Optical Communication and Networking size Is Powering the Expansion of Smart Cities

The optical communication and networking industry is experiencing rapid growth, fueled by increasing demand for high-speed data transmission, 5G deployment, and cloud computing. Leading companies are strengthening their market positions through technological advancements, strategic mergers, and significant investments. Here’s an overview of the top players, recent industry developments, and key financial activities shaping the sector.

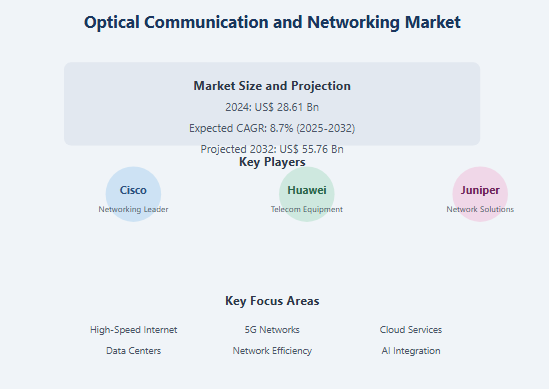

The market for optical communication and networking Size was estimated to be worth US$28.61 billion in 2024. From 2025 to 2032, the market is projected to develop at a compound annual growth rate (CAGR) of 8.7%, reaching around US$55.76 billion.

Top 5 Companies Dominating the Optical Communication and Networking Market

Huawei Technologies Co., Ltd.

A global leader in telecommunications, Huawei remains at the forefront of optical networking with its advanced optical transport solutions and 5G-integrated infrastructure. The company continues to invest heavily in R&D, focusing on next-generation fiber-optic technologies and AI-driven network optimization.

Nokia Corporation

Nokia’s optical networking division provides high-capacity fiber solutions for telecom operators and enterprises. The company has been expanding its portfolio with coherent optics and software-defined networking (SDN) solutions to enhance scalability and efficiency in data transmission.

Ciena Corporation

Specializing in high-performance optical networking systems, Ciena is a key player in wavelength division multiplexing (WDM) and programmable infrastructure. Its recent innovations include adaptive IP and photonic solutions for hyperscale data centers.

Cisco Systems, Inc.

Cisco’s optical networking segment offers end-to-end solutions, including pluggable optics and disaggregated routing platforms. The company has been integrating AI and automation to improve network performance and reduce operational costs.

ADVA Optical Networking (Now part of ADTRAN Holdings, Inc.)

Following its acquisition by ADTRAN, ADVA continues to deliver cutting-edge optical transport and edge solutions. The merger has strengthened its position in open networking and enterprise connectivity.

Get Free sample PPT: https://www.maximizemarketresearch.com/request-sample/269271/

Get Free sample PPT: https://www.maximizemarketresearch.com/request-sample/269271/

Recent Mergers and Acquisitions

The optical networking sector has seen significant consolidation as companies aim to enhance their technological capabilities and market reach.

ADTRAN’s Acquisition of ADVA (2022)

This $1.3 billion merger created a stronger competitor in optical transport and access solutions, combining ADTRAN’s broadband expertise with ADVA’s metro and long-haul optical technologies.

Infinera’s Acquisition of Coriant (2018)

Though not recent, this deal significantly expanded Infinera’s global footprint in optical networking, particularly in Tier-1 service providers and cloud operators.

Cisco’s Strategic Partnerships

While no major acquisitions were reported in 2023–24, Cisco has been actively collaborating with hyperscalers and telecom operators to deploy next-gen optical solutions.

Key Market Developments

The optical communication industry is evolving with advancements in speed, efficiency, and sustainability.

Coherent Optics and 800G Deployments

Companies like Ciena and Nokia are leading the shift toward 800G and beyond, enabling ultra-high-speed data centers and 5G backhaul networks.

Open RAN and Disaggregated Networks

The push for open, interoperable optical systems is gaining momentum, with firms like Huawei and Cisco developing flexible, software-driven architectures.

Energy-Efficient Networking

With rising power consumption concerns, manufacturers are introducing low-power optical transceivers and intelligent cooling solutions.

New Funding and Investments

While major public companies rely on internal R&D budgets, startups and emerging players are attracting significant investments.

Huawei’s Continued R&D Spending

Despite geopolitical challenges, Huawei remains one of the top R&D investors in optical tech, focusing on silicon photonics and quantum communications.

Private Equity in Optical Startups

Several startups specializing in photonic integrated circuits (PICs) and LiDAR-related optics have secured funding, though the top five incumbents dominate capital deployment.

Conclusion

The optical communication and networking market is highly competitive, with Huawei, Nokia, Ciena, Cisco, and ADTRAN/ADVA leading through innovation and strategic consolidation. As demand for bandwidth surges, advancements in coherent optics, open networking, and sustainability will define the industry’s future.

Concerning Us

About: is one of the top market research and business consulting agencies globally, with clients from around the world. Our revenue impacts and focused, growth-oriented research efforts make us a proud partner of most Fortune 500 organizations. Our diversified portfolio of clients belong to sectors such as IT & telecom, chemical, food & beverage, aerospace & military, healthcare, and others.

- Optical_Communication_and_Networking_Share

- Optical_Communication_and_Networking_Size

- Optical_Communication_and_Networking_Forecast

- Optical_Communication_and_Networking_Overview

- Optical_Communication_and_Networking_Industry_Growth

- Optical_Communication_and_Networking_Insights

- Optical_Communication_and_Networking_Research_Insights

- Optical_Communication_and_Networking_Research_Report

- Optical_Communication_and_Networking_Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness