Commercial Satellite Imaging Market Size Demand Analysis and Future Potential 2030

Global Commercial Satellite Imaging Market to Reach USD 9.64 Billion by 2030, Driven by Technological Advancements and Diverse Applications

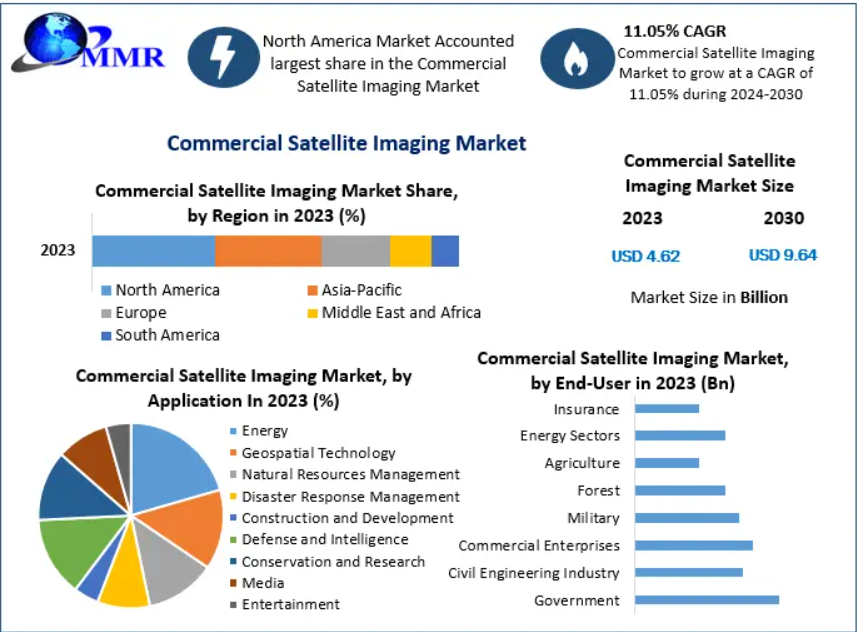

The Global Commercial Satellite Imaging Market Size is projected to grow from USD 4.2 billion in 2023 to USD 9.64 billion by 2030, registering a compound annual growth rate (CAGR) of approximately 11%. This growth is fueled by technological advancements, increasing demand across various sectors, and the expanding applications of satellite imagery.

Market Estimation, Growth Drivers, and Opportunities

Commercial satellite imaging involves capturing high-resolution images of the Earth's surface using satellites, providing critical data for industries such as defense, agriculture, environmental monitoring, and urban planning. Key factors driving market growth include:

-

Technological Advancements: Innovations in satellite technology have led to enhanced image resolution and reduced costs, making satellite imagery more accessible and valuable for commercial applications.

-

Diverse Applications: The increasing use of satellite imagery in disaster response, natural resource management, and infrastructure development has broadened the market's scope.

-

Government Initiatives: Supportive policies and investments in space technology by various governments have bolstered the market's expansion.

Opportunities within the market are emerging in sectors like precision agriculture, where satellite imagery aids in crop monitoring and yield prediction, and in environmental monitoring, where it assists in tracking climate change and deforestation.

Discover In-Depth Insights: Get Your Free Sample of Our Latest Report Today @https://www.maximizemarketresearch.com/request-sample/16869/

U.S. Market Trends and Investments

In 2024, the U.S. commercial satellite imaging market witnessed significant developments:

-

Defense and Security Demand: The defense sector's growing need for accurate, real-time data for surveillance and reconnaissance has propelled market growth. Satellite imagery plays a crucial role in threat assessment and strategic planning.

-

Venture Capital Investments: Increased venture capital funding has supported startups focusing on innovative satellite technologies, fostering a competitive and dynamic market landscape.

-

Public-Private Partnerships: Collaborations between government agencies and private companies have facilitated advancements in satellite imaging capabilities and data accessibility.

Market Segmentation with Largest Market Share

The defense and intelligence segment holds the largest share in the commercial satellite imaging market, accounting for approximately 49% of the market in 2023. This dominance is attributed to the sector's reliance on satellite imagery for national security, surveillance, and strategic operations.

Competitive Analysis

Leading companies in the global commercial satellite imaging market include:

-

Maxar Technologies: A prominent player offering high-resolution Earth imagery and geospatial data. Maxar has invested in next-generation satellites to enhance image quality and revisit rates.

-

Airbus Defence and Space: Provides comprehensive satellite imaging services with a focus on defense and intelligence applications. Airbus has integrated advanced data analytics into its offerings to provide actionable insights.

-

Planet Labs: Known for its large constellation of small satellites, Planet Labs delivers daily Earth imagery, enabling timely data for various industries. The company has recently expanded its analytics capabilities to offer more detailed environmental monitoring.

-

BlackSky Global: Specializes in real-time geospatial intelligence and has invested in artificial intelligence to improve image analysis and delivery speed.

-

ImageSat International: Offers high-resolution satellite imagery with applications in defense, agriculture, and infrastructure. The company has focused on enhancing its satellite fleet to provide more frequent and detailed imaging.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:https://www.maximizemarketresearch.com/market-report/global-commercial-satellite-imaging-market/16869/

Regional Analysis

-

United States: Holding approximately 44% of the global market share, the U.S. benefits from substantial government contracts, a robust private sector, and continuous technological innovation. Government policies promoting space exploration and commercialization have further supported market growth.

-

United Kingdom: The UK has invested in satellite technology through initiatives like the National Space Strategy, aiming to capture a significant share of the global space economy. The focus on innovation and international collaborations has bolstered the UK's position in the market.

-

Germany: With strong engineering capabilities and government support, Germany has become a key player in satellite manufacturing and imaging services. Policies encouraging research and development in space technology have contributed to market growth.

-

France: Home to major industry players like Airbus, France has a well-established presence in the satellite imaging market. Government investments in space infrastructure and collaborations with other European nations have strengthened its market position.

-

Japan: Japan's commitment to space technology is evident through its investments in satellite development and imaging applications. Government initiatives supporting disaster management and environmental monitoring have driven market growth.

-

China: Rapid advancements in space technology and substantial government funding have propelled China's commercial satellite imaging market. The country's focus on expanding its satellite constellation and offering competitive imaging services has increased its global market share.

Conclusion

The global commercial satellite imaging market is on a trajectory of robust growth, driven by technological advancements, diverse applications, and supportive government policies. The defense and intelligence sector remains the largest market segment, while opportunities in agriculture, environmental monitoring, and disaster response continue to emerge. As companies invest in innovation and expand their service offerings, the market is poised for dynamic evolution. Key growth factors include the integration of artificial intelligence for image analysis, the development of small satellite constellations for increased coverage, and the expansion into emerging markets seeking satellite imaging solutions for development and security purposes.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness