Diffractive Optical Elements Market Strategies Shaping Innovation, Customization, and Global Expansion Across Industries

The diffractive optical elements market has grown substantially over the past few years, driven by rising demand for miniaturized optical systems and high-efficiency light manipulation technologies. As industries increasingly integrate advanced optics into their systems, strategic approaches within the DOE market have become essential for maintaining competitiveness, enhancing product performance, and expanding into new sectors. Companies that adopt proactive strategies focusing on innovation, customization, partnerships, and regional diversification are well-positioned to capture the evolving market opportunities.

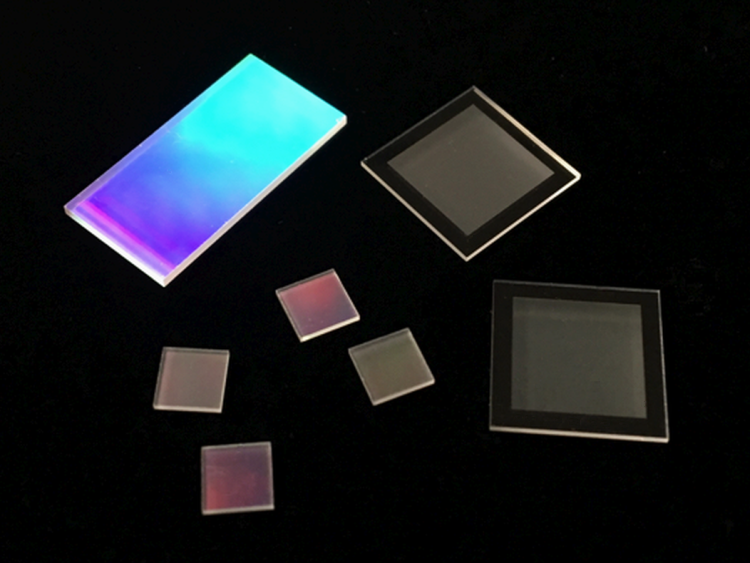

Diffractive optical elements (DOEs) are key to controlling light through diffraction, providing greater design flexibility compared to traditional refractive optics. Their ability to split, shape, and focus light with compact structure makes them suitable for applications in laser systems, imaging, sensors, and projection devices. To stay ahead in this competitive landscape, manufacturers and solution providers are developing strategies aligned with market trends, end-user expectations, and technological breakthroughs.

Innovation-Led Product Development

One of the most significant strategies driving the DOE market is the focus on continuous innovation. Companies are investing in research and development to create advanced products that deliver greater accuracy, improved efficiency, and expanded functionality. The shift toward nano-structured DOEs and hybrid optical components is enhancing performance, especially in complex laser-based systems used in medical devices and industrial applications.

Innovation in fabrication techniques, such as grayscale lithography and direct laser writing, is enabling manufacturers to reduce production time and enhance the quality of diffractive patterns. These advancements support the development of multi-functional DOEs that can perform multiple optical tasks within a single component, reducing system size and cost.

Strategically, leading companies are setting up in-house R&D centers or collaborating with research institutions to accelerate the commercialization of cutting-edge technologies. This not only helps in maintaining technological leadership but also in reducing the time-to-market for new DOE products.

Customization and Application-Specific Design

Another crucial strategy is the growing emphasis on customization. Since DOEs serve highly specialized purposes across different sectors, offering application-specific designs has become essential. Healthcare, defense, telecommunications, and consumer electronics all require unique specifications based on their system requirements and environmental conditions.

To meet this need, manufacturers are developing flexible design frameworks and software-driven modeling tools that allow for precise and rapid customization. This approach not only increases the value proposition of the product but also helps in building long-term customer relationships and reducing product rejection rates.

For instance, in the medical field, custom DOEs are being used in laser surgery tools and imaging systems where precision is critical. In automotive LiDAR systems, DOEs are tailored for high-resolution scanning and wide-angle beam shaping, supporting the development of safer autonomous driving technologies.

Strategic Partnerships and Collaborations

Strategic collaborations with system integrators, OEMs, and academic institutions are proving to be highly effective in expanding market reach and enhancing technical capabilities. Through joint ventures and co-development agreements, companies are gaining access to new markets and accelerating the integration of DOEs into a wider array of systems.

Such collaborations also allow for shared risk in innovation, especially when working on new product categories or entering regulated markets such as healthcare and defense. In addition, working closely with end-users ensures that DOE manufacturers receive timely feedback, enabling iterative improvements in design and performance.

Expansion into Emerging Markets

As the global demand for high-performance optical components increases, many companies are strategically expanding into emerging markets. Regions such as Asia-Pacific, particularly China, India, South Korea, and Southeast Asia, are becoming growth hotspots due to rapid industrialization, growing healthcare infrastructure, and increasing investment in defense and telecommunications.

To capture these opportunities, companies are establishing local manufacturing facilities, sales offices, and distribution networks. This localization strategy not only reduces logistics costs but also helps in understanding regional customer needs and regulatory requirements more effectively.

In addition to geographical expansion, vertical integration is also being pursued as a strategy to control quality, reduce dependency on third-party suppliers, and improve profit margins.

Focus on Scalability and Sustainability

Scalability is a major strategic focus, especially as DOEs find applications in mass-market products like smartphones, wearables, and AR/VR headsets. Companies are optimizing their manufacturing processes to accommodate large-volume production without compromising on precision or cost-efficiency.

Alongside scalability, sustainability is becoming increasingly important. Environmentally conscious manufacturing, waste reduction, and energy-efficient processes are gaining traction, especially among companies looking to align with global green initiatives. Using recyclable materials and eco-friendly packaging solutions also forms a part of long-term market positioning strategies.

Marketing, Education, and Customer Engagement

Educational marketing is an emerging strategy in this technical market. Given that DOEs are still relatively complex and not widely understood by all end-users, companies are investing in creating knowledge-based content such as white papers, webinars, and technical workshops to raise awareness about their benefits and applications.

Additionally, customer support and technical consultation services are being enhanced to build trust and loyalty. Offering lifecycle support, from design to post-deployment troubleshooting, allows companies to differentiate themselves in a crowded market.

In conclusion, the diffractive optical elements market strategies shaping the future of this industry revolve around continuous innovation, tailored product development, collaborative partnerships, and aggressive market expansion. By aligning technical capabilities with specific industry needs and regional demands, companies can not only enhance their market position but also drive the next wave of growth in the optics and photonics sector.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness