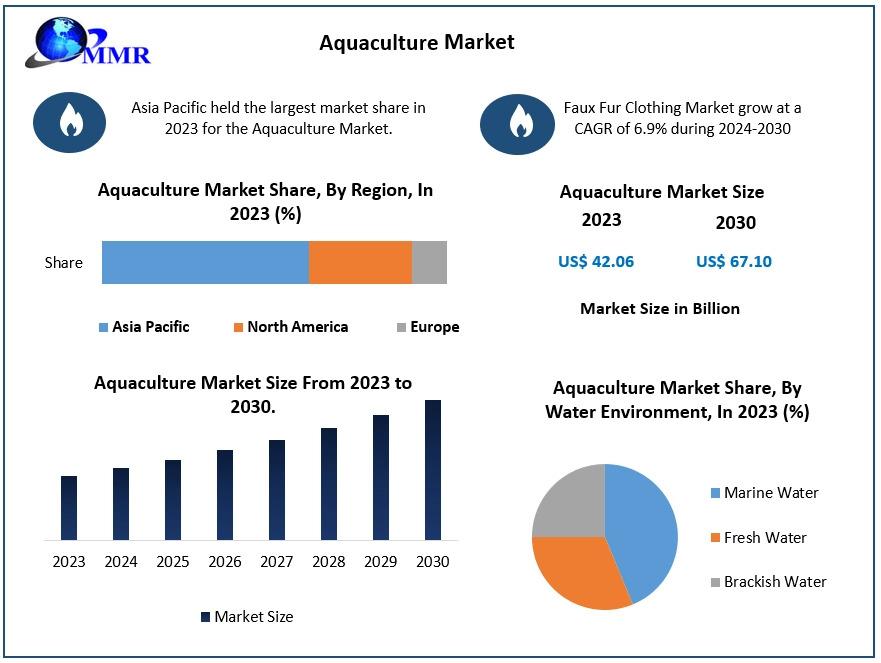

Aquaculture Market Size was valued at US$ 42.06 Bn in 2023 and the total revenue is expected to grow at 6.9 % through 2024 to 2030, reaching nearly US$ 67.10 Bn.

The Aquaculture Market Size is experiencing robust expansion, driven by increasing seafood consumption, technological innovations, and sustainable farming practices. Recent analyses project the market to reach approximately USD 573.7 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2035.

Get a Free Sample PDF of this Research Report for more insights:https://www.maximizemarketresearch.com/request-sample/65165/

Market Definition and Estimation

Aquaculture, commonly known as aqua farming, involves the controlled cultivation of aquatic organisms such as fish, mollusks, crustaceans, and aquatic plants. This practice encompasses interventions like regular stocking, feeding, and protection from predators to enhance production efficiency. In 2023, the aquaculture market was valued at USD 311.1 billion, with projections indicating a rise to USD 573.7 billion by 2035, reflecting a CAGR of 5.2% during the forecast period.

Drivers of Market Growth and Opportunities

Several factors contribute to the burgeoning growth of the aquaculture market:

-

Surging Seafood Demand: As consumers become more health-conscious, there's an increased preference for protein-rich diets, positioning seafood as a favorable choice. This shift is propelling the expansion of aquaculture to meet the escalating demand.

-

Technological Innovations: Advancements in aquaculture technologies, including recirculating aquaculture systems (RAS), automated feeding mechanisms, and water quality monitoring tools, are enhancing production efficiency and sustainability. These innovations enable farmers to optimize resources and minimize environmental impacts.

-

Sustainable and Eco-Friendly Practices: With growing environmental awareness, there's a concerted effort to adopt sustainable aquaculture practices. This includes integrating fish farming with agriculture, such as rice-fish culture, which offers mutual benefits like pest control and improved yields.

-

Expansion into Emerging Markets: Developing regions, particularly in Asia-Pacific, are witnessing significant investments in aquaculture infrastructure. The availability of natural water resources and favorable climatic conditions make these regions ideal for aquaculture activities.

Segmentation Analysis

The aquaculture market is categorized based on environment and species type:

-

By Environment:

-

Freshwater: Dominating the market, freshwater aquaculture utilizes resources like ponds, rivers, and lakes. Species such as salmon, trout, and tench are predominantly cultivated in these settings. In 2023, the freshwater segment accounted for more than two-thirds of the market revenue.

-

Marine Water: This segment involves farming in oceans and seas, focusing on species like oysters, clams, mussels, and certain fish varieties. Marine aquaculture is gaining traction due to the high demand for seafood delicacies.

-

Brackish Water: Utilizing estuarine areas where freshwater meets seawater, this segment is suitable for species like shrimp and certain fish that thrive in mixed salinity conditions.

-

-

By Species Type:

-

Fish: This includes a variety of species such as salmon, tilapia, catfish, and carp. Fish farming is the largest segment, driven by high demand for fish protein ly.

-

Mollusks: Encompassing species like oysters, clams, mussels, and scallops, mollusk farming is significant due to their culinary popularity and nutritional benefits. In 2023, the mollusks segment held the highest market share, accounting for more than two-thirds of the aquaculture market revenue.

-

Crustaceans: This segment includes shrimp, crabs, and lobsters, which are highly valued in seafood markets.

-

Country-Level Insights

-

United States: The U.S. aquaculture industry is experiencing growth due to technological advancements and a focus on sustainable practices. The adoption of recirculating aquaculture systems (RAS) has improved production efficiency and reduced environmental impacts. In 2023, the U.S. market generated revenue of approximately USD 35.81 billion, with projections reaching around USD 52.93 billion by 2032.

-

Germany: Germany places a strong emphasis on sustainable aquaculture practices, aligning with environmental goals and consumer preferences for eco-friendly products. In 2023, the German aquaculture market accounted for a 24.4% share in Europe and is anticipated to grow at a CAGR of 4.7% during the forecast period.

For in-depth competitive analysis, buy now @:https://www.maximizemarketresearch.com/market-report/global-aquaculture-market/65165/

Competitive Landscape

The aquaculture market is characterized by the presence of several key players who are instrumental in driving innovation and sustainability within the industry. Notable companies include:

-

Mowi ASA: A leading seafood company specializing in the production of farmed Atlantic salmon, Mowi ASA is recognized for its commitment to sustainable aquaculture practices.

-

Cermaq Group AS: Operating ly, Cermaq focuses on farming salmon and trout, emphasizing environmental stewardship and fish welfare.

-

Lerøy Seafood Group ASA: This company offers a wide range of seafood products, including salmon, trout, and other species, with operations spanning the entire value chain from farming to distribution.

-

Cooke Aquaculture Inc.: A family-owned company, Cooke Aquaculture is involved in the cultivation of Atlantic salmon and other seafood products, prioritizing innovation and responsible farming practices.

-

Nippon Suisan Kaisha, Ltd. (Nissui): Based in Japan, Nissui engages in diverse seafood businesses, including aquaculture, and is known for its extensive research and development efforts in the field.

These companies are actively investing in research and development to enhance aquaculture technologies, improve feed efficiency, and ensure the health and welfare of farmed species. Collaborative efforts among industry players aim to address challenges such as disease management, environmental impacts, and the development of