POS Payment Market Evolution and Technological Innovations Impacting Consumer Payment Preferences and Behavior

The POS payment market is evolving rapidly, driven by various internal and external factors. These factors significantly shape the way consumers and businesses interact during transactions. In today’s world, the POS system is no longer a simple register; it has evolved into a complex, multifaceted platform capable of supporting different types of payment methods. As we look at the key factors impacting this market, it’s clear that technology, consumer behavior, regulatory policies, and market competition play pivotal roles in shaping its future.

Technological Advancements

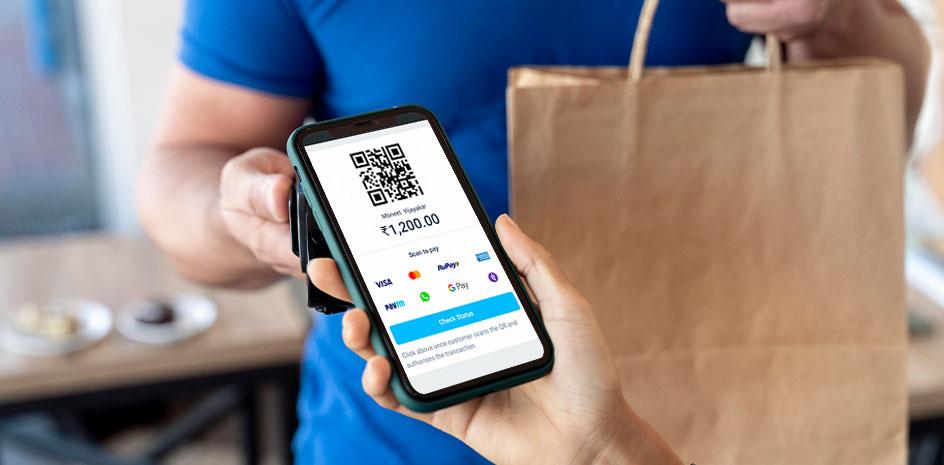

One of the most important factors driving the POS payment market is the rapid pace of technological advancements. Innovations in mobile payments, contactless payments, and the rise of cloud-based solutions have redefined how POS systems function. Mobile wallets, such as Apple Pay and Google Pay, allow users to make secure, quick transactions using their smartphones. These technologies have led to a shift from traditional card-based payments to more flexible, mobile-based methods. As technology continues to evolve, POS systems will keep integrating new features, enhancing the user experience for both businesses and customers.

Consumer Behavior and Expectations

Consumer expectations are significantly influencing the POS payment market. With the increasing adoption of digital payments, consumers are now looking for more seamless, faster, and secure ways to make purchases. Contactless payments have surged in popularity due to their convenience, as they allow customers to make payments without physically inserting a card into a reader. Furthermore, the growing preference for e-commerce and online shopping is prompting retailers to upgrade their POS systems to cater to both in-store and online customer needs. As consumer behavior evolves, businesses must adapt their payment solutions to stay competitive in the market.

Regulatory and Security Standards

Regulatory factors and security standards are crucial in shaping the POS payment market. As the digital payment landscape expands, governments worldwide have introduced stricter regulations to ensure the security and privacy of consumer data. The introduction of EMV (Europay, MasterCard, and Visa) standards, along with initiatives like the Payment Card Industry Data Security Standard (PCI DSS), has been essential in safeguarding payment data. These regulations ensure that POS systems are compliant with security measures, reducing the risk of fraud and data breaches. Compliance with these security standards is critical for businesses that want to maintain consumer trust and avoid legal issues.

Market Competition

Market competition is another significant factor influencing the POS payment market. The rise of fintech companies offering innovative payment solutions has increased competition in the industry. These companies often provide POS systems that are more affordable, user-friendly, and customizable compared to traditional solutions. As a result, businesses are faced with a wide range of options when selecting POS systems. The increased competition has led to improved product features, lower costs, and better customer support. Companies that fail to keep up with market trends risk losing customers to more agile competitors.

Integration of Artificial Intelligence (AI)

The integration of Artificial Intelligence (AI) into POS systems is another factor driving change in the market. AI enables systems to provide personalized experiences for customers, improving service efficiency and creating more opportunities for upselling. AI can also help in fraud detection, reducing the chances of fraudulent activities and improving transaction security. Additionally, AI-powered POS systems can analyze customer purchasing patterns, helping businesses optimize their inventory management, sales strategies, and customer interactions. As AI continues to evolve, its integration into POS systems will likely become more widespread.

Conclusion

In summary, the POS payment market is influenced by various factors, including technological advancements, consumer expectations, regulatory standards, market competition, and the integration of AI. Each of these factors plays a crucial role in shaping the evolution of payment systems. As technology progresses, businesses must remain agile and adapt to these changes in order to provide seamless and secure payment experiences for their customers. Understanding these influencing factors will be key to staying ahead in an increasingly competitive and technology-driven market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness