Montenegro Banking System Market Demand, Key Players Analysis, Market Statistics 2021-2027

Montenegro Banking System Market Demand was valued at US$ Mn. in 2021 and the total revenue is expected to grow at significant rate through 2022 to 2027, reaching nearly US$ Mn. by 2027.

Market Estimation & Definition

Montenegro's banking system has shown remarkable growth and resilience, with the total balance sheet of banks increasing from €2.8 billion in 2011 to €7 billion in 2025. This expansion highlights the sector's stability, solvency, liquidity, and strong capitalization. All banks in Montenegro comply with regulatory obligations, reflecting a sound financial environment. While local banks maintain profitability, their returns remain below the European Union average.

Download your sample copy of this report today! https://www.stellarmr.com/report/req_sample/Montenegro-Banking-System-Market/660

Market Growth Drivers & Opportunities

Several key factors contribute to the growth of Montenegro's banking sector:

- Deposit Base Expansion: A growing number of deposits in Montenegrin banks enhances financial stability and provides liquidity for lending.

- Regulatory Strengthening: Adoption of stricter banking regulations aligned with EU standards ensures financial security and risk management.

- Digital Transformation: Increased adoption of digital banking services improves customer access and operational efficiency.

- Foreign Investments: Rising foreign direct investment (FDI) in Montenegro strengthens banking activities, especially in real estate and tourism-related financing.

- Credit Market Growth: Increased credit demand from businesses and consumers fuels banking sector expansion.

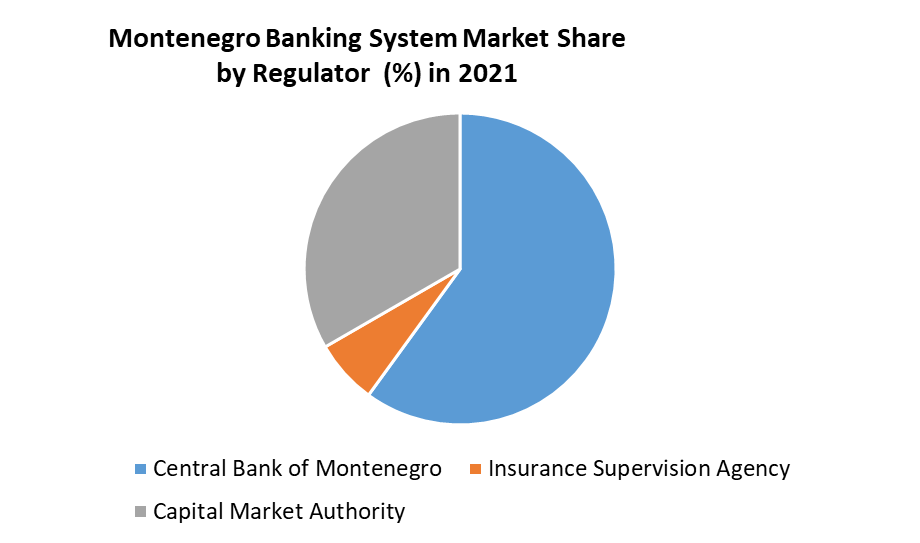

Segmentation Analysis

The Montenegrin banking system can be segmented based on key services and customer categories:

-

By Service Type:

- Retail Banking

- Corporate Banking

- Investment Banking

- Digital Banking & Fintech Services

-

By Customer Type:

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Corporations

-

By Loan Types:

- Housing & Mortgage Loans

- Business Loans

- Consumer & Personal Loans

To find more information about this research, please visit: https://www.stellarmr.com/report/Montenegro-Banking-System-Market/660

Country-Level Analysis

- Montenegro: The banking system remains stable, with strong liquidity and regulatory compliance. However, profitability levels are below the EU average.

- Germany: The influence of European banking regulations on Montenegro's financial sector has led to stricter compliance measures. German banks’ involvement in Montenegro contributes to financial sector modernization.

- United States: U.S. investors and financial institutions have shown growing interest in Montenegro’s banking industry, particularly in digital banking and fintech innovations.

Competitive Landscape

The banking sector in Montenegro consists of key local and international financial institutions:

- Crnogorska Komercijalna Banka (CKB): One of the largest banks in Montenegro, providing a wide range of banking services.

- Erste Bank Montenegro: A subsidiary of the Austrian Erste Group, offering corporate and retail banking services.

- NLB Banka: A strong player in the Montenegrin market, focusing on digital banking solutions.

- Hipotekarna Banka: Known for its innovative financial products and customer-oriented services.

- Societe Generale Montenegro: A key financial institution with strong corporate banking services.

Catch Up with Trending Topics :

Mexico Social Commerce Market https://www.stellarmr.com/report/Mexico-Social-Commerce-Market/1600

Foldable Smartphone Market https://www.stellarmr.com/report/Foldable-Smartphone-Market/1632

Conclusion

Montenegro’s banking sector continues to grow, driven by a solid regulatory framework, digital transformation, and increasing foreign investments. With an expanding deposit base and rising credit demand, the sector is poised for sustained development. However, banks must address profitability concerns to align with EU standards. The future of Montenegro’s banking industry looks promising, with ongoing advancements in financial technology and enhanced regulatory measures ensuring long-term stability.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@Stellarmarketresearch.com

+91 20 6630 3320, +91 9607365656

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness