Vision Sensor Market Analysis by Trends Size, Share, Future Plans and Forecast 2030

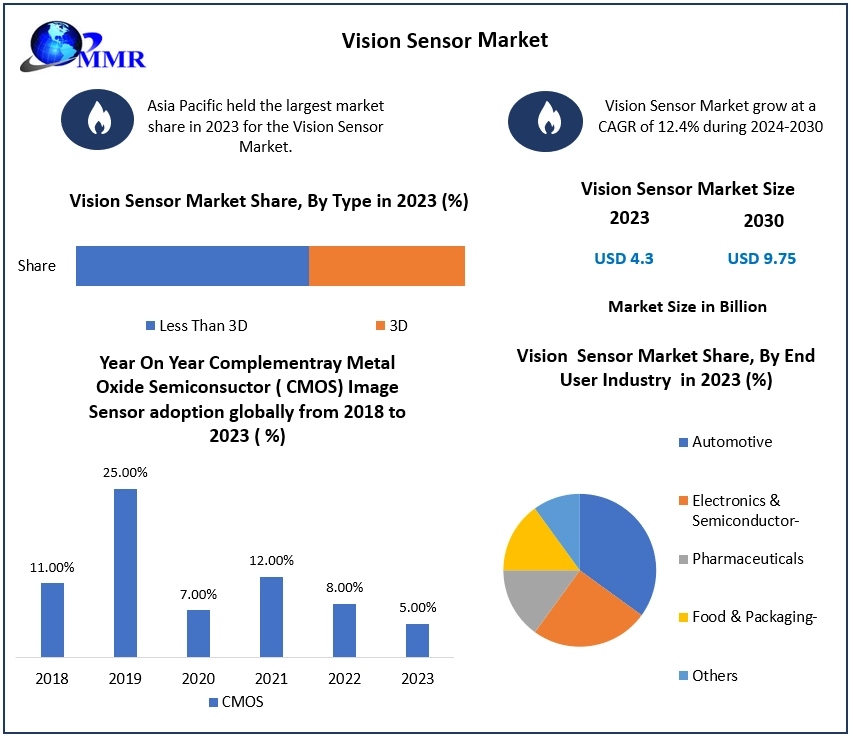

Vision Sensor Market Forecast to Grow from USD 4.3 Billion in 2023 to Nearly USD 9.75 Billion by 2030, at a CAGR of 12.4%

Market Size

The Vision Sensor Market reached an estimated USD 4.3 billion in 2023. It is projected to climb to approximately USD 9.75 billion by 2030, growing at a robust compound annual growth rate (CAGR) of 12.4% over the 2024–2030 period.

Overview

Vision sensors utilize integrated cameras and embedded processing to perform tasks such as object detection, defect inspection, dimension measurement, code reading, and part positioning. Critically important in automated manufacturing, they ensure precision, quality, and repeatability across industries like automotive, electronics, pharmaceuticals, food packaging, and others. The rise of Industry 4.0, coupled with IoT and AI integration, is significantly driving demand for smart, reliable machine vision solutions.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/29678/

Market Scope

- Base Year: 2023

- Forecast Period: 2024–2030

- Historical Period: 2018–2023

- Market Size (2023): USD 4.3 billion

- Market Size (2030 projection): USD 9.75 billion

- CAGR: 12.4% per annum

Segmentation

- By Sensor Type:

- Less Than 3D

- 3D Vision Sensor

- By Application:

- Inspection

- Gauging

- Code Reading & Localization

- By End‑User Industry:

- Automotive (largest in 2023)

- Electronics & Semiconductor

- Pharmaceuticals

- Food & Packaging

- Others

Major Manufacturers

- Cognex Corporation

- Keyence Corporation

- Omron Automation

- Basler AG

- Teledyne Technologies

- Pepperl+Fuchs

- IFM Electronic

- Balluff GmbH

- Leuze Electronic

- Baumer Holding

- Turck

- OmniVision (image sensor solutions)

Regional Analysis

- North America:

The largest regional market, due to high adoption in Industry 4.0-driven smart factories, precision manufacturing, and early technology uptake. The U.S. automotive and electronics sectors are primary growth contributors. - Europe:

Strong demand driven by automotive quality regulations, pharmaceutical precision standards, and growing use of vision in food and packaging lines—particularly in Germany, the UK, and France. - Asia Pacific:

Fastest-growing region, propelled by rising automation in China, India, South Korea, and Taiwan. Government initiatives supporting electronics manufacturing, along with rapid adoption in automotive and smart factories, underpin strong growth. - Middle East & Africa and South America:

Emerging adopters, advancing selective investments in automotive manufacturing, agro-processing, and consumer goods, with modernization of inspection processes creating new opportunities.

Country-Level Analysis

- USA:

Leading national market with widespread deployment of automated quality control systems in automotive, aerospace, electronics, and logistics sectors. - Germany:

Europe’s engineering powerhouse driving adoption of 3D vision sensors for precision inspection, robot guidance, and real-time defect detection within manufacturing.

COVID‑19 Impact Analysis

The pandemic initially disrupted supply chains and slowed industrial automation investments. However, it subsequently accelerated Industry 4.0 initiatives, emphasizing automation to reduce human contact and enhance production resilience. Vision sensor demand rebounded, driven by consumer electronics, pharmaceutical, and packaging industries focused on both quality and safety.

Market Growth Drivers & Opportunity

- Industry 4.0 & Smart Manufacturing:

Integration of vision with robotic systems enables automated inspection, real-time monitoring, and reduced production errors. - AI and Machine Learning Integration:

Advanced deep learning-based vision software provides precise and adaptive defect detection, localization, and measurement. - Surging Automotive Requirements:

Vision sensors are essential for high-volume part verification, code reading in assembly, and vehicle safety inspection. - Expanding Consumer Electronics Manufacturing:

As chip makers and phone assemblers scale, high-speed code reading and contamination control become critical. - Pharmaceutical & Packaging Standards:

Vision systems are needed in serialisation, seal verification, dosage inspection, and print readability.

Commutator Analysis

Leading vision sensor manufacturers differentiate through:

- Precision & Reliability:

High-resolution, high-speed sensors with low downtime and robust error detection capabilities. - 2D vs. 3D Vision:

Less-than-3D sensors are ideal for flat object inspection and code reading, while 3D offers depth analysis essential for robot positioning and volumetric gauging. - Software & AI Sophistication:

Competition between hardware-focused firms and those offering integrated AI vision platforms for deep learning-driven inspection. - Global Footprints & Channels:

Companies maintain local presence in industrial hubs and technical support; partnerships with integrators for turnkey vision solutions.

Key Questions Answered

- What was the market value in 2023?

USD 4.3 billion. - What is the forecast for 2030 and CAGR?

USD ~9.75 billion at a 12.4% CAGR. - Which region dominates and which grows fastest?

North America leads today; Asia Pacific grows fastest. - Which segments hold leadership?

Less-than-3D sensors lead by application; automotive is the largest industry end-user. - Who are the major players?

Cognex, Keyence, Omron, Basler, Teledyne, OmniVision, among others.

About Maximize Market Research

Maximize Market Research offers strategic market intelligence across global industries—from automation and semiconductors to healthcare and energy. Its research methodology includes comprehensive data analysis, expert interviews, PESTEL and Porter’s Five Forces, and scenario planning to support informed decision-making and forecasting.

Conclusion

The Vision Sensor Market is poised for remarkable growth through 2030, driven by automation, AI integration, and sector-specific quality demands. As factories evolve into smart ecosystems, robust vision capabilities are imperative for maintaining precision, reliability, and throughput. With North America and Europe leading adoption and Asia Pacific accelerating, manufacturers—including those focusing on deep learning, onboard AI, and 3D capabilities—are well-positioned to capture opportunities in the next wave of industrial automation and intelligent inspection systems.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness