India Smartphone Market Growth Report: Opportunities and Challenges (2024-2030)

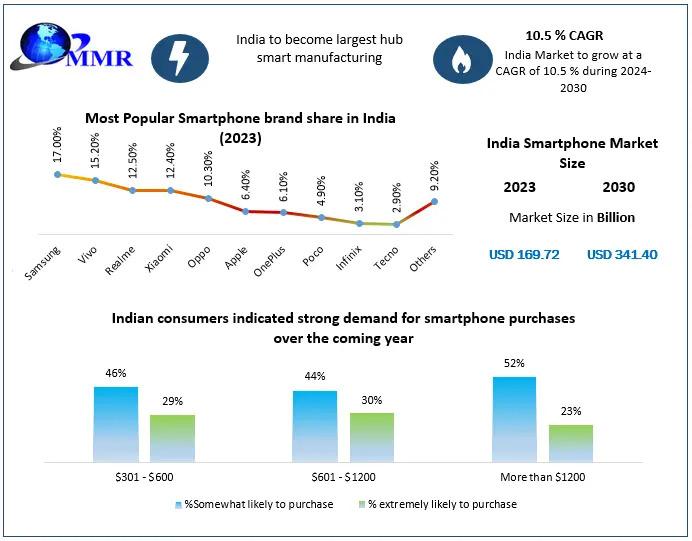

India Smartphone Market Growth, was valued at USD 169.72 Bn in 2023 and is expected to reach USD 341.40 Bn by 2030, at a CAGR of 10.5 % during the forecast period.

The India Smartphone Market Growth, has experienced remarkable growth over the past decade, solidifying its position as one of the most dynamic and rapidly expanding markets globally. This press release delves into the current landscape of India's smartphone market, exploring market estimations, growth drivers, segmentation, and a comparative analysis with key international markets such as the USA and Germany. Additionally, we examine the competitive landscape and conclude with insights into future prospects.

Speak with our Research Analyst :-https://www.maximizemarketresearch.com/request-sample/20060/

Market Estimation & Definition

As of 2023, the Indian smartphone market was valued at USD 169.72 billion and is projected to reach USD 341.40 billion by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

A smartphone is defined as a mobile device that combines cellular and mobile computing functions into one unit, offering features such as internet browsing, email access, multimedia playback, and a wide range of applications. Equipped with advanced operating systems like iOS and Android, smartphones have become indispensable tools for communication, entertainment, and productivity.

Market Growth Drivers & Opportunities

Several key factors are propelling the growth of the smartphone market in India:

-

Increasing Internet Penetration: The widespread availability of affordable smartphones, coupled with the growing accessibility of high-speed internet connectivity, has fueled smartphone adoption across urban and rural areas in India. The increasing penetration of 4G and the imminent rollout of 5G networks are further driving smartphone usage and data consumption in the country.

-

Economic Growth and Rising Disposable Incomes: As India's economy continues to grow, disposable incomes are on the rise, enabling more consumers to afford smartphones. The increasing purchasing power of consumers, particularly in urban centers and tier 2/3 cities, is contributing to the growth of the India smartphone market.

-

Government Initiatives: The Indian government's initiatives to promote digitalization, such as the "Digital India" campaign, have created a conducive environment for smartphone adoption. Policies encouraging local manufacturing and foreign direct investment have further bolstered the market.

-

Technological Advancements: Continuous innovations, including the integration of Artificial Intelligence (AI), Augmented Reality (AR), and enhanced camera technologies, have made smartphones more appealing to consumers, driving frequent upgrades and new purchases.

Segmentation Analysis

The Indian smartphone market can be segmented based on price range, operating system, and distribution channel.

1. Price Range

-

Entry-Level Smartphones: Priced below USD 200, these devices cater to first-time users and budget-conscious consumers. They offer basic functionalities and have been instrumental in increasing smartphone penetration in rural areas.

-

Mid-Range Smartphones: Ranging from USD 200 to USD 500, these smartphones balance affordability with advanced features. They are popular among urban and semi-urban consumers seeking value for money.

-

Premium Smartphones: Priced above USD 500, premium smartphones target affluent consumers desiring high-end features, superior build quality, and brand prestige. This segment has seen growth due to rising disposable incomes and aspirational purchasing.

2. Operating System

-

Android: Dominating the market, Android smartphones offer a wide range of options across various price points, making them accessible to a broad audience.

-

iOS: Apple's iOS holds a significant share in the premium segment, attracting consumers with its ecosystem integration, brand loyalty, and consistent user experience.

3. Distribution Channel

-

Online Retailers: E-commerce platforms have gained prominence, offering competitive pricing, exclusive launches, and convenience, appealing especially to tech-savvy and younger consumers.

-

Offline Retailers: Traditional brick-and-mortar stores remain vital, providing hands-on experience and catering to consumers who prefer in-person purchases. They are particularly significant in semi-urban and rural regions.

Country-Level Analysis: USA and Germany

Comparing India's smartphone market with those of the USA and Germany provides valuable insights into global trends and positioning.

United States

The US smartphone market is characterized by high penetration rates, with a significant portion of the population owning smartphones. The market is mature, with growth primarily driven by technological advancements and replacement cycles. Apple's iOS holds a dominant position, reflecting strong brand loyalty and integration within the Apple ecosystem. The introduction of AI-powered features in smartphones has been a recent trend, aiming to enhance user experience and drive upgrades.

Germany

Germany's smartphone market is also mature, with high penetration rates. As of February 2025, Apple and Samsung lead the market, holding 35.32% and 34.52% shares, respectively.

The market has seen a growing interest in refurbished smartphones, projected to grow at a CAGR of 8% from 2023 to 2033, indicating a shift towards sustainable consumption.

Additionally, the integration of AI features in smartphones is gaining traction, with consumers showing interest in enhanced functionalities.

Click the Link for Further Information and Insights:-https://www.maximizemarketresearch.com/market-report/india-smartphone-market/20060/

Competitor Analysis

The Indian smartphone market is highly competitive, with both global and local players striving for market share.

1. Samsung

Samsung has maintained a strong presence in India, offering a diverse portfolio catering to various consumer segments. The company's focus on innovation, such as the introduction of AI-powered smartphones, aims to enhance user experience and maintain its competitive edge.

2. Apple

Apple targets the premium segment in India, appealing to consumers seeking a seamless ecosystem and brand prestige. Despite global challenges

3. Realme

4. Vivo

5. Nokia

6. Intex

7. Karbonn

8. Celkon Mobiles

9. iBall

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness