Semiconductor Chemicals Market Analysis: Growth Drivers, Trends, and Regional Insights Through 2032

Introduction

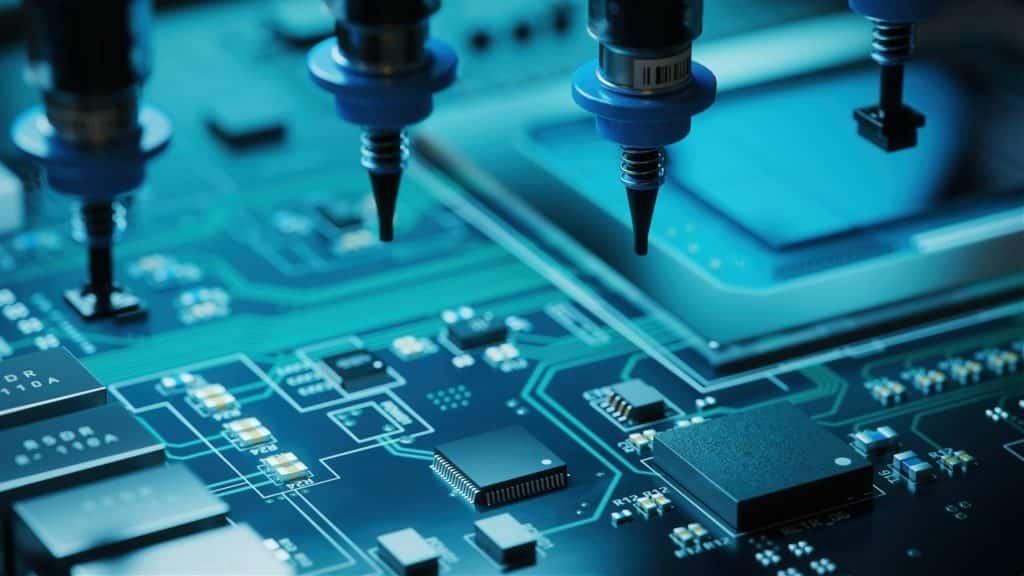

The global semiconductor chemicals market is undergoing significant transformation, fueled by rapid technological advancements, increasing demand for miniaturized electronic devices, and rising investments in semiconductor fabrication facilities. As integrated circuit (IC) design becomes more complex and fabrication nodes shrink below 7nm, the need for high-purity and application-specific semiconductor-grade chemicals continues to grow. From wafer processing to etching, doping, and cleaning, these chemicals play a crucial role in enabling higher yields, performance, and efficiency across the electronics supply chain.

This article presents an in-depth market analysis of semiconductor chemicals, highlighting key market segments, growth drivers, regional insights, and the competitive landscape shaping the future of this critical industry.

Market Overview

The semiconductor chemicals market was valued at approximately USD 9.5 billion in 2022 and is projected to reach over USD 17.2 billion by 2032, growing at a CAGR of around 6.2% during the forecast period. This market includes a wide range of chemicals such as photoresists, strippers, etchants, wet chemicals, CMP slurries, dopants, and specialty gases, all of which are essential for semiconductor wafer production.

Market growth is driven by the surge in global electronics consumption, the expansion of 5G infrastructure, and the increasing demand for smart devices, autonomous vehicles, and high-performance computing (HPC) chips. Additionally, semiconductor fabs are becoming more localized across Asia-Pacific, North America, and Europe, creating localized demand for chemicals and material supply chains.

Key Market Drivers

-

Miniaturization and Advanced Node Technology

As the semiconductor industry advances toward sub-5nm and even 2nm technology nodes, there is a significant rise in demand for ultra-high-purity chemicals and advanced lithographic processes. This shift requires highly specific photoresists, antireflective coatings, and etching gases that meet stringent contamination control standards, driving up the value and volume of materials consumed per wafer. -

Rise of AI, IoT, and 5G Ecosystem

Emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity are pushing the demand for more powerful semiconductors. The resulting boom in chip manufacturing is translating to increased consumption of wet chemicals, strippers, and solvents, particularly in logic, memory, and sensor applications. -

Global Semiconductor Manufacturing Expansion

To address chip shortages and reduce dependency on single-source suppliers, governments and private players are investing billions into new semiconductor fabs, especially in countries like China, India, South Korea, the U.S., and Germany. These initiatives are boosting local demand for reliable and cost-effective chemical suppliers.

Segmentation Analysis

-

By Product Type:

-

Etchants & Solvents dominate the market due to their broad applications in cleaning and etching.

-

CMP slurries and photoresists are gaining traction with advanced node manufacturing.

-

Specialty gases, including fluorinated compounds and noble gases, are vital for plasma etching and deposition processes.

-

-

By Application:

-

Semiconductor manufacturing (logic and memory chips) holds the largest share.

-

Packaging and testing is an emerging segment, especially with the rise of chiplet and heterogeneous integration.

-

-

By End User:

-

Foundries and integrated device manufacturers (IDMs) are the key end users.

-

Research institutions and academic labs form a smaller but growing segment, given the push for R&D in semiconductor materials.

-

Regional Insights

-

Asia-Pacific is the largest and fastest-growing region, led by semiconductor hubs in Taiwan, South Korea, China, and Japan. The region accounts for over 60% of global semiconductor fabrication and is a key consumer of chemicals.

-

North America is experiencing renewed growth due to U.S. CHIPS Act investments, especially in Arizona, Texas, and New York, fostering local demand.

-

Europe is focusing on advanced packaging and automotive-grade chips, driving demand for specialty wet chemicals and resist materials.

Competitive Landscape

The semiconductor chemicals market is moderately consolidated, with a mix of multinational players and specialized suppliers. Major companies include:

-

BASF SE

-

DuPont de Nemours, Inc.

-

Fujifilm Electronic Materials

-

Merck KGaA (EMD Performance Materials)

-

Hitachi Chemical Co., Ltd.

-

Linde plc

-

Versum Materials (Acquired by Merck)

These firms compete based on innovation, product purity levels, global supply chain capabilities, and long-term partnerships with leading fabs like TSMC, Samsung, Intel, and GlobalFoundries.

Trends and Future Outlook

-

Green and Sustainable Chemistry

Sustainability is emerging as a priority, with fabs seeking low-waste, low-carbon-emission chemicals and suppliers investing in recycling, reclamation, and energy-efficient production processes. -

Material Innovation for EUV Lithography

The rise of extreme ultraviolet (EUV) lithography demands next-generation photoresists, underlayers, and anti-scattering coatings. Companies focusing on these materials are likely to see a surge in demand. -

Regionalization and Onshoring of Supply Chains

Ongoing geopolitical tensions are accelerating regional supply chain realignment, especially for critical materials. Local sourcing of high-purity chemicals is becoming a strategic priority for nations.

Conclusion

The semiconductor chemicals market stands at the intersection of technological advancement and industrial resilience. As chip designs grow more complex and end-use applications expand, chemical suppliers will play an increasingly vital role in enabling efficient, sustainable, and high-performance semiconductor manufacturing. Manufacturers, market players, and consultants looking to invest or expand in this domain must keep a close eye on purity standards, material compatibility, and regional demand patterns to remain competitive through 2032 and beyond.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness