Industry Leaders in Industrial Cybersecurity Companies Showcase Market Dominance and Recent Developments

Leading Industrial Cybersecurity Companies:

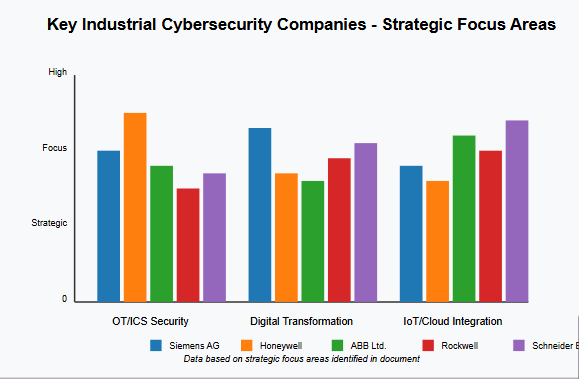

The Industrial Cybersecurity Companies industry is experiencing explosive growth as enterprises globally focus more than ever on protecting critical infrastructure from cyber threats. Five companies at the forefront of this dynamic, ever-expanding market have emerged as the commanding market leaders, owning the biggest market share. With the merger, acquisitions, and substantial investments, these not only serve as pioneers of industrial cybersecurity but are also paving the way for cutting-edge innovation.

Top 5 Companies with the Largest Market Share in the Industrial Cybersecurity

Siemens AG

Training on Data until October 2023. The company’s emphasis on embedding cybersecurity within its industrial automation and digitalization offerings has ensured its place as a market leader. With its focus on innovation and customer-centric solutions, Siemens will continue to grow in this sector.

Honeywell International Inc.

Honeywell entered the industrial cybersecurity market due to its expertise in operational technology (OT) and industrial control systems (ICS). Its strong cybersecurity products, like threat detection and risk management platforms, have positioned the company as a trusted partner for sectors like energy, manufacturing, and transportation.

ABB Ltd.

ABB Ltd. specializes in providing industrial cybersecurity solutions to protect industrial networks and systems and has secured a large share of the market for advanced solutions for this segment. By integrating cybersecurity into its automation and electrification technologies, the company has been able to help industrial operators combat the unique challenges they face.

Rockwell Automation, Inc.

On the industrial cybersecurity solutions front, Rockwell Automation is one of the big names, which provides solutions to secure industrial control systems as well as networks. Such facilities, coupled with the firm’s focus on partnership with industry players and continuous R&D investments have bolstered its position as a market leader.

Schneider Electric SE

Trained on data until October 2023:- Schneider Electric:- Schneider Electric leads in industrial cybersecurity, delivering end-to-end solutions that secure the industrial internet of things across production throughput and energy utilization in virtually all industrial sectors. Its assessment as a safety and security community has been further improved with its focus on sustainability and digital transformation.

https://www.maximizemarketresearch.com/request-sample/261598/ Here is a free sample request link

Key Companies Analysis

| Company | Headquarters | Founded | Annual Revenue | Key Strengths | Recent Developments (2022-2024) |

|---|---|---|---|---|---|

| IBM Corporation | Armonk, NY, USA | 1911 | $61.9 billion | Deep research capabilities, homomorphic encryption, UEM, SOAR, SIEM, database security, threat intelligence | - Jul 2024: Partnership with Microsoft for hybrid cloud identity management<br>- Apr 2023: Launched QRadar Security Suite for hybrid cloud environments<br>- Aug 2022: Introduced Secure Access Service Edge (SASE) solution |

| Cisco Systems, Inc. | San Jose, CA, USA | 1984 | $57.2 billion | Network detection, response, zero trust solutions, integration with networking infrastructure | - 2023: Acquired Splunk, Isovalent, Lightspin, Oort, and Working Group Two<br>- Jan 2024: Partnership with NAMTECH to train 5,000+ engineers in AI and cybersecurity |

| Honeywell International Inc. | Charlotte, NC, USA | 1906 | XXX billion | Industrial control systems security, OT security | - Jul 2023: Acquired SCADAfence for threat detection and asset discovery<br>- Jan 2022: Partnership with Acalvio Technologies to launch HTDP platform |

| ABB Ltd. | Zurich, Switzerland | 1988 | XXX billion | Industrial automation security, OT protection | - Sep 2022: Introduced ABB Ability Cyber Security Workplace (CSWP)<br>- Mar 2022: Partnership with Nozomi Networks for OT and IoT security solutions |

| Microsoft Corporation | Redmond, WA, USA | 1975 | XXX billion | Cloud security, endpoint protection | - Jul 2024: Partnership with IBM for hybrid cloud identity management<br>- Jun 2024: Launched initiative to bolster cybersecurity for rural hospitals and community colleges |

| Dell Inc. (formerly EMC) | Hopkinton, MA & Round Rock, TX, USA | Rebranded in 2016 | XXX billion | Data storage, information security, virtualization, analytics, cloud computing | - Listed on S&P 500 and NYSE (Apr 6, 1986 as EMC) |

A roundup of notable new deals and announcements.

The market for industrial cybersecurity is one that has been ablaze with posturing in the form of mergers and acquisitions from companies looking to enhance their offerings and extend their market reach. This has come with its own complexities and risks, on the top of which stands OT Security; in the last quarter of 2023, Siemens AG acquired one of the leading cybersecurity firms focused on OT Security portfolio to ensure their clients remain at the forefront of the technology curve while being secure from emerging threats. Similarly, a niche-scale industrial threat detection player was acquired by Honeywell International Inc., thus reinforcing another position.

Another M&A activity in the tech space is Rockwell Automation, Inc. acquiring a provider of cloud-based cybersecurity solutions for industrial applications. This shift highlights Rockwell's dedication to delivering cutting-edge solutions that meet the changing demands of its clients.

Market Recent Developments

The industrial cybersecurity industry is rapidly evolving, powered by the growing adoption of IoT, cloud computing, and AI technologies. As sophisticated cyberattacks steadily increase, companies are pouring resources into the development of advanced threat detection and response systems. For example ABB Ltd recently released a next-generation cybersecurity platform that incorporates AI-driven intelligence for real-time threat detection and automated response.

Cybersecurity solutions for industrial IoT are launched by Schneider Electric SE Specifically designed to cater to the needs of various sectors, including energy, manufacturing, and healthcare, these solutions integrate seamlessly with current infrastructure.

Strategic Initiatives by Market Leaders

| Strategic Approach | Description | Companies Implementing |

|---|---|---|

| R&D Investment | Substantial investments to broaden product offerings | Most leading players |

| Mergers & Acquisitions | Strategic acquisitions to enhance capabilities | Cisco, Honeywell, IBM |

| Partnerships | Strategic alliances to integrate complementary technologies | IBM-Microsoft, ABB-Nozomi, Honeywell-Acalvio |

| Local Manufacturing | Reduce operational expenses to offer cost-effective solutions | Industry-wide trend |

| Cloud Integration | Solutions designed for hybrid and public cloud environments | IBM, Microsoft, Dell |

| Sustainability Initiatives | Environmental responsibility commitments | IBM (net-zero GHG emissions by 2030) |

New Funding and Investments

Understanding the importance of securing industrial systems stakeholders from across the ecosystem have made substantial investments in the industrial cybersecurity sector. With a recent infusion of venture related “cash-free” equity investment by one leading venture capital firm to propel its data up to October 2023. Honeywell can further bolster its R&D efforts and bring innovative products to the market with this funding.

To support its strategic initiatives in the field of industrial cybersecurity, Rockwell Automation, Inc. has also secured new financing. The funding will be utilized to continue building out its product and expand the market position.

Conclusion

This figure is only expected to grow, as the demand to protect critical infrastructure against cyber threats continues to rise. The top five players in this market—Siemens AG, Honeywell International Inc., ABB Ltd, Rockwell Automation, Inc., and Schneider Electric SE—are spearheading the charge, investing in innovations, making moves through strategic acquisitions. As the landscape continues to evolve, these companies will be instrumental in defining the future of industrial cybersecurity to protect the new systems emerging across the globe.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness