Introduction: Why Vesting Schedules Matter

In the world of Web3, tokens are more than just digital assets: they’re powerful tools for community building, user engagement, and long-term brand loyalty. But with great power comes great responsibility. Suppose tokens are released all at once to founders, early investors, or even community members. In that case, the entire market can become vulnerable to price manipulation, mass sell-offs, and an overall loss of trust in the project.

This is where vesting schedules come in. By regulating how and when tokens are unlocked, vesting schedules aim to keep distribution fair, promote trust, and ensure the people behind the project remain committed for the long haul. For Web3 marketing agencies—tasked with creating and distributing tokens to engage users—understanding vesting schedules is not just a “nice to have” but a fundamental aspect of building credibility and preventing market manipulation.

In this blog, we’ll delve into why vesting schedules matter, how they work, and the different types of vesting that you can deploy for your token distribution. Whether you’re new to the concept or looking for ways to refine your tokenomics, you’ll walk away with actionable insights on designing vesting schedules that foster loyalty and confidence in the Web3 ecosystem.

Vesting: The Basics

A vesting schedule is a structured timeline dictating when tokens—allocated to specific stakeholders—become fully accessible (or “unlocked”). Until each vesting milestone is reached, the token holder cannot transfer or sell those locked tokens. If the holder leaves the project or fails specific criteria before tokens are fully vested, they might lose the unvested portion.

Key Stakeholders That Often Have Vesting

- Founders and Core Team: Ensures they stay committed to the project’s success.

- Advisors and Consultants: Rewards long-term contributions.

- Early Investors: Prevents massive sell-offs that can crash token prices.

- Community Members or Ambassadors: Encourages ongoing participation rather than short-term speculation.

Primary Goals of Vesting

- Promote Long-Term Alignment: Encourages participants to work towards the project’s growth.

- Prevent Pump-and-Dump: Avoids sudden large sell-offs from whales or insiders.

- Build Market Confidence: Transparency around vesting can instill trust in new investors, partners, and users.

Why Vesting Is Crucial in Web3

Unlike traditional equity in startups—where vesting schedules are common practice—many Web3 projects initially overlooked vesting. This led to high-profile “rug pulls,” where teams abandoned projects after dumping large tokens on public markets.

1. Market Stability

Without vesting, a handful of individuals or entities can monopolize a token supply and sell it unexpectedly, causing sharp price fluctuations. By gradually releasing tokens over time, the risk of these market shocks diminishes.

2. Regulatory Assurance

Authorities worldwide are scrutinizing crypto projects for signs of fraudulent or manipulative behavior. A well-structured vesting schedule signals that your project is acting responsibly and aiming for a fair token ecosystem.

3. Community Trust

Web3 thrives on community ownership. If early participants see that core team members and large token holders are subject to vesting, it reduces fears of a quick cash grab. This reassurance can encourage more users to join and stay engaged with the project.

4. Long-Term Commitment

Vesting effectively locks team members into building real value for the project. It aligns their financial upside with the token’s performance over time rather than allowing them to profit rapidly from an initial price spike.

Types of Vesting Schedules

Vesting can be tailored to fit the unique needs of a Web3 project. Below are three common vesting approaches:

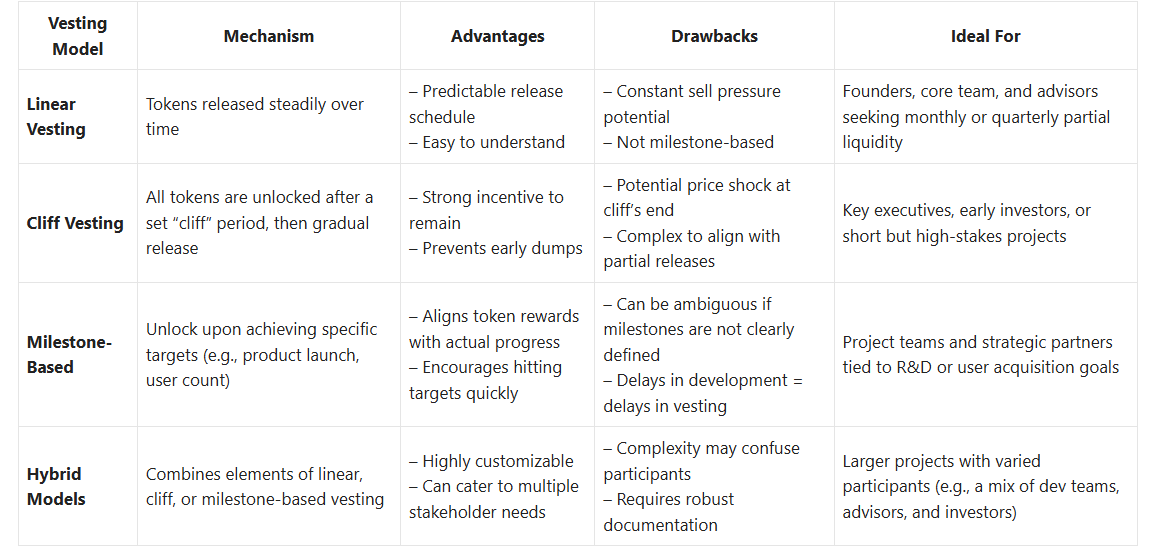

1. Linear Vesting

Linear vesting distributes tokens gradually over a set period. Think of it like a steady, month-by-month (or week-by-week) drip:

- Example: If a founder has 120,000 tokens vested over 12 months, they will receive 10,000 tokens monthly.

- Pros: Predictable and straightforward; holders can plan around monthly unlocks.

- Cons: Doesn’t necessarily align with project milestones; continuous sell pressure if recipients decide to liquidate tokens as they’re unlocked.

2. Cliff Vesting

Cliff vesting requires token holders to wait a specified period (the “cliff”) before receiving any tokens:

- Example: A 6-month cliff means no tokens are released until month six. If the stakeholder remains engaged for that duration, they receive a chunk of tokens at once, with the remaining tokens vesting gradually thereafter.

- Pros: Strong incentive for loyalty, ensuring holders commit before any partial release.

- Cons: It can cause a sudden sell-off if many tokens unlock simultaneously.

3. Milestone-Based Vesting

Tokens are released when specific project or performance milestones are met:

- Example: A development milestone could be launching a mainnet or achieving a user adoption goal (e.g., 10,000 active users).

- Pros: Aligns token distribution with tangible progress, fostering accountability.

- Cons: If milestones are subjective or delayed, it can cause stakeholder tension or confusion among community members.

How Vesting Impacts Market Dynamics

Vesting schedules don’t just benefit your project’s internal stakeholders; they also have external market implications.

- Reduced Volatility

- Staggered releases of tokens help stabilize supply in secondary markets, preventing dramatic price swings.

- Investors can make more informed decisions if they know future unlock dates.

- Price Discovery

- A transparent vesting schedule signals traders when more tokens could hit the market, aiding in more accurate price discovery.

- Enhanced Liquidity Management

- For Web3 marketing agencies designing token campaigns, understanding when tokens vest can help orchestrate liquidity mining or staking programs that coincide with token unlocks, further managing sell pressure.

- Psychological Impact

- Knowing insiders or whales are locked into vesting can boost smaller investors’ confidence.

- Projects highlighting a “fair vesting structure” in marketing materials often appeal to a broader audience concerned about potential manipulation.

Implementing Vesting Schedules: A Step-by-Step Guide

Step 1: Define Your Vesting Goals

- Align with Project Roadmap: Is your goal to secure developer loyalty, reward early investors, or ensure team members stick around until significant milestones?

- Balance Fairness and Flexibility: Consider how to keep your team motivated while providing some liquidity over time.

Step 2: Choose the Vesting Model

- Linear, cliff, milestone-based, or a hybrid approach.

- Factor in token unlock intervals—monthly, quarterly, or event-based.

Step 3: Draft a Vesting Agreement

- Specify exact token amounts and unlock periods for each stakeholder.

- Outline conditions that could pause or forfeit vesting (e.g., leaving the project prematurely).

Step 4: Implement Smart Contracts

- For on-chain transparency, deploy a vesting smart contract that automates the release of tokens.

- Ensure a reputable firm audits your code to avoid exploits.

Step 5: Communicate the Vesting Schedule

- Publish a comprehensive tokenomics document detailing your vesting approach.

- Share a timeline or schedule so the community and investors understand future unlocks.

Step 6: Monitor and Report

- Keep track of key dates (e.g., the end of a cliff, milestone achievements).

- Provide regular updates on token vesting progress—transparency is key to maintaining trust.

Common Pitfalls and How to Avoid Them

- Overly Complex Schedules

- Pitfall: Vesting that’s too intricate can confuse both your team and the community.

- Solution: Keep it simple; if complexity is necessary, break it down visually (e.g., charts, timelines) and include thorough explanations.

- Insufficient Clarity on Milestones

- Pitfall: Disagreements and delays can arise if you choose milestone-based vesting without precise definitions.

- Solution: Define milestones as quantifiable objectives—like user acquisition numbers or development deliverables.

- Lack of Public Communication

- Pitfall: Failing to disclose vesting details fosters suspicion among potential investors or community members.

- Solution: Publish a tokenomics whitepaper or website page with precise, concise information. Offer regular updates via newsletters, social media, or AMA sessions.

- Neglecting Regulatory Considerations

- Pitfall: Certain jurisdictions may have strict rules on token distributions that can resemble securities.

- Solution: Work with legal advisors. Ensure your vesting strategy aligns with local and international regulations.

- Ignoring Ongoing Market Conditions

- Pitfall: Large token unlocks during a market downturn can exacerbate price drops.

- Solution: Coordinate with marketing campaigns or token buybacks to manage liquidity. Maintain flexibility to adjust schedules if the community consents (via on-chain governance or proposals).

Best Practices for Web3 Marketing Agencies

As a Web3 marketing agency, you’re the bridge between a project and its audience—helping craft narratives that resonate with potential users and investors. Here’s how you can leverage vesting schedules effectively:

- Highlight Vesting in Marketing Materials

- Make vesting front-and-center in your pitch. This helps investors and the community see the project’s commitment to trust and long-term growth.

- Educate First-Time Readers

- Create easy-to-digest guides or infographics showing how and when tokens unlock.

- Use real-world analogies (like a monthly paycheck or staged bonus) to demystify the concept of vesting.

- Time Your Community Campaigns

- Align significant community events—like new feature rollouts or NFT drops—with token unlock dates.

- This can help incentivize holders to keep tokens (if new use cases are introduced) rather than selling immediately.

- Incorporate Governance

- Encourage community input on adjusting vesting terms if market conditions change. This fosters a sense of shared ownership.

- Track Metrics and Sentiment

- Monitor on-chain data for suspicious activities (e.g., large token movements right after unlocks).

- Keep an eye on social channels—if community sentiment sours around vesting, address concerns promptly.

Vesting Schedule Comparison Table

Below is a quick reference table comparing the most common vesting strategies. Use this as a starting point to decide which model best suits your project.

Conclusion

Vesting schedules are a foundational tool in the Web3 toolkit, designed to promote trust, mitigate market manipulation, and align the incentives of everyone involved—from developers and founders to community members and institutional investors. For Web3 marketing agencies, understanding the hows and whys of vesting is crucial for creating compelling campaigns that underscore a project’s commitment to fairness and long-term sustainability.

A well-thought-out vesting strategy can:

- Reassure potential investors that the team won’t abandon the project.

- Demonstrate real commitment by founding members, advisors, and core contributors.

- Mitigate wild price swings by preventing sudden token dumps.

- Foster community loyalty by offering continuous or milestone-based incentives.

Remember that transparency is the name of the game. The more you communicate your vesting schedule—through whitepapers, blogs, AMAs, and community updates—the more likely you will build a dedicated audience willing to grow with your project. If done well, vesting isn’t just a technical mechanism; it’s a powerful statement of trust and integrity that can drive sustainable success for any Web3 endeavor.