Automotive Gear Market Segmentation and Competitive Landscape

Introduction

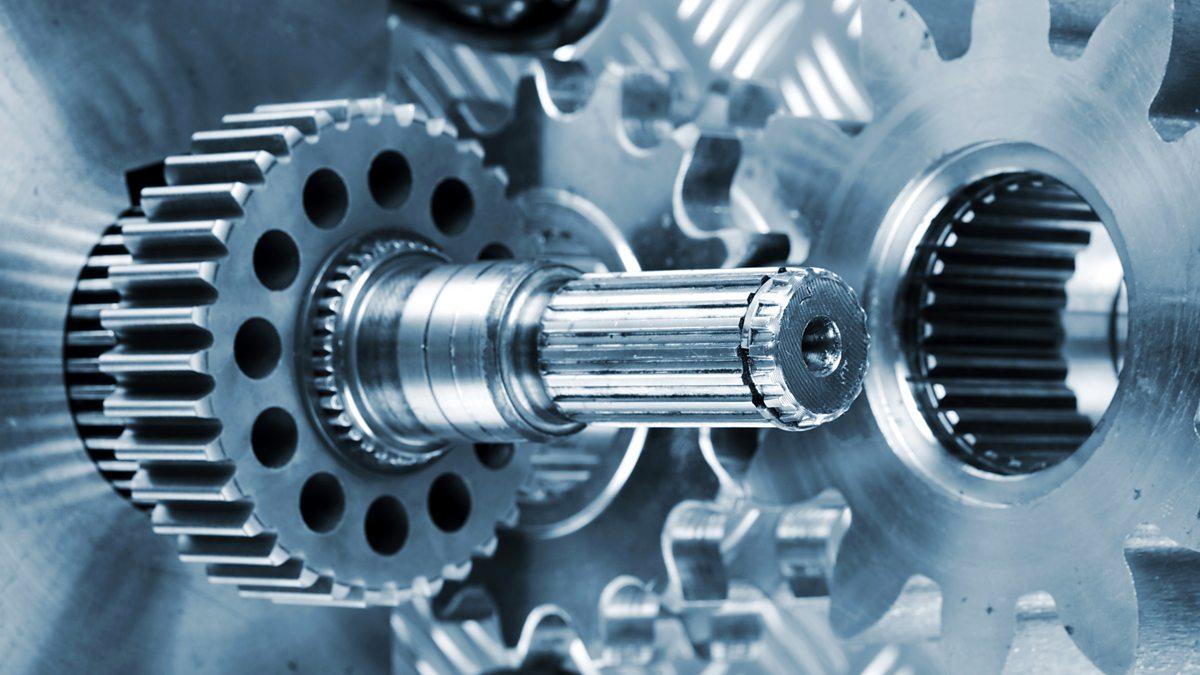

The automotive gear market is a vital component of the global automotive industry, supporting drivetrain and transmission systems across all vehicle types. With growing demand for fuel efficiency, enhanced performance, and electric mobility, the market is undergoing rapid evolution. Understanding the market segmentation and the dynamics of the competitive landscape is essential to identify growth opportunities and assess market positioning strategies.

This article provides a comprehensive overview of the automotive gear market segmented by key factors and a deep dive into the leading players shaping the competitive environment.

Automotive Gear Market Segmentation

The automotive gear market is segmented based on gear type, material, application, vehicle type, and region. Each segment plays a unique role in shaping market trends and determining demand patterns.

1. By Gear Type

-

Spur Gears: Common in manual transmissions and low-speed applications.

-

Helical Gears: Preferred for smoother, high-speed power transmission in automatic gearboxes.

-

Bevel Gears: Used in differential systems and rear-wheel drive vehicles.

-

Worm Gears: Applied in power steering and seat mechanisms due to their compact and self-locking nature.

-

Planetary Gears: Gaining popularity in EVs and hybrid vehicles for their efficiency and compact design.

-

Hypoid Gears: Primarily used in heavy-duty and commercial vehicles for high torque applications.

2. By Material

-

Metal Gears (Steel, Cast Iron, Aluminum): Dominant in most applications due to strength and durability.

-

Plastic and Composite Gears: Increasingly used in lightweight applications like interior electronics, especially in electric vehicles.

3. By Application

-

Transmission Systems: Largest application segment, especially in ICE vehicles.

-

Differential Systems: Widely used in both passenger and commercial vehicles.

-

Steering Systems: Worm and bevel gears for precision and torque control.

-

Electric Vehicle Drivetrains: Focus on compact, quiet, and efficient gear systems like planetary gears.

-

Interior Components: Seat adjusters, window regulators, and sunroof systems utilize smaller plastic gears.

4. By Vehicle Type

-

Passenger Cars: Highest market share due to volume and range of applications.

-

Light Commercial Vehicles (LCVs): Demand driven by logistics and last-mile delivery services.

-

Heavy Commercial Vehicles (HCVs): Require high-strength gears for torque and durability.

-

Electric Vehicles (EVs): Fastest-growing segment due to increasing global electrification.

5. By Region

-

Asia-Pacific: Leading region, driven by high automotive production in China, India, and Japan.

-

Europe: Focused on advanced technology and luxury vehicles.

-

North America: Strong demand for SUVs, trucks, and electric vehicle innovations.

-

Rest of the World: Emerging markets in Latin America and the Middle East showing steady growth.

Competitive Landscape

The automotive gear market is moderately fragmented, with a mix of global giants and regional manufacturers competing on innovation, quality, and price.

Key Players in the Automotive Gear Market:

1. ZF Friedrichshafen AG (Germany)

A global leader in transmission systems and gear technologies, ZF supplies advanced gear modules for both ICE and EV platforms. The company invests heavily in R&D for electric powertrains and autonomous mobility solutions.

2. Aisin Corporation (Japan)

A member of the Toyota Group, Aisin is known for manufacturing automatic transmissions and drive units. It is expanding its portfolio to cater to hybrid and electric vehicles.

3. BorgWarner Inc. (USA)

With a strong presence in drivetrain and electric propulsion systems, BorgWarner is focusing on next-gen transmission solutions and gear systems tailored for EVs.

4. Magna International Inc. (Canada)

A diversified automotive supplier with expertise in powertrain systems, including gear components for hybrid and all-electric vehicles.

5. Schaeffler Group (Germany)

Specializes in precision gear components, bearings, and systems for both ICE and electric drivetrains. Schaeffler is investing in smart and lightweight gear technologies.

6. GKN Automotive (UK)

Renowned for its constant velocity joints and eDrive systems, GKN plays a major role in developing advanced gear assemblies for electric drivetrains.

7. Valeo (France)

While primarily known for its thermal and electrical systems, Valeo is increasingly involved in producing high-efficiency transmission components, especially for EVs.

Competitive Strategies

-

Innovation & R&D: Companies are investing in new gear materials, smart gear systems, and digital manufacturing.

-

Mergers & Acquisitions: Strategic partnerships and acquisitions are helping expand market reach and technological capabilities.

-

Geographic Expansion: Major players are increasing their presence in high-growth markets like India, China, and Southeast Asia.

-

Sustainability Initiatives: Eco-friendly manufacturing, recyclable materials, and lightweight designs are becoming competitive differentiators.

Conclusion

The automotive gear market is characterized by diverse segmentation and intense competition. As the industry shifts toward electric and intelligent vehicles, gear manufacturers must align with emerging technologies and evolving customer demands. Success in this market depends on innovation, adaptability, and strategic positioning across both traditional and electric mobility sectors. With strong demand across applications and regions, the market holds robust opportunities for growth through 2030 and beyond.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness