Desktop 3D Printer Market :Reinvented by Software, Sustainability, and Decentralized Production Models

The desktop 3D printer market has evolved dramatically in the past decade, shifting from a niche hobbyist tool to a widely adopted solution for prototyping, education, and even small-scale manufacturing. While general statistics often cite growth projections and key players, there are lesser-known dynamics and trends shaping this market that can offer valuable insight for investors, innovators, and users alike.

1. The Quiet Rise of Hybrid Machines

An emerging trend in the desktop 3D printer market is the convergence of additive and subtractive manufacturing. Several newer desktop models are combining 3D printing with CNC milling, laser engraving, and resin curing functionalities in a single unit. These hybrid machines cater to makerspaces, design labs, and educational institutions that want multifunctionality in a compact form. The dual capability not only enhances prototyping speed but also allows users to post-process prints without additional equipment.

2. Materials Are the Real Growth Engine

While much of the market focus is on hardware, material innovation is where significant disruption is brewing. Beyond PLA and ABS, there’s a surge in interest in flexible filaments, conductive materials, carbon fiber-reinforced filaments, and even food-safe or biodegradable options. Startups are entering this space offering “smart” filaments that embed metadata, allowing for tracking of product life cycles, temperature resistance, and even recycling profiles. These smart materials are enabling more advanced applications in fields like electronics and biomedical prototyping.

3. Regional Micro-Markets Are Redefining Strategy

The traditional view of the desktop 3D printer market lumps countries into broad regions—North America, Europe, APAC. But within those are micro-markets showing unique behaviors. For example:

-

Eastern Europe, particularly Poland and Czechia, is becoming a low-cost production hub with educational institutions integrating 3D printing into STEM early education.

-

Indonesia and Vietnam are emerging as manufacturing-friendly economies with strong government backing for digital fabrication.

-

In the Middle East, desktop 3D printing is being used in sustainable construction experiments with sand- and clay-based filaments.

These sub-regional pockets are often underserved and represent untapped opportunities for vendors who can localize effectively.

4. Software Ecosystems Are the Next Battleground

Printer hardware is becoming commoditized, leading companies to differentiate via software ecosystems. A quiet war is being waged over slicing software, remote print monitoring, workflow automation, and cloud-based file repositories. Subscription models are creeping in, especially for collaborative environments like product design teams and schools.

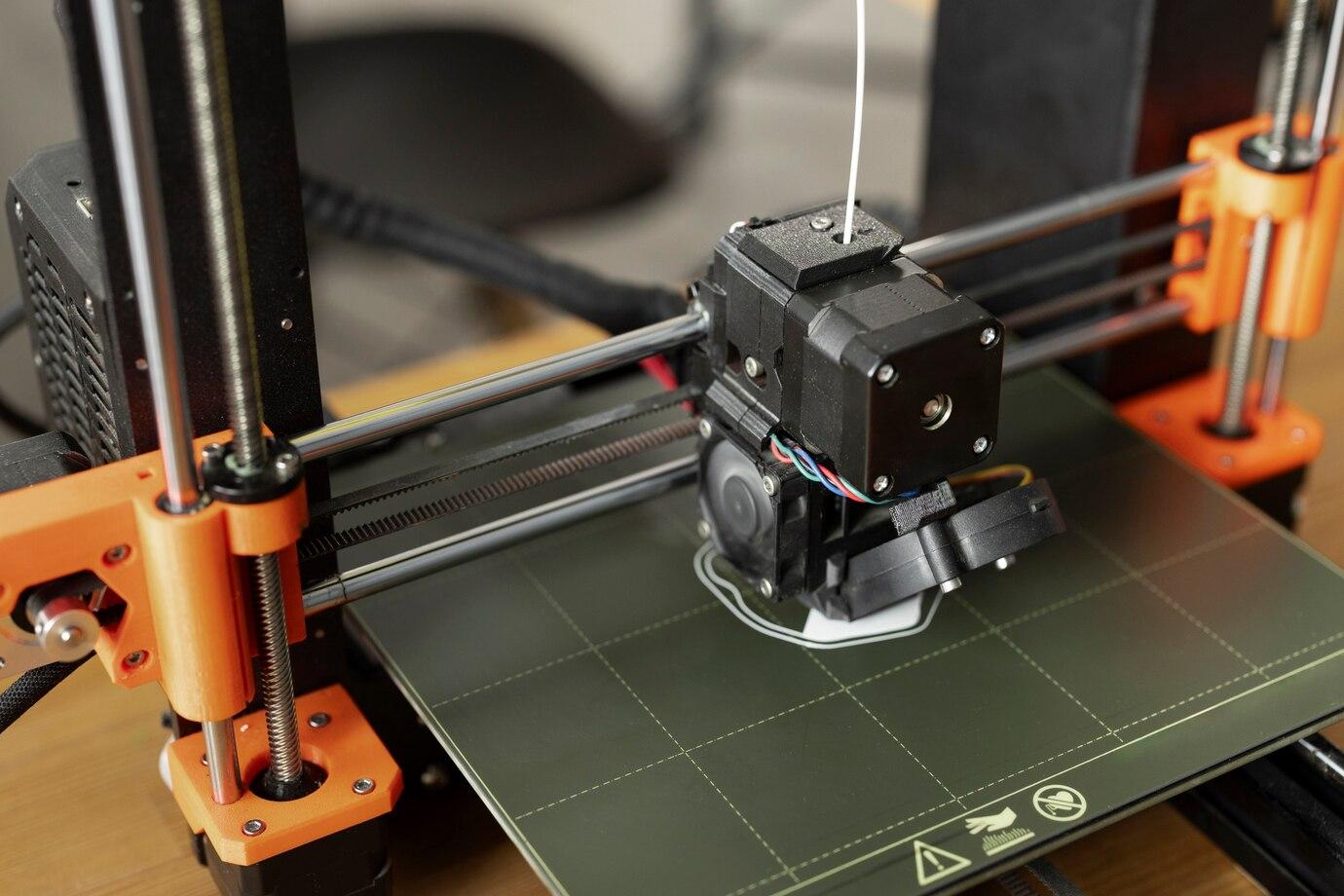

Companies like Prusa and Bambu Lab are gaining traction partly due to robust, user-friendly firmware and ecosystem integration. Moreover, the growing use of AI in print correction and optimization is reducing failure rates, a major barrier for non-technical users.

5. Used Printers and Refurbishing: An Invisible Secondary Market

One of the most underreported segments of the desktop 3D printer market is the used and refurbished printer economy. As businesses upgrade, older units enter secondary markets, often through eBay, local makerspaces, or B2B channels. These are especially attractive to schools and startups in developing economies. A cottage industry of repair experts, modders, and firmware hackers supports this ecosystem, giving older machines new life—often with better performance than when new, thanks to firmware upgrades and modified parts.

6. Environmental Regulations Are Quietly Influencing Product Design

While not always visible to end users, increasing environmental regulations, especially in the EU and parts of Asia, are impacting how desktop 3D printers are designed. Emissions of volatile organic compounds (VOCs) and ultrafine particles during printing are now under scrutiny. This is leading to more enclosed designs, HEPA filter integration, and emission reporting—especially in printers marketed to schools and homes.

Companies slow to adapt to these changes may find themselves shut out of key markets.

7. Education Is Creating Future Market Loyalty

While education is often discussed as a "growth driver," what's overlooked is the long-term brand loyalty it’s creating. Students exposed to a specific brand of printer in school are likely to continue using it in their careers or recommend it within professional settings. Companies like MakerBot capitalized on this early, but newer entrants like Anycubic and FlashForge are now aggressively targeting this strategy.

Some vendors offer freemium education bundles with curriculum integration, effectively planting seeds for future market dominance.

8. Decentralized Manufacturing and IP Risk

A risk not often discussed is intellectual property leakage in decentralized 3D printing. As desktop printers become more accurate and accessible, companies prototyping in-house may unintentionally expose designs to risk via unsecured file sharing or third-party print services. This is leading to the development of secure slicing environments, encrypted STL formats, and even blockchain-based provenance tracking.

Final Thought

The desktop 3D printer market is more than just a growing industry—it’s a dynamic, evolving ecosystem influenced by invisible forces ranging from software innovation to regional educational policies. Stakeholders who focus only on printer specs and market share numbers risk missing out on deeper opportunities hidden in materials, ecosystems, and niche user communities.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness