India Chocolate Industry Dynamics: Key Segments, Emerging Trends, and 2030 Forecast

Market Estimation & Definition

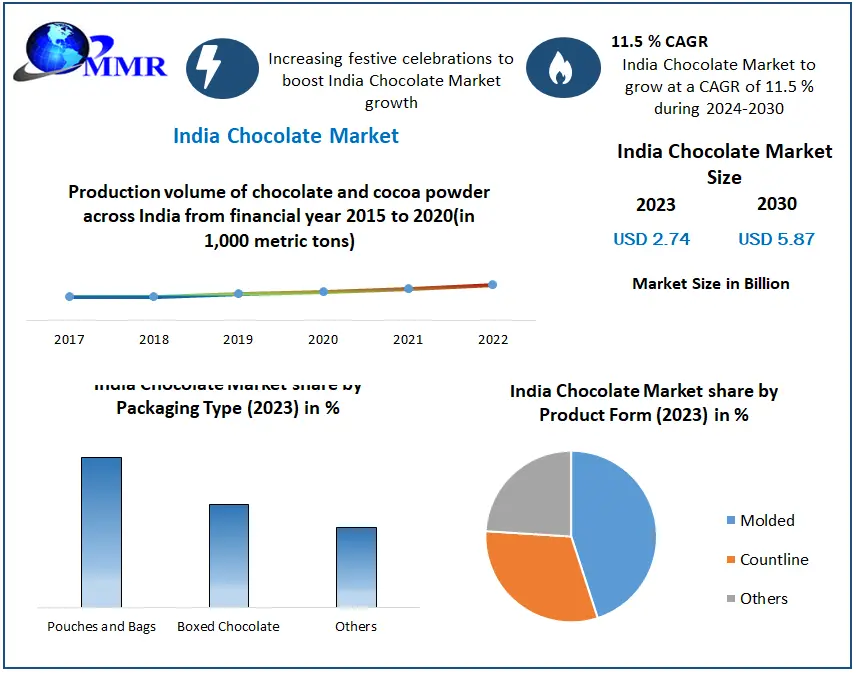

The India Chocolate Industry stood at approximately USD 2.74 billion in 2023 and is projected to nearly double to USD 5.87 billion by 2030, reflecting a strong 11.5% CAGR over the 2024–2030 period. The market encompasses a wide range of chocolate products—including solid bars, liquid chocolates, pastes, molded variants, countline bars, boxed assortments, pouch packs, and more.

Ask for Sample to Know US Tariff Impacts on India Chocolate Industry @ https://www.maximizemarketresearch.com/request-sample/24126/

Market Trend:

Increasing Demand of Premium and Healthy Chocolates

People in India want to indulge themselves with bite-sized chocolates to restrict their confectionery consumption, hence the premium chocolate industry is highly popular. Premium chocolate fits very nicely with the country's 'clean eating' trend. Because chocolate has been shown to have several health benefits, people are opting for luxury chocolates for a guilt-free experience. Supermarkets and hypermarkets such as D-Mart and Reliance Mart are attempting to acquire market momentum by carrying premium chocolate brands such as Ferrero. Premium chocolate has well-balanced components, which is beneficial to health and lowers the risk of low blood pressure and cholesterol.

Nanofabrication technologies are emerging as innovative solutions across India, with the goal of developing active materials for use in the design of packages, coatings, and packaging technologies, which helps in maintaining and improving the sensorial and nutritional characteristics and safety of foodstuffs, as well as increasing their shelf life.

Market Growth Drivers & Opportunity

-

Rising disposable income: As urban and rural incomes climb, a growing middle- and upper-class population is indulging in both everyday and premium chocolate consumption.

-

Health-oriented choices: Consumers are increasingly drawn to dark, sugar-free and organic chocolates, especially those highlighting wellness benefits such as antioxidants and low-sugar formulations.

-

Gifting and celebratory trends: Festivals, holidays, and social occasions fuel demand for premium, aesthetically appealing chocolates, offering opportunities in limited-edition, boutique-style product lines.

-

Sustainable innovation: As environmental awareness rises, demand grows for eco-friendly, recyclable, and minimal-waste packaging—an area ripe for product differentiation.

-

Niche segments: Vegan, gluten-free, and functional chocolates catering to specific dietary needs present untapped potential.

Explore key trends, innovations & market forecasts: https://www.maximizemarketresearch.com/market-report/india-chocolate-market/24126/

Segmentation Analysis

Based on Product Type, the market is segmented into Milk Chocolate, White Chocolate, Dark Chocolate, and Others. Milk Chocolate segment dominated the market in 2023 and is expected to hold the largest India Chocolate Market share over the forecast period. Milk chocolate is creamy and sweet taste makes it a favored choice for indulgence and snacking. As a culturally diverse nation, milk chocolate aligns with the traditional palate, making it a familiar and comforting treat. Milk chocolate is often associated with nostalgia and festive celebrations, further driving its demand during special occasions. Strategic marketing campaigns, seasonal promotions, and attractive packaging also play an important role in maintaining milk chocolate's position as a dominant player in the India chocolate market.

Based on Product Form, the market is segmented into Molded, Countline, and Others. Moulded segment dominated the market in 2023 and is expected to hold the largest India Chocolate Market share over the forecast period. The molded segment is primarily influenced by consumer preferences for visually appealing and creatively designed chocolates. Molded chocolates come in various shapes and sizes, captivating consumers with their novelty and charm. The attractive appearance of molded chocolates makes them ideal for gifting, especially during festivals and special occasions. The flexibility of molded chocolates allows Chocolate manufacturers to experiment with different flavors, fillings, and textures, catering to diverse tastes. As the gifting culture continues to thrive in India, the demand for aesthetically pleasing molded chocolates remains high, which significantly boosts the India Chocolate Market growth.

Country-Level Analysis: USA and Germany

-

USA: Characterized by high per-capita chocolate intake. Mainstream and premium chocolate both thrive, accelerated by online retail penetration and gifting culture.

-

Germany: A leader in chocolate consumption within Europe, with consumer preferences skewed toward organic, fair-trade, and high-quality variants. Premium and health-oriented options are particularly well-received.

Competitive Analysis

Leading companies—including major Indian players and multinational brands—are focused on:

1. Ferrero India Private Limited

2. Amul

3. Nestle India Limited

4. Mars International India Private Limited

5. ITC Limited

6. Hershey India Private Limited

7. Lotus Chocolate Company Limited

8. Gujarat Cooperative Milk Marketing Federation Ltd

9. Mondelez India Food Pvt Ltd

10. Others

Competitive Landscape

The Competitive Scenario presents an outlook study of the suppliers' various business growth strategies. The stories in this part give helpful views at various stages while keeping up to speed with the business and engaging players in the economic debate. The competitive scenario includes press releases or news from organizations in the following categories: Merger & Acquisition, Agreement, Collaboration, & Partnership, New Product Launch & Enhancement, Investment & Funding, and Award, Recognition, & Expansion. All of the news gathered assists vendors in understanding market gaps and competitors' strengths and weaknesses, consequently providing insights to improve products and services.

Conclusion

India’s chocolate market is poised for a transformative rise through 2030. With accelerating consumer incomes, evolving health and gifting patterns, and a growing focus on sustainability, brands equipped to innovate in product development, packaging, and omnichannel strategy will capture the greatest growth. As preferences shift toward premium, wellness, and eco-conscious offerings, now is the moment for companies to solidify their position in one of the world’s most promising chocolate markets.

Frequently asked Questions:

1] What segments are covered in the India Chocolate Market report?

2] What is the market size of the India Chocolate Market by 2030?

3] What was the market size of the India Chocolate Market in 2023?

4] Key players in the India Chocolate Market.

5] What are the key factors driving the India Chocolate Market?

ADDITIONAL REPORTS

Apple Cider Vinegar Market https://www.maximizemarketresearch.com/market-report/global-apple-cider-vinegar-market/98303/

Starch Derivatives Market https://www.maximizemarketresearch.com/market-report/global-starch-derivatives-market/27540/

Breakfast Cereal Market https://www.maximizemarketresearch.com/market-report/global-breakfast-cereal-market/28323/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness