Carburettor Market Strategies: Innovation, Regional Focus, and Competitive Positioning in Dynamic Sectors

The carburettor market continues to maintain its relevance through a combination of smart strategies tailored to evolving global demands. Despite growing competition from fuel injection systems and electric powertrains, carburettors remain widely used in two-wheelers, small engines, and industrial machinery—especially in developing regions. To stay competitive, manufacturers and stakeholders in this market are deploying a variety of strategies that focus on innovation, regional adaptation, and targeted growth.

Innovation Through Design and Technology

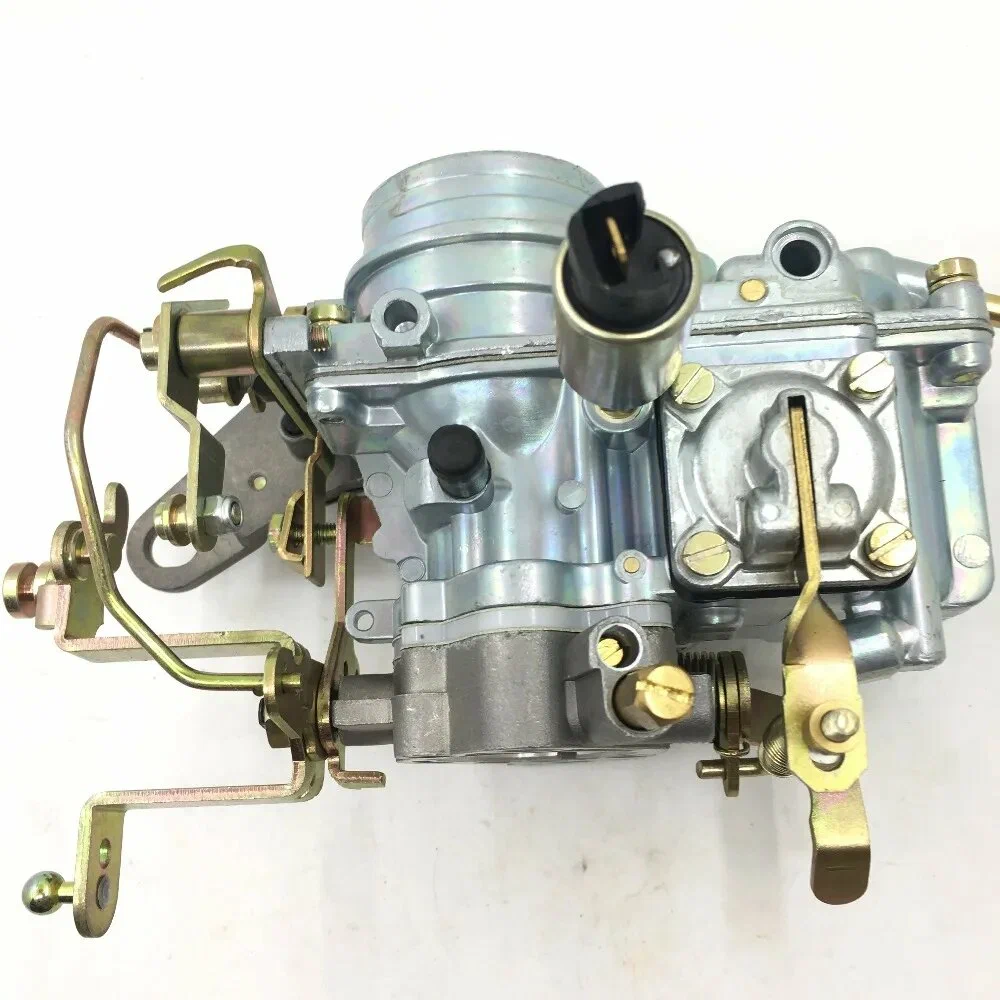

One of the most critical strategies reshaping the carburettor market is product innovation. Companies are redesigning carburettors to meet modern performance and environmental standards. Precision tuning, better fuel atomization, and compatibility with ethanol-blended fuels are just some of the improvements being introduced.

Advanced carburettors now come with features like electric chokes, diaphragm-based fuel flow systems, and hybrid mechanical-electronic components. These upgrades provide better throttle response, improved fuel efficiency, and lower emissions—qualities that make carburettors more acceptable in regions with tightening environmental regulations.

Additionally, the use of lightweight and corrosion-resistant materials, such as aluminum alloys and polymers, helps manufacturers reduce product weight and improve durability. This innovation enhances the lifespan of carburettors used in rugged environments like construction sites and farms.

Regional Market Adaptation

Regional strategy is a cornerstone of success in the carburettor industry. Since demand is highly concentrated in developing nations, manufacturers are tailoring their product lines and marketing approaches to suit local needs.

For example, in the Asia-Pacific region—especially India, Vietnam, and Indonesia—two-wheelers dominate the market. Carburettor manufacturers cater to this segment with models designed for low-cost production and easy maintenance. By understanding the cultural and economic contexts of these markets, companies are able to maintain a strong foothold in the region.

In Latin America and Africa, demand is driven by small commercial vehicles and utility engines. Carburettors for these applications need to withstand varied fuel quality and harsh operational conditions. Companies that design region-specific carburettors—adapted for local infrastructure and fuel types—gain a distinct advantage.

Localization is also a strategic move from a manufacturing standpoint. Establishing production facilities in high-demand regions reduces logistics costs, shortens delivery times, and increases responsiveness to changing market conditions. Several leading firms have already invested in setting up regional plants and research centers to meet these goals.

Strengthening the Aftermarket Ecosystem

Another strategic focus area is the expansion of the carburettor aftermarket. Millions of carburettor-equipped engines remain in service, and this creates a robust and growing demand for spare parts, rebuild kits, and tuning tools.

Companies are capitalizing on this by developing detailed service manuals, user-friendly tuning apps, and online support platforms. These tools empower end-users to maintain and repair carburettors themselves, which is particularly important in rural or underserved regions with limited access to specialized mechanics.

Digital channels are also becoming essential to aftermarket strategies. Through e-commerce platforms, manufacturers can directly reach customers across the globe, ensuring availability of niche components and increasing brand visibility. The ability to offer genuine parts online helps companies retain customer loyalty and protect against counterfeit alternatives.

Niche Market Positioning

Strategically tapping into niche segments is another key trend. The restoration of vintage vehicles, motorsports, and custom engine builds all favor carburettors for their tunability and simplicity. These niche markets may not have massive volumes but offer high margins and loyal customer bases.

Manufacturers are creating performance carburettors with features such as adjustable jets, high-flow passages, and modular designs that appeal to enthusiasts. Strategic partnerships with racing teams, restoration garages, and influencer mechanics help build credibility and customer interest within these communities.

These specialized markets also drive innovation that can trickle down into mainstream products. Lessons learned from performance tuning often influence the design of more durable and versatile carburettors for everyday use.

Collaboration and Compliance Strategies

Collaborating with vehicle OEMs is a long-term strategy that many carburettor companies are pursuing. These partnerships ensure that carburettor models are optimized for specific engines and compliant with regional emission norms. Joint development helps in reducing time-to-market and aligning with changing regulatory frameworks.

Furthermore, companies are proactively engaging with regulatory bodies to understand upcoming standards and develop products that meet future requirements. This preemptive compliance strategy prevents last-minute overhauls and demonstrates a commitment to environmental responsibility.

Conclusion

The carburettor market is not simply surviving—it is strategically evolving. By embracing design innovation, regional focus, niche market expansion, and strong aftermarket support, manufacturers are carving out sustained relevance in an increasingly complex engine ecosystem.

As global demand continues to shift and engine technologies advance, the companies that adapt through agile, market-specific strategies will be best positioned to lead the next phase of growth in the carburettor sector.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness