A Detailed Overview of the Biocontrol Agents Market and Its Global Growth Trajectory

The biocontrol agents market is witnessing substantial growth as the agriculture industry embraces sustainable and environmentally friendly practices. Biocontrol agents, which include beneficial organisms such as bacteria, fungi, viruses, and insects, are increasingly being used to manage crop pests and diseases. Unlike chemical pesticides, biocontrol agents offer natural, safe, and eco-compatible solutions, making them a key component in modern agriculture. This overview explores the current state of the market, emerging trends, regional outlooks, and the driving forces behind its expansion.

Market Definition and Scope

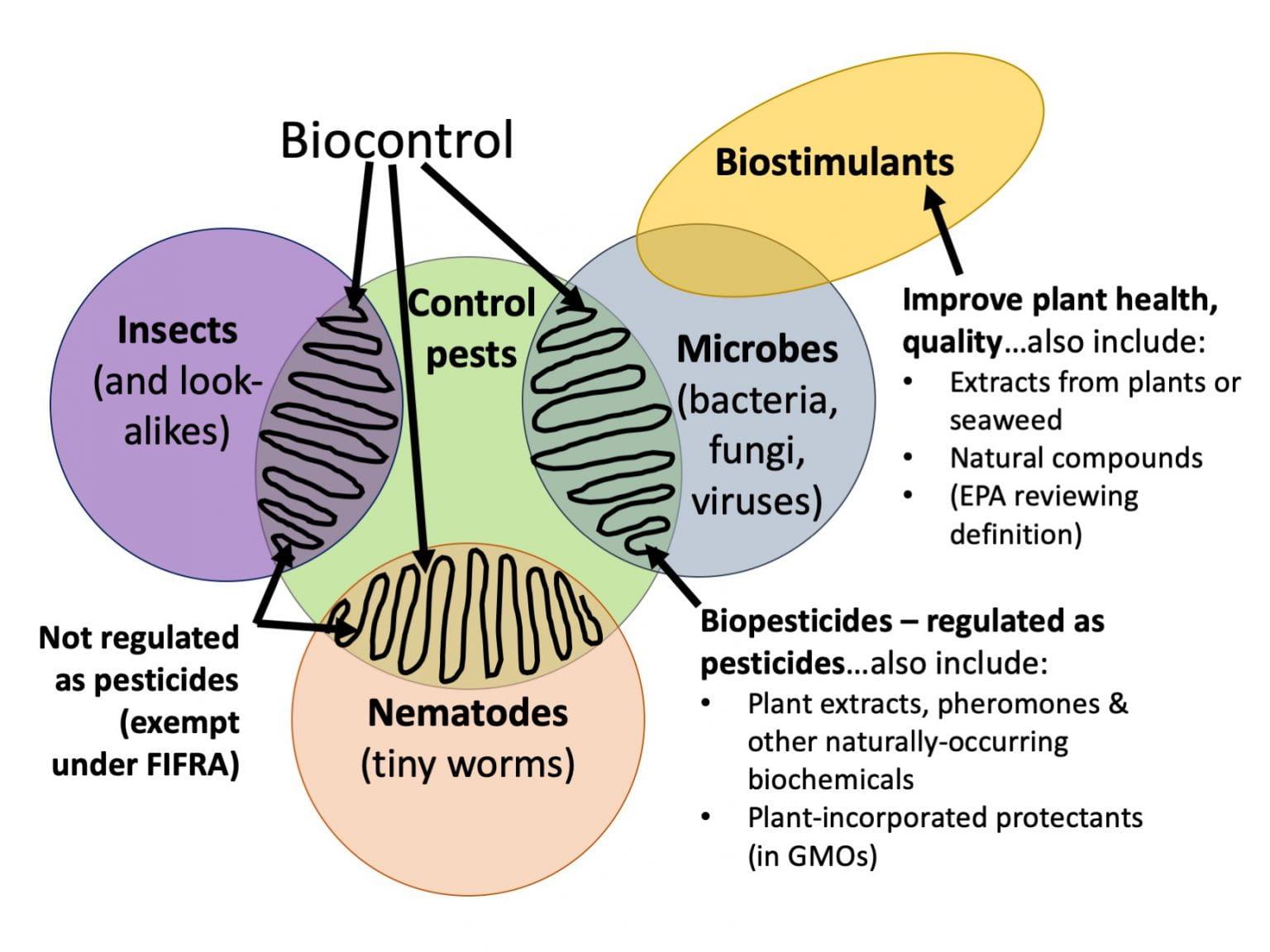

Biocontrol agents are biological products used to suppress the activity of harmful pests and pathogens in agriculture. These agents are typically classified into three categories: microbial (including bacteria, fungi, and viruses), macrobial (including insects and nematodes), and biochemical (such as plant extracts or pheromones). Their growing use is largely tied to increasing concerns over pesticide residues, environmental degradation, and the long-term health impacts of synthetic crop protection chemicals.

The market covers various sectors including field crops, fruits and vegetables, greenhouse crops, turf and ornamentals, and post-harvest applications. Biocontrol agents are used both in open field agriculture and controlled environments, offering flexibility and adaptability across a wide range of conditions.

Current Market Dynamics

Over the past decade, the biocontrol agents market has experienced notable growth. A combination of consumer preferences, regulatory changes, and environmental awareness has accelerated the adoption of biological pest control solutions. The market is particularly strong in regions with advanced agricultural systems and strong environmental governance, such as Europe and North America.

Organic farming practices have played a critical role in this upward trend. With the global organic food market expanding steadily, demand for chemical-free cultivation methods has surged. Biocontrol agents align perfectly with organic certification standards, making them essential tools for farmers seeking to meet these requirements.

Additionally, integrated pest management (IPM) is gaining traction globally. IPM strategies rely on a balanced approach to crop protection, combining biological, cultural, and chemical methods. Biocontrol agents form the backbone of these systems, offering sustainable, targeted, and long-lasting solutions to pest problems without creating pesticide resistance or harming non-target species.

Key Market Segments

The market can be segmented by type, crop application, mode of application, and geography. Among these, microbial biocontrol agents hold the largest market share due to their wide applicability and ease of formulation.

-

By Type: Microbial agents lead the segment, followed by macrobial and biochemical agents.

-

By Crop Type: Fruits and vegetables are the most common crops treated with biocontrol agents due to their high value and sensitivity to chemical residues.

-

By Application: Foliar spray is the most widely used application method, though seed treatment and soil application are also popular in certain crop systems.

-

By Region: Europe leads the market, followed by North America. Asia-Pacific is showing rapid growth due to increased government support and rising food demand.

Regional Overview

-

Europe: With strong regulatory frameworks and high consumer demand for organic food, Europe remains the dominant market for biocontrol agents. Countries like France, Germany, and Spain are investing in sustainable agriculture at both public and private levels.

-

North America: The U.S. and Canada are key contributors, driven by a mix of environmental awareness, large-scale farming operations, and the presence of major biocontrol manufacturers.

-

Asia-Pacific: The region is emerging as a significant growth area, with countries such as China, India, and Japan showing increased interest in sustainable farming practices. Government initiatives and educational programs are further encouraging adoption.

-

Latin America & Africa: These regions are gaining traction due to rising exports of organic crops, such as coffee, cocoa, and bananas. International trade regulations often demand pesticide-free certification, boosting the use of biocontrol agents.

Challenges and Opportunities

While the market outlook is positive, certain challenges persist. These include limited farmer awareness, the need for precise application techniques, and varying results based on climatic conditions. Additionally, regulatory hurdles in some regions can delay product approvals, slowing market entry for new innovations.

On the opportunity side, advancements in biotechnology and formulation science are helping improve product stability, shelf life, and effectiveness. The rise of digital agriculture tools is also enabling more precise application of biocontrol agents, enhancing their overall performance and reducing costs.

Moreover, strategic collaborations between research institutions, agribusinesses, and startups are fostering innovation and accelerating the commercialization of new biocontrol solutions. As more investment flows into sustainable agri-tech, the market is poised for further expansion.

Conclusion

The biocontrol agents market represents a critical frontier in the transformation of global agriculture. With growing consumer demand for safe food, regulatory support for sustainable practices, and rapid technological advances, this market is expected to continue its upward trajectory. Companies that focus on innovation, farmer education, and accessibility are likely to lead the way in this evolving landscape, helping shape a greener and more resilient future for farming.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness