Electronic Health Records Market Size and Investment Trends (2024-2030)

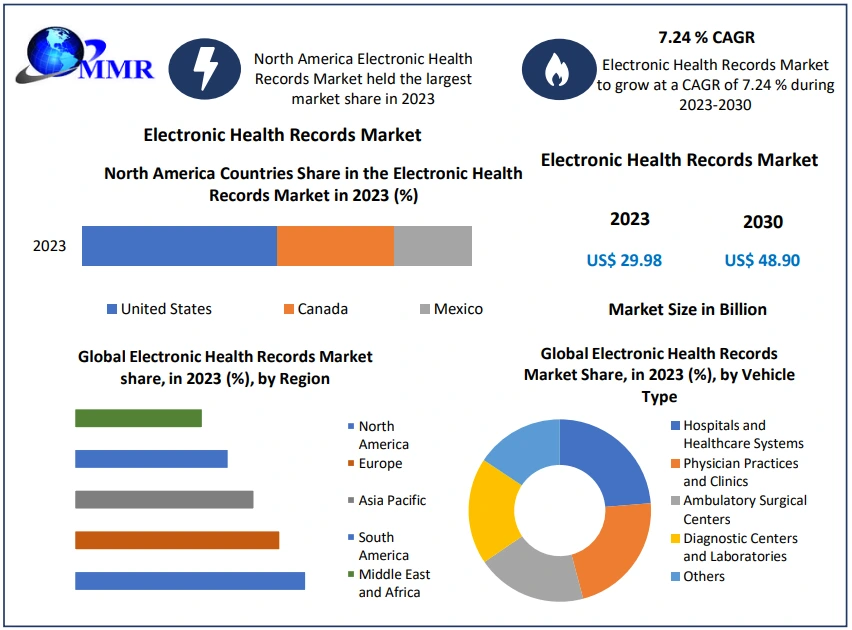

Electronic Health Records Market Size was valued at USD 29.98 Bn in 2023 and is expected to reach USD 48.90 Bn by 2030, at a CAGR of 7.24%.

Market Estimation & Definition

An Electronic Health Records Market Size is a digital repository that houses an individual's complete medical history, systematically managed by healthcare providers. It encompasses crucial administrative and clinical data, including demographics, progress notes, medications, vital signs, immunizations, and laboratory results. EHRs automate data access, streamlining clinician workflows and supporting evidence-based decision-making, quality management, and outcomes reporting.

The global EHR market has witnessed robust growth over the past decade. According to recent analyses, the market size was valued at approximately USD 29.98 billion in 2023 and is projected to reach USD 48.90 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 7.24% during the forecast period.

Get a Free Sample PDF of this Research Report for more insights:https://www.maximizemarketresearch.com/request-sample/17991/

Market Growth Drivers & Opportunities

Several key factors are propelling the growth of the EHR market:

-

Technological Advancements: The integration of artificial intelligence (AI), machine learning, and data analytics into EHR systems has enhanced clinical decision support, personalized medicine, and patient engagement. These technologies enable healthcare providers to deliver more accurate diagnoses and tailored treatment plans.

-

Government Initiatives and Regulatory Support: Governments worldwide are actively promoting EHR adoption through regulatory initiatives, incentivizing interoperability standards, and investing in digital infrastructure. For instance, the U.S. government's meaningful use program has significantly boosted EHR implementation across healthcare facilities.

-

Emphasis on Value-Based Care: There's a growing focus on value-based care models that prioritize patient outcomes over service volume. EHRs facilitate this transition by providing comprehensive data that supports quality measurement, reporting, and population health management.

-

COVID-19 Pandemic: The pandemic has accelerated the adoption of telehealth and remote patient monitoring, underscoring the essential role of interoperable and accessible EHRs in contemporary healthcare. This shift has highlighted the need for robust digital health infrastructures.

-

Improved Patient Safety and Care Coordination: EHRs reduce medical errors by improving record accuracy and accessibility, expediting treatment, and minimizing test duplication. Their shared nature among diverse healthcare entities facilitates seamless information exchange, contributing to a more integrated and efficient healthcare ecosystem.

Segmentation Analysis

The EHR market is segmented based on product type, end-user, and region.

By Product Type:

-

Acute EHR: Designed for short-term care facilities like hospitals, acute EHRs manage patient information during brief but severe episodes of illness or injury. They are essential for inpatient settings where timely data access is critical.

-

Ambulatory EHR: Tailored for outpatient care settings, ambulatory EHRs support clinics and physician practices by managing patient information during routine visits and minor procedures. They emphasize efficiency in documentation and care coordination.

-

Post-Acute EHR: These systems cater to long-term care facilities, such as rehabilitation centers and nursing homes, focusing on the extended management of patient health records and continuity of care.

By End-User:

-

Hospitals: Large-scale healthcare institutions that require comprehensive EHR systems to manage vast amounts of patient data, streamline workflows, and ensure compliance with regulatory standards.

-

Clinics: Smaller healthcare facilities that benefit from EHRs by enhancing patient record management, appointment scheduling, and billing processes.

-

Specialty Centers: Facilities focusing on specific medical fields (e.g., cardiology, oncology) utilize specialized EHR systems designed to meet the unique documentation and workflow needs of their specialties.

-

Other Healthcare Providers: This category includes entities like pharmacies and laboratories that integrate EHR systems to improve data sharing and operational efficiency.

Country-Level Analysis

United States:

The U.S. leads in EHR adoption, driven by substantial government initiatives and a well-established healthcare IT infrastructure. The implementation of the Health Information Technology for Economic and Clinical Health (HITECH) Act has incentivized EHR adoption across healthcare settings. As of 2023, the U.S. EHR market size was estimated at USD 11.38 billion, with expectations to grow at a CAGR of 2.24% from 2024 to 2030. Major EHR vendors like Epic Systems and Oracle Health hold significant market shares, collectively accounting for over half of the inpatient EHR market.

Germany:

Germany has been proactive in digitalizing its healthcare system, with the EHR market experiencing steady growth. Government initiatives, such as the E-Health Act, aim to enhance interoperability and data security within healthcare IT systems. The adoption of EHRs in Germany is expected to rise as healthcare providers recognize the benefits of digital records in improving patient care and operational efficiency.

For in-depth competitive analysis, buy now @:https://www.maximizemarketresearch.com/market-report/global-electronic-health-records-market/17991/

Competitive Analysis

The EHR market is characterized by the presence of several key players who contribute to its dynamic landscape:

-

Epic Systems Corporation: Holding nearly 38% of hospital installations in the U.S., Epic is renowned for its comprehensive EHR solutions that cater to large healthcare organizations. Its platforms are known for seamless integration capabilities and a strong reputation for reliability.

-

Oracle Health: Formerly known as Cerner Corporation, Oracle Health is a significant player in the EHR market, offering solutions that cater to various healthcare settings. The company's acquisition by Oracle has bolstered its technological capabilities and market reach.

-

GE Healthcare: As a subsidiary of General Electric, GE Healthcare provides EHR solutions integrated with advanced imaging and diagnostic tools, catering to both hospital and ambulatory settings.

-

Veradigm LLC (Allscripts Healthcare, LLC): Veradigm offers EHR solutions focusing on enhancing clinical workflows and patient engagement, serving a diverse clientele from small practices to large hospitals.

-

eClinicalWorks: Known for its cloud-based EHR solutions, eClinicalWorks caters to ambulatory settings, emphasizing interoperability and patient-centric features.

-

Greenway Health, LLC: This company provides EHR solutions tailored for various specialties, focusing on improving care coordination and clinical outcomes.

-

NextGen Healthcare, Inc.: NextGen offers EHR solutions designed for ambulatory practices, emphasizing usability and specialty-specific features.

-

Medical Information Technology, Inc. (Meditech): Meditech provides EHR solutions focusing on interoperability and scalability, serving both small and large healthcare organizations.

-

CPSI: Specializing in rural and community hospitals, CPSI offers EHR solutions that address the unique challenges of these settings.

-

AdvancedMD, Inc.: AdvancedMD provides cloud-based EHR solutions for independent practices, emphasizing practice management and patient engagement.

-

CureMD Healthcare: CureMD offers web-based EHR solutions focusing on usability and affordability for small to mid-sized practices.

-

McKesson Corporation: As a global leader in healthcare supply chain management, McKesson also provides EHR solutions integrated with its extensive healthcare services

- Electronic_Health_Records_Market_Size

- Electronic_Health_Records_Market_Growth

- Electronic_Health_Records_market

- Electronic_Health_Records_Market_Research

- Electronic_Health_Records_Market_Research_Report

- Electronic_Health_Records_Market_Demand

- Electronic_Health_Records_Market_Share

- Electronic_Health_Records_Market_Price

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness