Airborne Fire Control Radar Market Strategies: Innovations, Collaborations, and Global Defense Expansion Plans

The airborne fire control radar market has become a focal point in modern defense strategies, with nations and manufacturers adopting dynamic approaches to strengthen aerial superiority. As technological demands rise and global security concerns evolve, the market is being shaped by well-defined strategies involving innovation, collaborations, localization, and tactical integration. These strategies are enabling defense forces and radar manufacturers to stay ahead in an increasingly competitive and rapidly changing defense landscape.

Technological Innovation as a Core Strategy

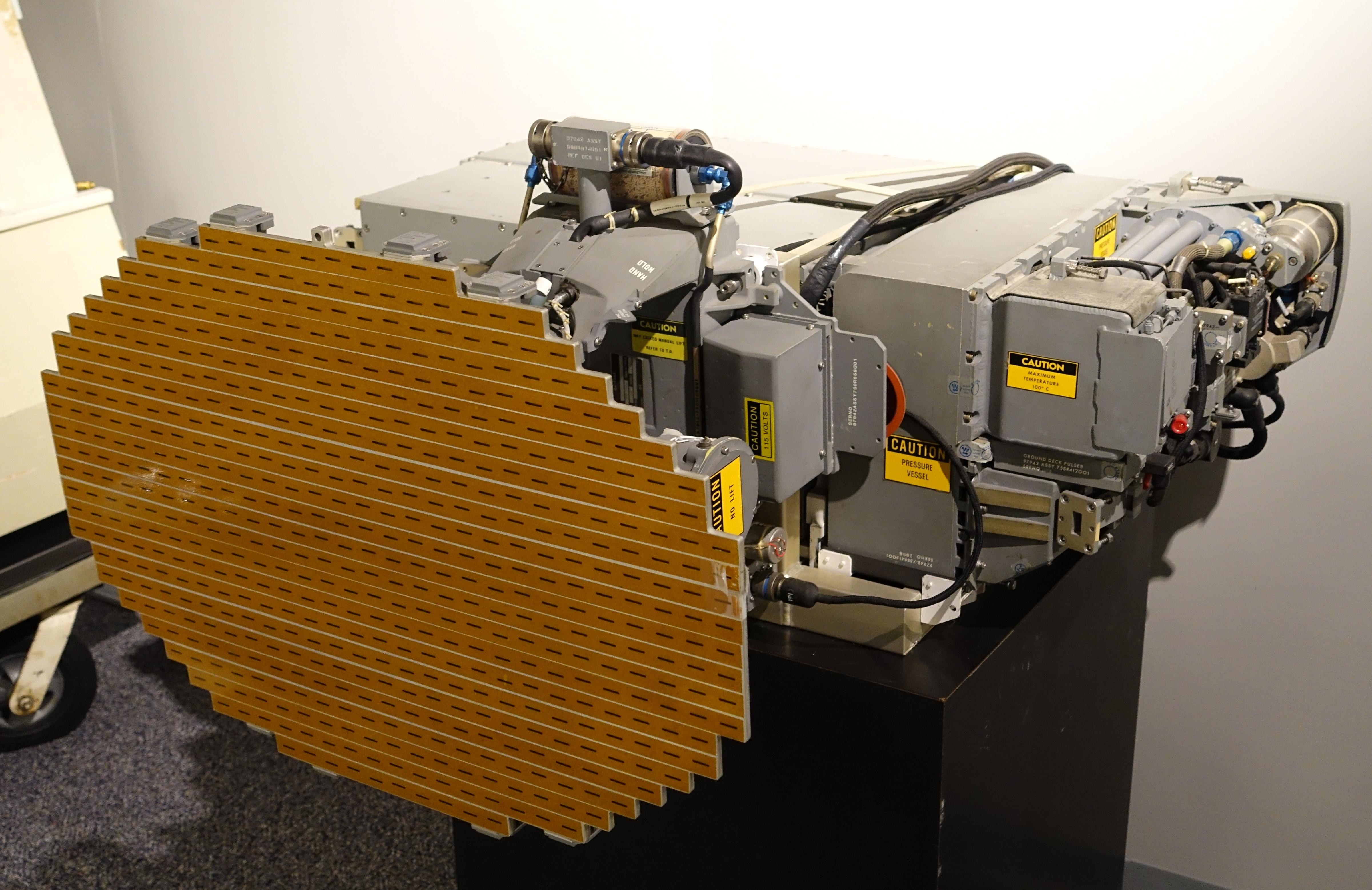

Leading players in the radar industry are consistently investing in research and development to advance radar capabilities. One major area of focus is the integration of Active Electronically Scanned Array (AESA) technology, which offers improved reliability, precision tracking, and enhanced resistance to electronic warfare techniques.

Alongside AESA, manufacturers are introducing modular radar systems that allow for easier upgrades and system integration across various aircraft platforms. These modular systems not only reduce costs over time but also extend the life of the equipment. Moreover, software-defined radar solutions are gaining popularity as they offer flexibility and adaptability without requiring major hardware changes.

The incorporation of AI and machine learning is also becoming a strategic differentiator. AI-powered radars can autonomously assess threats, prioritize targets, and adapt to changing conditions in real time. These technologies help militaries gain an edge in highly contested and electronic warfare-heavy environments.

Strategic Partnerships and Defense Collaborations

Another prominent strategy shaping the airborne fire control radar market is the formation of strategic alliances and joint ventures between global defense companies. These collaborations help in pooling technical resources, expanding product portfolios, and penetrating new regional markets.

For example, major defense firms from North America and Europe are collaborating with companies in Asia-Pacific and the Middle East to co-develop radar systems. These partnerships are driven by the increasing emphasis on local defense manufacturing and technology transfer, as many countries aim to strengthen their domestic military-industrial base.

Additionally, public-private partnerships between defense ministries and private firms are being used to accelerate the development of indigenous radar technologies. These collaborations support national defense autonomy and reduce dependence on foreign imports, which is a rising concern for many emerging economies.

Customization to Meet Regional Needs

One-size-fits-all solutions are no longer effective in today’s diverse military landscape. Radar system providers are now focusing on customized solutions that cater to specific geographic, operational, and technological requirements. For instance, radar systems developed for arid desert conditions will differ significantly from those used in cold or maritime environments.

Tailoring solutions not only boosts operational efficiency but also improves customer satisfaction and fosters long-term client relationships. This strategy is particularly effective in regions like Asia-Pacific and Latin America, where environmental and tactical conditions vary significantly.

Expansion Through Emerging Markets

While North America and Europe have long been the dominant markets for airborne fire control radars, attention is increasingly shifting toward emerging markets in Asia, the Middle East, and Africa. These regions are undergoing rapid military modernization and seeking to upgrade their air defense capabilities with cutting-edge radar technology.

To capture these opportunities, radar companies are adopting localized market entry strategies, including establishing regional service centers, training programs, and maintenance facilities. Some are even setting up production units in collaboration with local partners to ensure quicker delivery timelines and cost-effective support.

These strategies not only improve the global footprint of radar manufacturers but also allow for better compliance with local procurement regulations and offset requirements.

Integration with Multi-Domain Operations

Modern defense strategies require seamless coordination across air, land, sea, and cyber domains. As a result, airborne fire control radar systems are increasingly being developed with network-centric warfare capabilities in mind. These systems are being integrated with larger battle networks, enabling real-time data sharing and synchronized operations between different units and platforms.

Radar companies are aligning their strategies with the demand for interoperability, ensuring that their products can work efficiently with other military systems, including command and control centers, missile defense units, and reconnaissance platforms.

This shift toward integrated defense ecosystems marks a significant strategic pivot in how radar systems are designed, marketed, and deployed.

Focus on Lifecycle Support and Sustainability

Another strategic area gaining attention is lifecycle management. Defense agencies are looking for radar solutions that are not only technologically advanced but also easy to maintain and upgrade over time. As a result, manufacturers are offering comprehensive lifecycle support packages that include predictive maintenance, software updates, and training services.

Sustainability is also emerging as a key concern. Companies are working to create energy-efficient radar systems with reduced environmental impact, aligning with broader defense sustainability goals.

Conclusion

The airborne fire control radar market is evolving through a mix of forward-looking strategies that reflect the growing complexity of modern warfare. From cutting-edge innovation and strategic alliances to market expansion and lifecycle support, radar system providers are proactively shaping the industry’s future.

As defense priorities shift toward speed, precision, and integrated operations, these strategic initiatives will continue to define market competitiveness and drive sustained growth across global regions.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness