Plant-based-Beverages -Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

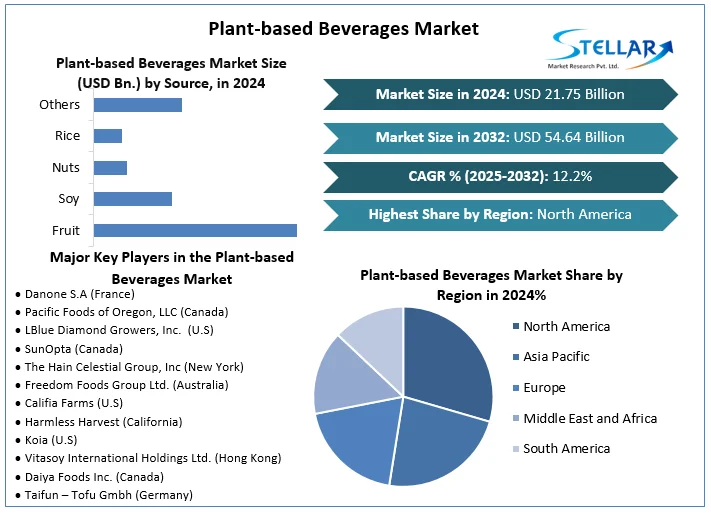

Plant‑Based Beverages Market was valued at USD 21.75 billion in 2024 and is projected to grow to USD 54.64 billion by 2032, reflecting a strong CAGR of approximately 10–12% during 2024–2032 Rising lactose intolerance, sustainability concerns, and expanding vegan and flexitarian diets are primary forces fueling the market’s rapid expansion.

Request free Sample Report:https://www.stellarmr.com/report/req_sample/Sensitive-Skin-Care-Products-Market/1727

Market Estimation, Growth Drivers & Opportunities

Analysts consistently forecast a market trajectory from USD 21.8 billion in 2024 to USD 54–55 billion by 2032, at around 11–12% CAGR

Key growth drivers include:

-

Health & dietary shifts: More consumers are lactose intolerant or are choosing dairy-free diets due to health concerns like cholesterol and cardiovascular disease

-

Environmental and ethical motivations: Production of plant-based beverages uses significantly less land and emits fewer greenhouse gases than dairy, prompting eco-conscious consumption

-

Product innovation & fortified nutrition: Manufacturers are developing enhanced variants to improve taste, protein content, and added nutrients, increasing appeal .

-

Flexible distribution: Growth in careful regulation and e-commerce supports global penetration and product availability

Opportunities ahead include:

-

Neu-formulations: Fortified plant milks targeting bone, heart, and cognitive health.

-

Emerging ingredients: Rice, pea, oat, and hemp milks are gaining traction for taste and functional advantages

-

New delivery formats: Ready-to-drink plant-based lattes, smoothies, and hybrid beverages are expanding consumption occasions.

-

Functional blends: Probiotic, collagen, chocolate, or flavored infusions tapping into immune and wellness trends

U.S. Market: 2024 Trends & Investment

North America—particularly the U.S.—holds the largest regional share, with North America expected to dominate through 2032

2024 Highlights:

-

Surge in lactose intolerance and flexitarian diets is driving repeat purchases of plant-based milks .

-

Health consciousness is prompting fortified offerings like heart- or bone-health blends .

-

Retail expansion includes plant-based lattes at coffee chains and off-premise grocery growth.

-

R&D focus: Brands are improving taste/texture and fortifying with protein, fiber, vitamins, and pre/probiotics.Market Segmentation – Leading Category

Market breakdown by source shows:

-

Soy milk leads current market share (~39%) due to nutritional properties

-

Coconut milk is the fastest-growing category, leveraging indulgent taste and use in beverages

By product type:

-

Plain plant milk (~70%) still commands majority usage.

-

Flavored variants (vanilla, chocolate, barista blends) are the fastest-growing segment

Emergen Research estimates the global market will reach USD 54.9 billion by 2032, at a 12.1% CAGR

Competitive Analysis – Top 5 Companies

Major players shaping the market include:

-

Coca‑Cola

Expanding plant-based dairy alternatives through innovation and acquisitions, targeting non-dairy beverage growth. -

PepsiCo, Inc.

Investing in and launching brands (e.g., oat and almond-based), emphasizing fortified nutrition and sustainability. -

Danone SA

Through its Alpro brand, the company converted dairy plants for oat beverages; scaling output to over 300,000 liters per day precedenceresearch.com+1marketresearchfuture.com+1reddit.com. -

Hain Celestial Group

Specializing in natural and organic plant milks, releasing probiotic lassi and functional blends. -

SunOpta Inc.

Ingredients and branded entrants in almond, oat, and soy, focusing on clean-label transparency and texture innovation.

These companies drive industry transformation through R&D, plant conversions, mergers & acquisitions, and sustainability pledges.

Regional Analysis – USA, UK, Germany, France, Japan, China

-

United States: Leading due to prominent e-commerce, flavor innovation, and retail tie-ups. North America holds the highest regional share

-

United Kingdom: Fast adoption of oat and flavored milks, plus chain café distribution.

-

Germany: Europe’s strongest market, with high vegan penetration supporting soy and oat growth.

-

France: Significant investment by Alpro and Oatly in French plant milk factories reflects domestic demand

-

Japan: Strong reputation for non-dairy beverages (soy and rice), with new flavored and fortified launches appealing to health-conscious consumers.

-

China: Large domestic market with soy legacy; modern dairy alternatives expanding rapidly due to rising affluence .

Conclusion & Strategic Outlook

The Global Plant‑Based Beverages Market is on track to more than double over the next eight years, fueled by health, sustainability, and product innovation. A surge toward USD 54–55 billion by 2032, representing 10–12% annual growth, underscores an enduring shift in consumer values and manufacturing strategy.

About us

Phase 3,Navale IT Zone,

S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness