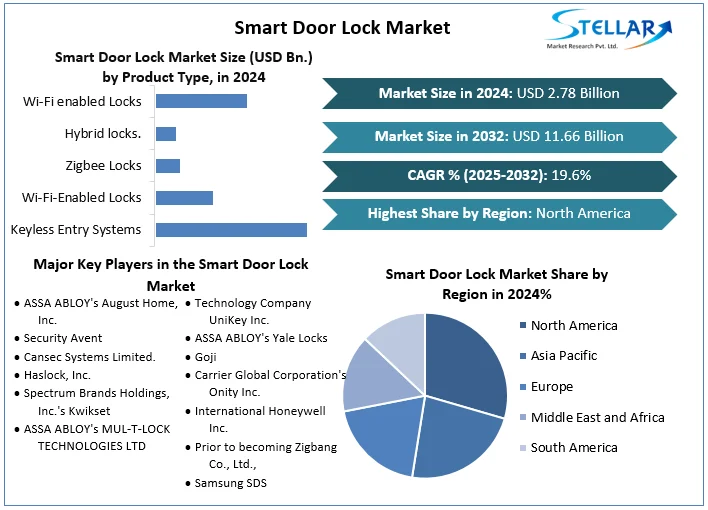

Smart Door Lock Market, valued at USD 2.92 billion in 2024, is projected to grow to USD 11.88 billion by 2032, at a compound annual growth rate (CAGR) of ~19.4% through 2025–2032 Alternative estimates forecast stable expansion toward USD 11.92 billion by 2032, at ~18.1% CAGR Conservative modeling places the market at USD 9.9 billion by 2032 at ~18.3% CAGR . Together, these projections underscore a robust outlook driven by smart infrastructure, security optimism, and technolo

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Smart-Door-Lock-Market/1473

Market Estimation, Growth Drivers & Opportunities

With forecasts between USD 9.9–11.9 billion by 2032, a ~19% CAGR is widely expected

Growth Drivers:

-

Smart city initiatives and IoT expansion, significantly accelerating demand

-

Biometric authentication adoption: Fingerprint, facial, palm, and iris sensors are increasingly integrated for enhanced security

-

Remote access proliferation: Wi‑Fi and Bluetooth connectivity enabling smartphone-based locking/unlocking .

-

AI-enhanced systems: Generative AI is beginning to power anomaly detection and predictive alerts .

Opportunities:

-

Expand smart authentication through biometrics, AI alerts, and decentralized access control.

-

Deploy integrated smart-city solutions, connecting door locks to broader public infrastructure.

-

Serve hospitality, commercial, and co-living segments with multi-user access management.

U.S. Market – 2024 Trends & Investment

The U.S., commanding the largest regional share (~35% in 2024), saw the market hit USD 2.92 billion

2024 highlights:

-

Biometric locks (especially fingerprint and facial recognition) are the fastest-growing sub-segment .

-

Schlage’s Encode Smart Wi‑Fi Lever, widely rolled out in 2023, simplified retrofit installations for single-bore door formats

-

Generative AI features are beginning to emerge in smart lock systems, improving security awareness

Market Segmentation – Leading Segments

-

Application: Residential remains the largest segment, leading the market as early adopters

-

Product Type: Deadbolt locks dominate, valued at approximately USD 1.37 billion in 2024, with ~11% projected growth

-

Technology: Biometric locks are the fastest-growing segment over 2025–2032 .

Competitive Analysis – Top 5 Companies

Leading players include:

-

Assa Abloy (Sweden): Covers Yale, August; strong biometric and mobile-pass ecosystem

-

Dormakaba Group (Switzerland): Extensive offerings in residential and commercial locking systems

-

Allegion plc (Schlage) (U.S.): Introduced Wi‑Fi Encode and Encode Plus UWB models

-

Honeywell International (U.S.): Broadening smart home/security focus with integrated solutions .

-

Xiaomi (China): Strong in APAC with affordable smart-lock offerings .

Notable mentions:

-

SALTO Systems launched the DBolt Touch deadbolt in 2023

-

August Home, Nuki, Aqara, Samsung SDS, Legrand are gaining traction in retrofit segments

Top companies invest in biometric R&D, AI-powered security, retrofit compatibility, and partnerships across hospitality and multi-residential markets.

Regional Analysis – USA, UK, Germany, France, Japan, China

-

USA: ~35% share; driven by smart home adoption, consumer spending, and residential preferences .

-

UK & Germany: GDPR-led data privacy focus supports biometric smart locks; brands like Nuki and Aqara are gaining market share

-

France: Residential and smart-building upgrades, including keyless systems, fuel adoption.

-

Japan: Tech-forward environment is ripe for mobile/app and biometric lock use .

-

China: Leads APAC (~40% share); Xiaomi and Be‑Tech dominate; market supported by smart city projects

-

Asia-Pacific: Fastest regional GDP growth in smart lock adoption, driven by urbanization, IoT, and middle-class expansion .

Conclusion & Strategic Outlook

The Smart Door Lock Market is undergoing transformative growth—expected to expand from USD 2.9 billion to approximately USD 12 billion by 2032, driven by IoT, biometrics, AI, smart homes, and urban expansion.

Strategic recommendations:

-

Expand biometric and AI-enabled product lines to capture high-growth segments.

-

Launch retrofit-ready solutions compatible with U.S. single-bore door systems.

-

Target smart-city and hospitality sectors with multi-user and integrated security solutions.

-

Invest heavily in cybersecurity and firmware resilience to build consumer trust.

-

Customize offerings to meet regional standards and deployment infrastructure across key markets.