Biochar -Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Biochar Market, valued at approximately USD 763.5 million in 2024, is forecast to grow to USD 2.10 billion by 2032, with a CAGR of 13.6% between 2025 and 2032 . Other projections estimate even stronger outcomes—up to USD 3.79 billion by 2032 at a 23.2% CAGR —highlighting robust investor and policy backing.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Biochar-Market/1608

Market Estimation, Growth Drivers & Opportunities

The market is on a rapid trajectory—from USD 763 million in 2024 toward USD 2.10 billion by 2032 (13.6% CAGR) . Conservative forecasts also anticipate USD 1.68 billion by 2032 (13.4% CAGR), while more bullish scenarios envision USD 3.79 billion (23.2% CAGR) .

Primary growth drivers:

-

Sustainable agriculture: Biochar improves soil health—enhancing nutrient retention, structure, and water-holding capacity .

-

Carbon sequestration: Recognized under carbon‑credit regimes and net-zero frameworks, driving incentive for adoption .

-

Circular economy model: Converting agricultural and municipal biomass into valuable biochar aligns with eco-friendly waste strategies .

-

Energy co-benefits: Biomass pyrolysis generates syngas alongside biochar, increasing operational viability .

-

Tech innovation: Emergence of compact pyrolysis units and AI-controlled reactors enhances production efficiency .

Key opportunities:

-

Carbon credit arrangements: Long-term offtake deals with corporates seeking verifiable offsets .

-

Agritech applications: Premium, quality-assured biochar blends sold to agribusiness and horticulture.

-

Diversified products: Granular grades for water treatment, livestock feed, and concrete additives .

-

Decentralized systems: Farm-scale pyrolyzers like Takachar’s offer localized circular solutions .

U.S. Market Latest Trends & Investment (2024)

North America’s biochar submarket stood at roughly USD 13.9 million in 2023, expected to reach USD 19.4 million by 2031 (~4.3% CAGR); U.S. volumes may hit USD 43.6 million by 2032 due to escalating federal and state programs .

2024 highlights:

-

Policy support: Funding through climate and agriculture incentives is enabling pilot and commercial pyrolysis plants.

-

Decentralized adoption: Takachar’s biomass systems are gaining traction among U.S. farmers .

-

Corporate offtake: Google and other firms are securing biochar‑based carbon credits from Indian and global farms .

-

Policy engagement: Global outreach by farmers’ groups and governments (e.g., India) is accelerating plant investment in pyrolysis .

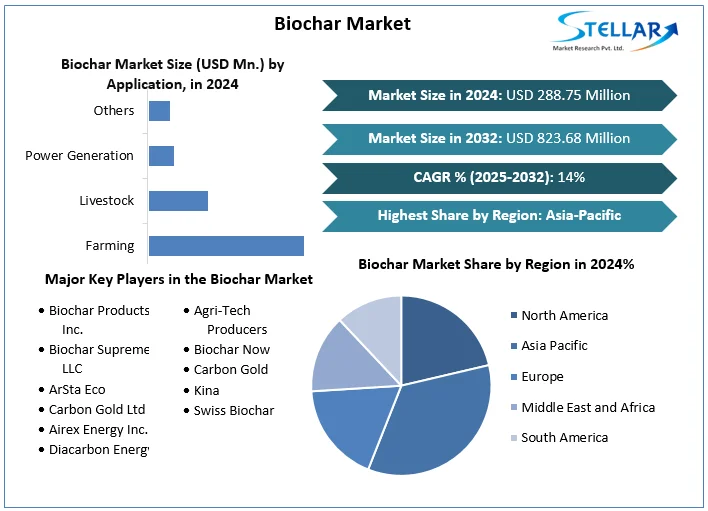

Market Segmentation – Leading Share Categories

By application:

-

Agriculture/farming captures ~77–82% of volume due to widespread soil enhancement usage .

By product type:

-

Granular biochar for horticulture generated ~USD 77 million in 2023 and is growing at ~12.5% CAGR .

By feedstock:

-

Forestry and agricultural residues dominate production with higher carbon yield .

By technology:

-

Slow pyrolysis remains preferred due to consistency in quality and carbon retention .

Competitive Analysis – Top 5 Companies

-

Airex Energy Inc. – Provides modular pyrolysis units; growing presence in North America and Europe .

-

Black Owl Biochar – Focuses on premium-grade soil enhancement products .

-

Biochar Now, LLC – Major U.S. manufacturer with standardized agricultural biochar offerings .

-

Phoenix Energy Group – Converts biomass into syngas and biochar at commercial scales .

-

Carbon Gold Ltd – UK-based leader in horticultural blends, granular formats, and UK soil applications .

These firms are scaling via R&D, product diversification, carbon integration, and vertical value‑chain involvement.

Regional Analysis – USA, UK, Germany, France, Japan, China

-

USA: Climate and farming policy support fund domestic growth; U.S. market projected at USD 43 million by 2032 .

-

UK: Strong horticulture demand; Carbon Gold leads in innovative product development .

-

Germany: European leader in advanced pyrolysis tech, water treatment, and EU soil regulations .

-

France: Decarbonization strategies include biochar subsidies for poor soil rehabilitation.

-

Japan: Researching magnetic biochar for PFAS-contaminated water remediation .

-

China: Holds ~82% of Asia-Pacific market (~USD 630 million in 2024) through agricultural and rice-husk biochar production .

Asia-Pacific is the market leader, followed by Europe and North America—each region supported by agricultural and environmental regulations.

Conclusion & Strategic Outlook

The Global Biochar Market is entering a transformative phase—expected to at least double to around USD 2.10 billion by 2032, with upside potential based on carbon policy and product adoption.

Strategic recommendations:

-

Develop premium agritech soils and granular blends for high-value agricultural sectors.

-

Secure carbon-credit contracts through long-term partnerships with corporate buyers.

-

Deploy decentralized pyrolysis units to foster local circular economy models.

-

Invest in cutting-edge pyrolysis tech (AI-based control, low emissions).

-

Explore industrial use cases (water treatment, construction, PFAS cleanup).

-

Align with farmer-focused policies and agricultural subsidies for adoption at scale.

About us

Phase 3,Navale IT Zone,

S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness