India Smartphone Market Size, Global Demand, Sales, Consumption and Forecasts to forecast 2030

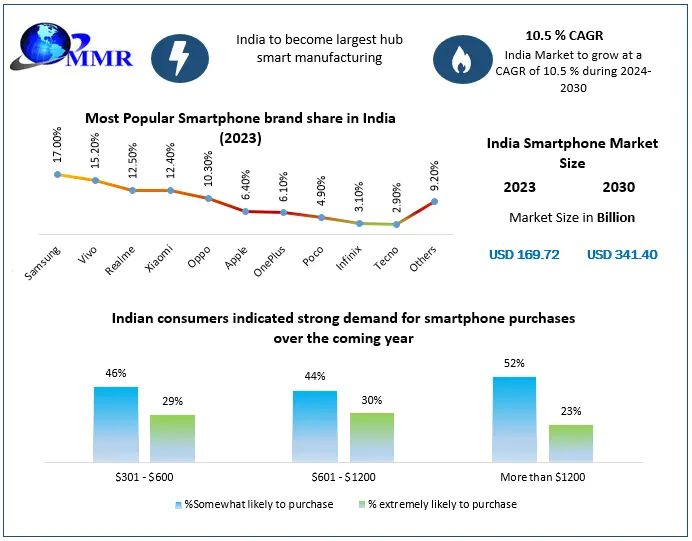

India Smartphone Market Size was valued at USD 169.72 Bn in 2023 and is expected to reach USD 341.40 Bn by 2030, at a CAGR of 10.5 % during the forecast period.

Market Estimation & Definition

A India Smartphone Market Size is a multifunctional device that integrates cellular communication with computing capabilities, enabling users to access the internet, manage emails, play multimedia content, and utilize a plethora of applications. In India, with a population exceeding 1.3 billion and a burgeoning middle class, the smartphone market has witnessed substantial growth, selling millions of units annually. Notably, the market penetration stands at approximately 40%, trailing the global average of 60%, suggesting significant room for expansion.

Get a Free Sample PDF of this Research Report for more insights:https://www.maximizemarketresearch.com/request-sample/20060/

Growth Drivers and Opportunities

-

Digital Infrastructure Expansion: The rollout of 5G networks is set to revolutionize mobile connectivity in India. Enhanced internet speeds and reduced latency are expected to elevate user experiences, thereby increasing the demand for 5G-enabled smartphones.

-

Economic Growth and Rising Incomes: India's economic ascent has led to higher disposable incomes, enabling consumers to invest in advanced smartphones. This trend is particularly evident in urban centers and tier-2 and tier-3 cities, where there is a growing appetite for feature-rich devices.

-

Government Initiatives: Policies such as the "Make in India" campaign and the Production Linked Incentive (PLI) scheme have incentivized domestic manufacturing of smartphones. These initiatives aim to position India as a global hub for electronics production, reducing dependency on imports and boosting local employment.

-

E-commerce Proliferation: The rise of online retail platforms has made smartphones more accessible to a broader audience. E-commerce giants offer competitive pricing, exclusive launches, and convenient purchasing options, contributing to increased smartphone penetration across the country.

Segmentation Analysis

The Indian smartphone market is diverse, catering to various consumer preferences and price points. Key segments include:

-

Operating System: Android dominates the market, powering a vast majority of devices due to its open-source nature and affordability. iOS, representing Apple's ecosystem, appeals to the premium segment, offering a seamless and secure user experience.

-

Price Range: The market is bifurcated into mass and premium segments. The mass segment, encompassing devices priced between INR 3,000 and INR 35,000, is favored by cost-conscious consumers. The premium segment, starting from INR 35,000 onwards, attracts consumers seeking advanced features and brand prestige.

-

Distribution Channel: Smartphones are distributed through offline channels, including OEM stores, retail outlets, and specialty stores, as well as online platforms. While offline channels have a strong presence, online sales are rapidly gaining traction due to convenience and exclusive online offerings.

Regional Insights

Regionally, North India holds a significant share of the smartphone market, driven by states like Uttar Pradesh, Delhi, and Punjab. The increasing urbanization and economic development in these areas contribute to higher smartphone adoption rates. South India also presents substantial growth opportunities, with tech-savvy consumers in states such as Karnataka and Tamil Nadu showing a preference for mid to high-end smartphones.

For in-depth competitive analysis, buy now @:https://www.maximizemarketresearch.com/market-report/india-smartphone-market/20060/

Competitive Landscape

The Indian smartphone market is highly competitive, with both global and domestic players vying for market share. Key industry participants include:

-

Samsung: Maintains a strong presence across various price segments, offering a diverse portfolio that caters to both budget-conscious and premium consumers.

-

Xiaomi: Known for its value-for-money propositions, Xiaomi has captured a significant portion of the market by providing feature-rich smartphones at competitive prices.

-

Vivo and OPPO: These brands have established a robust offline presence and are recognized for their camera-centric smartphones, appealing to the youth demographic.

-

Apple: Catering to the premium segment, Apple has seen growth in market share, particularly among affluent consumers seeking a premium user experience.

-

Realme: A relatively new entrant, Realme has quickly gained popularity by targeting the youth segment with stylish designs and competitive pricing.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness