Commercial Insurance Market Size, Share, Trends, and Report 2025-2033

Market Overview:

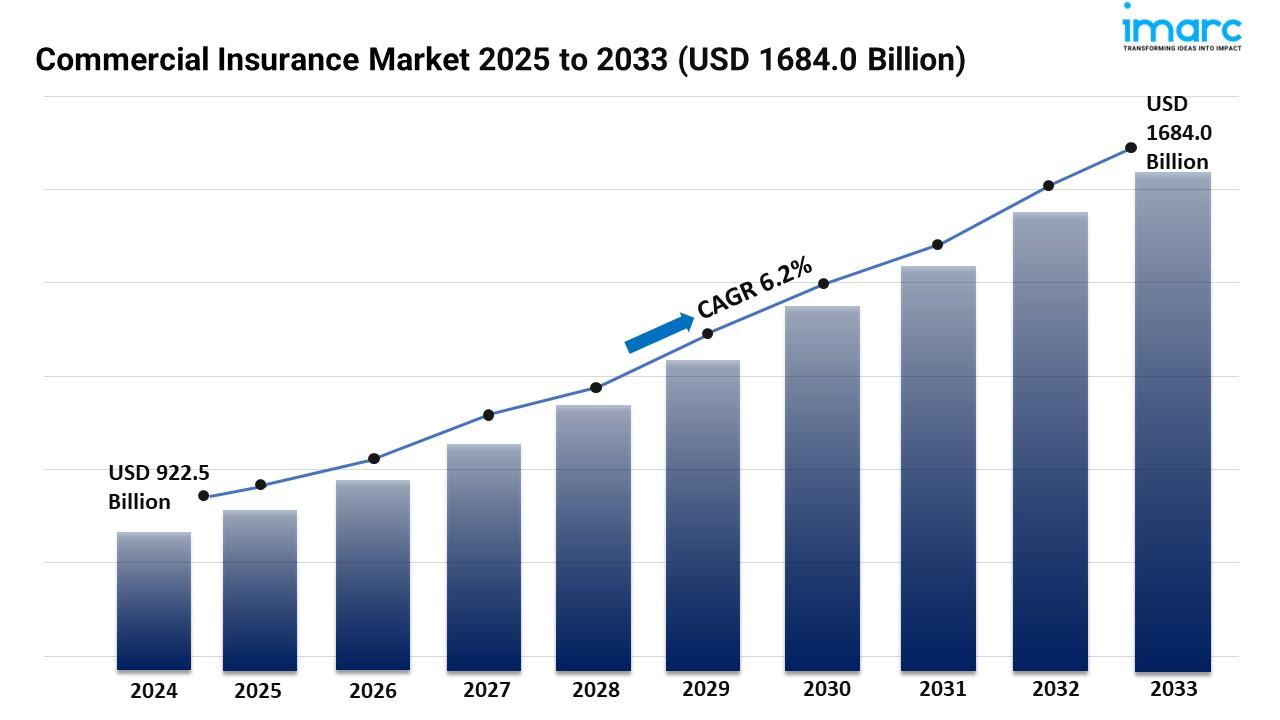

The commercial insurance market is experiencing rapid growth, driven by digital transformation reshaping, evolving risk landscape, demand for customization. According to IMARC Group's latest research publication, "Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the global commercial insurance market share. The global market size was valued at USD 922.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,684.0 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/commercial-insurance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Commercial Insurance Industry:

- Rising Demand for Cyber Insurance

The commercial insurance market is seeing a rise in demand for cyber insurance. This is due to more digitalization and increasing cyber threats. Businesses of all sizes now realize they need protection against data breaches, ransomware attacks, and other cyber risks. Insurers are offering tailored policies, but pricing and coverage terms are changing quickly because of the unpredictable nature of these risks. By 2033, cyber insurance is likely to be a standard part of commercial coverage, with premiums increasing at double-digit rates. Companies that do not adopt cyber insurance may face serious financial exposure. This makes it a key growth area for insurers.

-

Shift Toward Customized Policies

Commercial insurance are shifting from one-size-fits-all solutions. They now offer custom policies for different industries. Advances in data analytics and AI help insurers assess risks better. This allows them to create tailored coverage for sectors like healthcare, manufacturing, and logistics. This trend lets businesses get coverage that matches their specific risks. As a result, satisfaction and retention improve. By 2025, personalized insurance products will lead the market. Traditional insurers must adapt or risk losing ground to more agile competitors.

-

Impact of Climate Change

Climate-related risks are changing the commercial insurance market. Insurers face challenges in underwriting policies due to more natural disasters. Claims from floods, wildfires, and hurricanes are rising. This leads to higher premiums and stricter underwriting rules. Some insurers are pulling coverage from high-risk areas, which creates protection gaps. By 2033, climate resilience will greatly impact policy pricing. Businesses in vulnerable sectors must invest in mitigation strategies to get affordable coverage. This situation highlights the urgent need for new risk modeling and sustainable insurance solutions.

Leading Companies Operating in the Global Commercial Insurance Industry:

- Allianz SE

- American International Group Inc.

- Aon plc

- Aviva plc

- Axa S.A.

- Chubb Limited

- Direct Line Insurance Group plc

- Marsh & McLennan Companies Inc.

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group Ltd.

Commercial Insurance Market Report Segmentation:

Breakup By Type:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Liability insurance represents the largest segment because businesses face various risks related to third-party injuries, damages, or legal claims, making liability coverage essential for protecting operations.

Breakup By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share as they typically require more extensive coverage for their complex operations, higher assets, and greater exposure to risks.

Breakup By Distribution Channel:

- Agents and Brokers

- Direct Response

- Others

Agents and brokers exhibit a clear dominance in the market owing to their personalized services, expert advice, and businesses navigation insurance products.

Breakup By Industry Vertical:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics hold the biggest market share due to the significant risks associated with the movement of goods, including accidents, delays, and cargo loss.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the commercial insurance market on account of its established insurance infrastructure, rising demand from diverse industries, and a robust regulatory framework.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness