India Smartphone Market Opportunities, Sales Revenue, Leading Players and Forecast 2030

India's Smartphone Market Poised for Robust Growth: A Comprehensive Analysis

Market Estimation & Definition

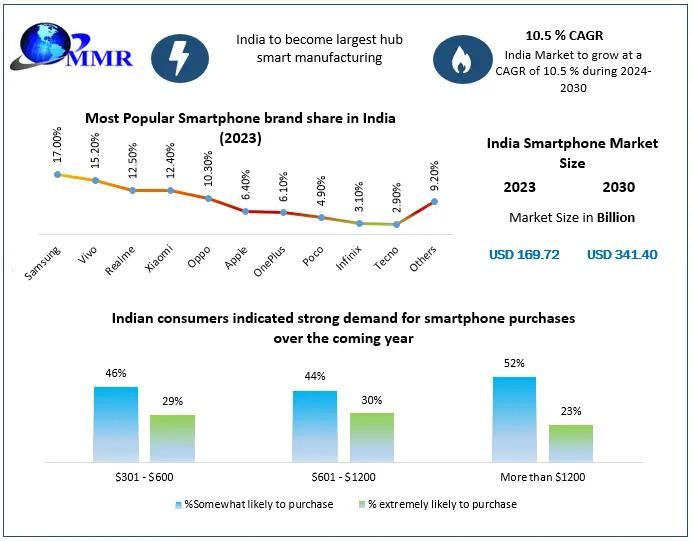

The India Smartphone Market has witnessed significant expansion, with a valuation of USD 169.72 billion in 2023. Projections indicate that this figure is set to escalate to USD 341.40 billion by 2030, reflecting a compound annual growth rate (CAGR) of 10.5% over the forecast period. This growth trajectory underscores the increasing integration of smartphones into the daily lives of Indian consumers, driven by technological advancements and evolving user preferences.

A smartphone is a multifaceted device that amalgamates the functionalities of a cellular phone with features commonly associated with computers. These include internet browsing, email access, multimedia playback, and a plethora of applications. Equipped with sophisticated operating systems such as Android, iOS, or Windows, smartphones empower users to install and operate applications, customize settings, and interact seamlessly with digital content. In the Indian context, the smartphone has transitioned from a luxury item to an essential tool, facilitating communication, entertainment, education, and commerce.

Click here for free sample + related graphs of the report @:https://www.maximizemarketresearch.com/request-sample/20060/

Market Growth Drivers & Opportunities

Several pivotal factors are propelling the growth of the Indian smartphone market:

-

Increasing Internet Penetration: The widespread adoption of high-speed internet connectivity, particularly the rollout of 5G networks, has significantly enhanced smartphone usage across the nation. Affordable data plans and improved network infrastructure have democratized internet access, enabling a broader segment of the population to engage in online activities such as social media interaction, e-commerce, content streaming, and digital payments.

-

Affordability and Diverse Offerings: The market is characterized by a wide array of budget-friendly and mid-range smartphones. Both domestic and international manufacturers are introducing devices with competitive pricing and advanced features, making smartphones accessible to a larger demographic. Financing options, discounts, and promotional offers further facilitate consumer acquisition.

-

Economic Growth and Rising Disposable Incomes: India's burgeoning economy has led to increased disposable incomes, particularly in urban centers and tier 2/3 cities. This financial upliftment enables more consumers to invest in smartphones, contributing to market expansion.

-

Shift Towards Premium Devices: There is a discernible trend of consumers gravitating towards premium smartphones equipped with advanced features such as 5G support, enhanced battery life, superior camera systems, and increased storage capacity. Projections suggest that over the next decade, approximately 80% of market growth will be driven by devices priced above $250, a substantial increase from the 10% observed in the previous five years.

-

Government Initiatives and Local Manufacturing: The Indian government's push towards local manufacturing has transformed the industry. A decade ago, 98% of mobile phones were imported; today, 99.2% are domestically produced. The government's ambition to achieve USD 300 billion in electronics manufacturing by 2025-26, with mobile phones contributing over USD 50 billion to exports, further bolsters the market.

Segmentation Analysis

The Indian smartphone market can be dissected based on product type and distribution channels:

-

By Product Type:

-

Android Devices: Dominating the market, Android smartphones account for over 90% of sales. Their widespread adoption is attributed to the open-source nature of the operating system, allowing various manufacturers to offer a diverse range of devices across different price points. Customization options, regional language support, and compatibility with numerous applications enhance their appeal.

-

iOS Devices: Apple's iOS holds a smaller yet significant market share. iPhones are perceived as premium products, attracting consumers seeking high-end features, robust security, and a seamless ecosystem. The aspirational value associated with the brand contributes to its steady demand.

-

Windows Devices: Once a contender in the smartphone arena, Windows-based devices have seen a decline in market presence. Limited app support and a shift in Microsoft's strategic focus have led to reduced consumer interest.

-

-

By Distribution Channel:

-

Online Sales: E-commerce platforms such as Amazon, Flipkart, and Snapdeal have revolutionized smartphone retailing. They offer extensive selections, competitive pricing, and the convenience of home delivery. Exclusive online launches and flash sales create buzz and drive substantial volumes. The online segment has gained significant traction, especially among tech-savvy and price-conscious consumers.

-

Offline Sales: Traditional brick-and-mortar stores continue to play a crucial role, particularly in tier 2 and tier 3 cities where consumers prefer hands-on experience before purchasing. Retail outlets provide personalized customer service, immediate product availability, and trust, which are vital factors for many buyers.

-

Country-Level Analysis

While the focus is on India, drawing comparisons with other major markets provides valuable insights:

-

United States: The U.S. smartphone market is characterized by high penetration rates, with a significant portion of the population owning smartphones. The market leans towards premium devices, with Apple holding a substantial share. Carrier contracts and financing options make high-end smartphones more accessible. Technological innovations and early adoption of new features are hallmarks of this market.

-

Germany: Germany represents one of Europe's largest smartphone markets, with a strong preference for quality and brand reputation. Android devices dominate, but there is a notable segment of iOS users. The market is mature, with replacement cycles driving sales. Consumers exhibit a growing interest in sustainable and eco-friendly devices.

For more information about this report visit: https://www.maximizemarketresearch.com/market-report/india-smartphone-market/20060/

Competitive Analysis

The Indian smartphone market is intensely competitive, featuring a mix of global giants and domestic players:

-

Samsung: A leading player offering a wide range of smartphones from entry-level to premium segments. Samsung's focus on innovation, quality, and extensive service network enhances its market position.

-

Xiaomi: Known for its value-for-money proposition, Xiaomi has rapidly gained market share by offering feature-rich smartphones

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness